Congress, Not The Fed, Is The New Driver Of Financial Markets

Tyler Durden

Sun, 11/01/2020 – 18:00

Submitted by Howard Wang at Convoy Investments

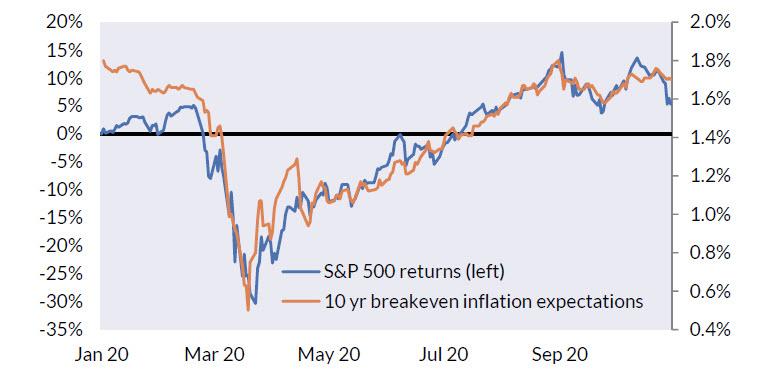

For as long as you’ve known me, I’ve been saying the Fed is the single most dominant player in the markets. That changed as of this year. The chart below may surprise you. Since the start of the pandemic, the ups and downs of the markets have exactly tracked changing inflation expectations.

Why is this significant? While the Fed can control short-term or long-term interest rates, they cannot directly control inflation. They can only influence inflation by changing interest rates, which are already anchored at close to zero. So the Fed is largely helpless in stimulating the economy and the markets. It is now in an era where it must rely on Congress bills in order to enact expansionary monetary policy.

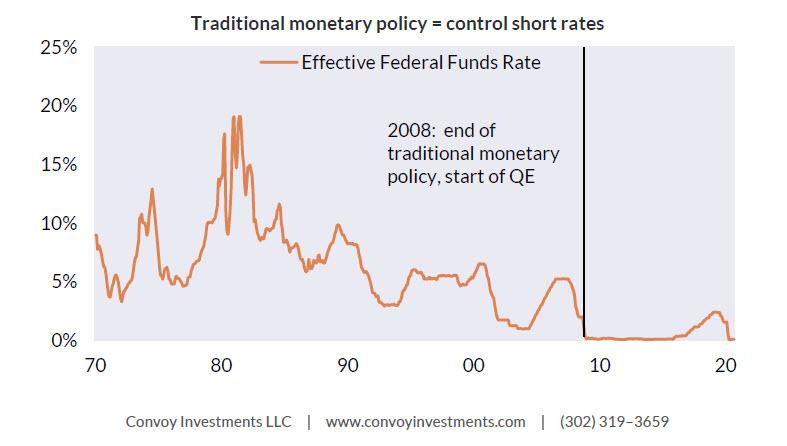

Up until 2008, the Fed controlled the economy and the markets through short-term interest rates. By setting expectations of future short rates, the Fed can also indirectly influence long rates, thus impacting the financing rates of capital transfers over various time frames.

This approach was effective until 2008 when short rates hit zero and the Fed could no longer use this lever. In 2009, the Fed had to move further out on the yield curve and began to directly control long rates by buying bonds via quantitative easing. Because of the size of the bond market, these operations had to be in the $trillions in order to be effective. But ultimately it worked to lower borrowing rates and discount rates, propping up the economy and boosting financial assets.

When the pandemic hit this year and we saw historic levels of deterioration in the economy and the markets, QE was the lever the Fed immediately went to, quickly lowering long rates down to close to zero. Yet that wasn’t nearly enough stimulation for the economy.

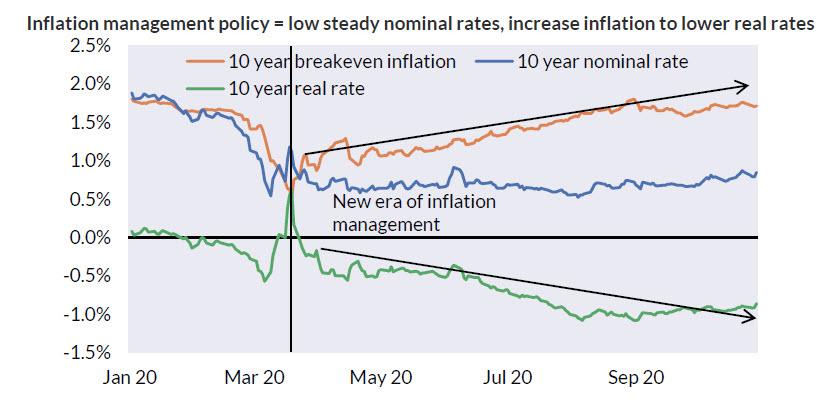

At that point, the Fed had two options to avoid a deflationary depression, keep the same QE approach which would mean forcing long rates into the negative territory like Europe, or keep nominal interest rates low and steady and manage inflation expectations in order to force real interest rates negative. As you can see in the chart below, the Fed chose the second route. They kept the nominal interest rate nearly constant while stimulus checks from Congress boosted inflation expectations, thus suppressing real interest rates to be materially negative.

To the extent the US can, they will continue to prefer the second route because it is much less disruptive to the financial system to have low and steady nominal interest rates than negative ones, especially as the reserve currency of the world. While this second option seems more palatable, they both punish savers in the form of negative real returns. So what does this new era of monetary policy mean for the economy and markets?

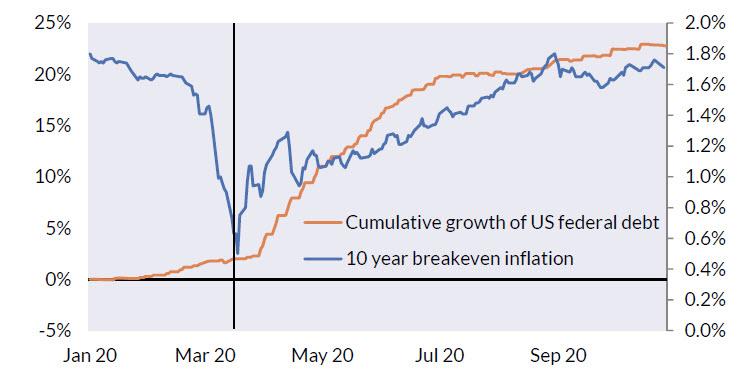

First and foremost, the Fed is now no longer in control of monetary policy. Despite explicitly changing their mandate to target long-term average inflation, the Fed no longer has the tools to actually control inflation. All they can do is keep nominal interest rates steady and low, like they’ve been doing. To stimulate the economy during a downturn like the potential second COVID wave, they rely on the Congress passing fiscal stimulus to boost inflation expectations and drop real interest rates. Expansionary monetary policy relies solely on continued growth of US federal debt. This is why the Fed Chair Powell has been so desperately calling for more help from Congress recently.

Second, instead of economists fine tuning interest rates on a daily basis, monetary policy now depends on politicians passing stimulus bills. If the easing is overdone, the Fed can always increase interest rates or lower their bond holdings, but it is harder to take stimulus checks back once they are issued. This type of monetary policy is like doing a delicate surgery with a machete. Further, as we see in the recent gridlock around the second round of stimulus, the stability of the economy is often not the only goal in politics. I believe we are in an era of heightened volatility.

Finally, I believe market will dance to a new rhythm. In the 2010s, markets did well when the Fed bought bonds and did poorly when the Fed tapered buying. Now markets depend more on the timing of fiscal stimulus. As stimulus is being handed out, inflation expectations improve, commodity markets boom, real rates drop and almost all financial assets do well. When stimulus runs out, commodities markets drop, inflation expectations fall, real rates rise, and almost all financial assets lose money. Lack of political coordination on a second round of fiscal stimulus is why the markets have been so choppy in the last few months leading up to the US election. I expect continued market volatility until there is more coordination among the branches of the government.

via ZeroHedge News https://ift.tt/2JmpqrT Tyler Durden