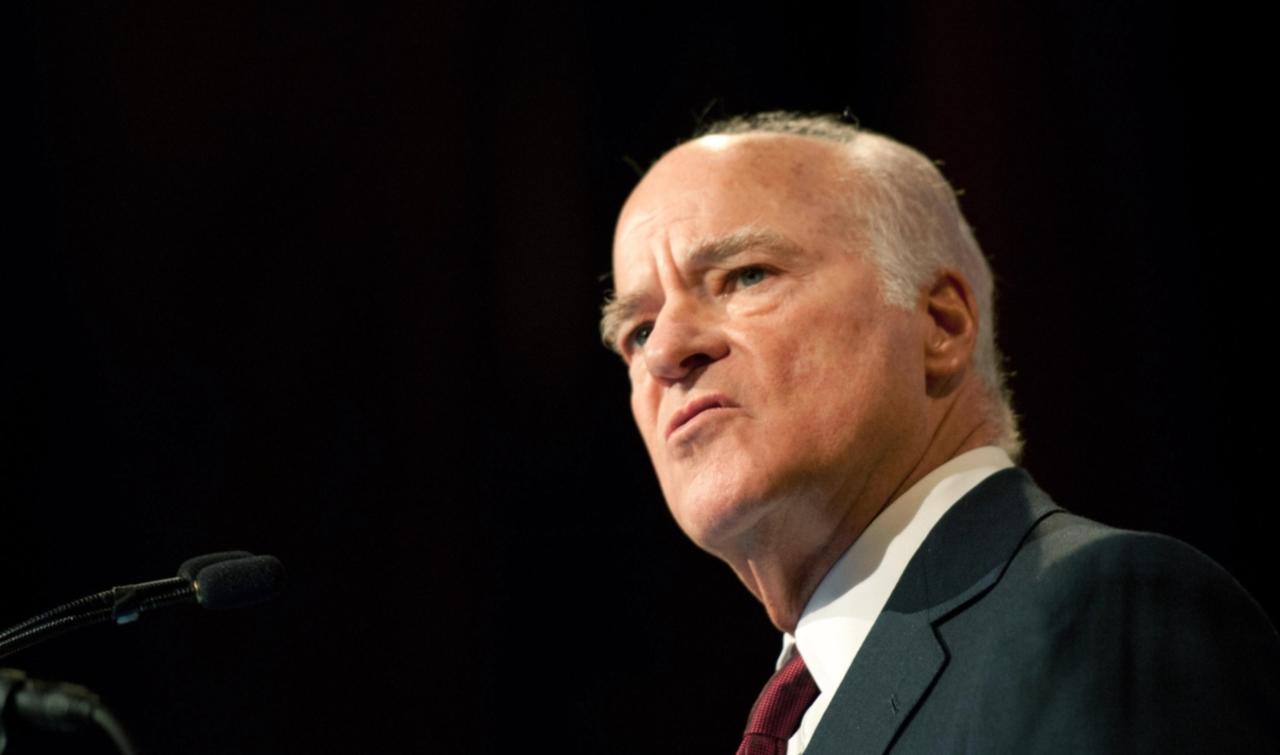

Private Equity Titan Henry Kravis Says In 50 Years He Has Never Seen Markets This Volatile

Tyler Durden

Fri, 10/30/2020 – 13:50

Private Equity titan Henry Kravis has seen a lot during his half century on Wall Street. But he says he has never seen turmoil like this. Thanks to COVID-19, and the Fed’s attempt to backstop markets for fear that a crash could translate into harm for the real economy, 500-point swings back and forth have become routine.

“I’ve been investing for over 50 years, I don’t remember a time when I’ve seen such volatility as we see today,” Kravis, the co-founder of KKR & Co., said Friday during a live Bloomberg webcast.

“Just look at our markets in the US, we’re up one day 300, 400 points and then the next day, for almost no reason, we’re down 400 to 500 points.”

Kravis praised central banks’ global stimulus efforts for staving off economic collapse, but warned that markets remain unnerved by the virus, and that any news related to a vaccine or therapeutic would likely impact sentiment.

This year has seen nigh-unprecedented volatility has stocks sunk to levels unseen since the Obama era before bouncing back to record highs. According to Bloomberg, the VIX, the market’s gauge of implied volatility, has averaged 33 since February, which is 14 points higher than the average level over the last 30 years.

KKR has taken advantage of the turbulence, with Kravis’s firm (which he has long since ceased managing) doing some $40 billion in deals already this year.

“When we shut down our offices in the U.S. on about March 12, I was wondering, ‘What are we going to do, how are we going to even keep busy?’” Kravis, 76, said. “As it turned out, we’ve probably had the busiest year and (most) productive year that we’ve had almost ever.”

Kravis has enjoyed a reputation as a ruthless capitalist for years While buying and selling companies still drives Kravis, he said the pandemic has changed his outlook on life and work and, possibly, softened him up a bit.

“You see so many people in the US, in New York City in particular earlier on, become ill and so many of them pass away,” he said. “It makes you think about what’s really important in life and to me, it’s family, my wife without a doubt.” Beyond that, “I probably have become more patient than I was. I’ve always been known to be impatient,” he said. “Probably my empathy levels have gone up, and trying to show more empathy toward everybody that I come into contact with, people at our firm and make sure they are OK.”

His “empathy levels” have gone “way up,” Kravis added.

Beyond that, “I probably have become more patient than I was. I’ve always been known to be impatient,” he said. “Probably my empathy levels have gone up, and trying to show more empathy toward everybody that I come into contact with, people at our firm and make sure they are OK.”

Later in the interview, Kravis discussed the firm’s management philosophy, which he said centers around allowing all the employees to be fully engaged in deals, handling different responsibilities and learning new things.

Aside from the firm’s new deals, Kravis said KKR had also sold “a number” of assets this year, before moving on to wax poetic about how he analyzes a prospective target.

“Every company is a living organ…it’s a series of still shots that make into a movie…and where is that movie going? If you’re only going to think of the photo of the company and think ‘well, this is what it is’…it’s being able to see where the puck is going. If you can anticipate that, then bring in the right group of operating people…and they will work with various companies to improve the operation, while at the same time we think how can we improve the balance sheet.”

Not that investors care – at least not right now – about corporate profits, but as volatility has surged, earnings have become more decoupled from share price than at any time in the last 70 years (dating back to 1950).

Could that portend more volatility ahead? We’ll let you be the judge.

The conversation continued for roughly 45 minutes. Readers can watch the whole thing below:

NOW: What lies ahead for global markets after a tumultuous year? And what does economic recovery look like in the wake of Covid-19? @jasonkellynews talks with @KKR_Co‘s Henry Kravis at #BloombergInvest Talks. https://t.co/94R6lD1aDd

— Bloomberg Live (@BloombergLive) October 30, 2020

via ZeroHedge News https://ift.tt/37SjDEV Tyler Durden