The Best And Worst Performing Assets In October

Tyler Durden

Mon, 11/02/2020 – 15:45

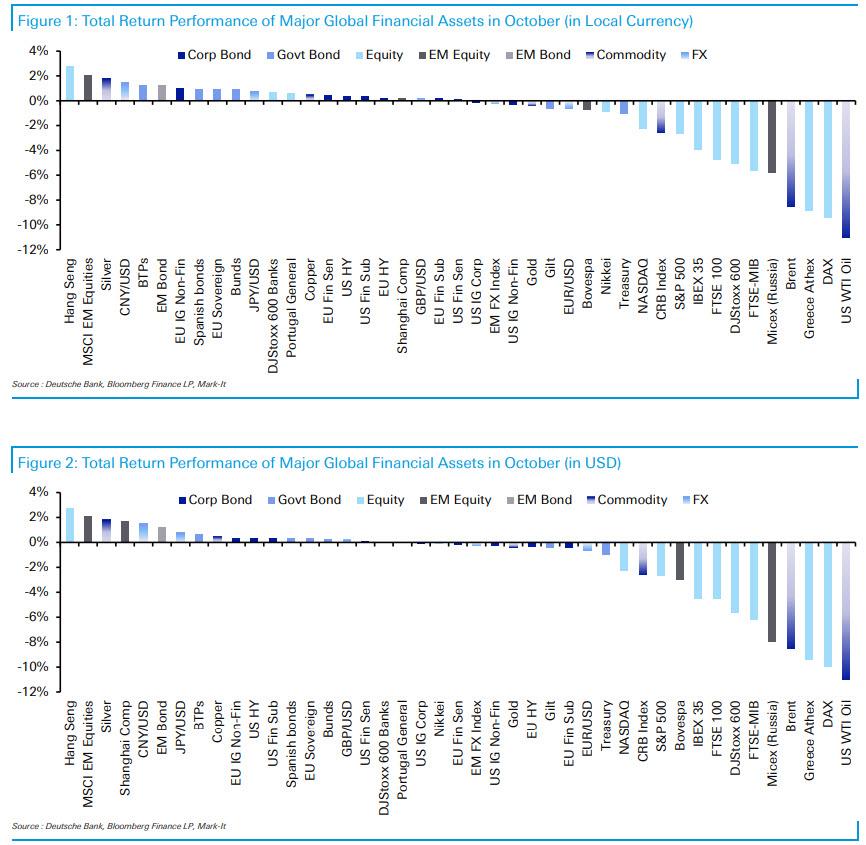

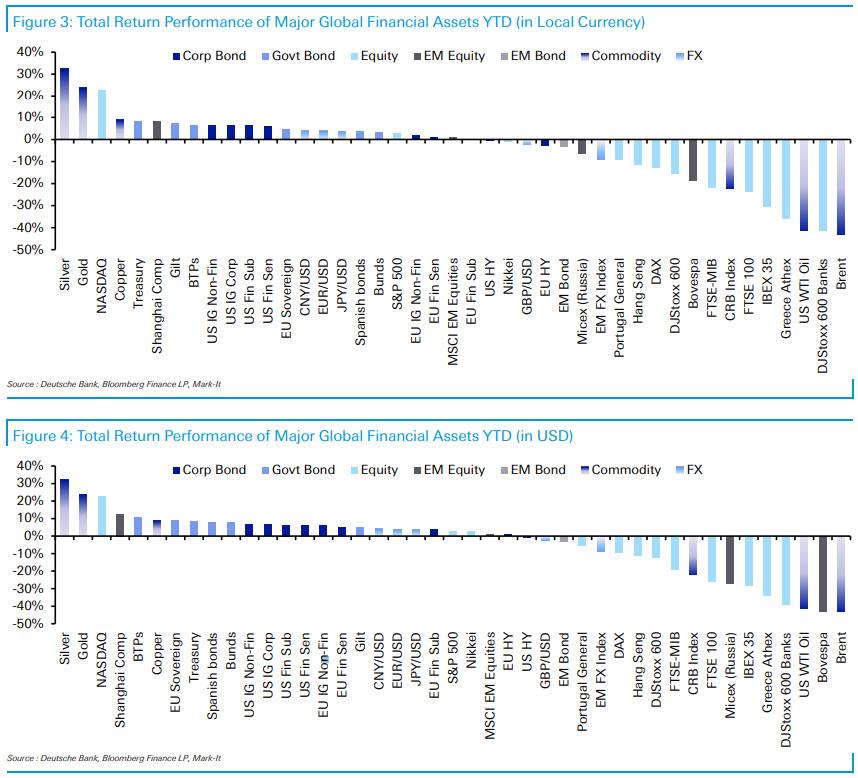

In a continuation of the September weakness across markets, October saw a further decline in risk sentiment across financial markets from the post-covid highs of late-Summer as case counts are rising to new highs across Europe and the US. And, as Deutsche Bank’s Karthik Nagalingam writes in his October performance review note, European equities and oil in particular were among the worst performers last month, while EM assets were among the best.

With partial national shutdowns announced in the two largest European economies and further restrictions across the continent in the face of quickly rising Covid-19 cases, indices such as the German DAX (-9.4%), Greek Athex (-8.8%) and Italian FTSE-MIB (-5.6%) had their worst months since March. The negative sentiment was partly shared on the other side of the Atlantic, with cases there reaching record highs as well, as the S&P 500 (-2.7%) and the Nasdaq (-2.3%) declined for a second straight month. It was not all bad news as Asian markets partly rallied, with the Hang Seng gaining +2.8% last month.

WTI (-11.0%) was the worst performing instrument, with Brent crude (-8.5%) not far behind as global demand worries on the back of further government shutdowns hurt energy prices. Both measures of oil are now at their lowest levels since late May. Not all commodities were lower in October however, as some metals saw a modest rise over the last month. Silver rose +1.8% and copper gained +0.5%, while gold declined -0.4% over the month.

Meanwhile, in fixed income, sovereign bonds rallied in Europe with the risk off tone and indications that the ECB would continue and possibly expand on its bond buying programme. BTPs led the way (+1.3%) for a second straight month, with Spanish debt (+1.0%) following, while bunds (+0.9%) advanced similarly. US Treasuries, on the other hand fell – 1.0%.

In terms of FX movements, the big move was in Asian currencies as the Chinese Renminbi strengthened +1.5% against the US dollar, while the Japanese Yen rose +0.8%. The Euro fell -0.6%, while the EM FX index dropped -0.3% as the dollar index rose +0.2% in its smallest monthly move since April.

via ZeroHedge News https://ift.tt/3mIBBOc Tyler Durden