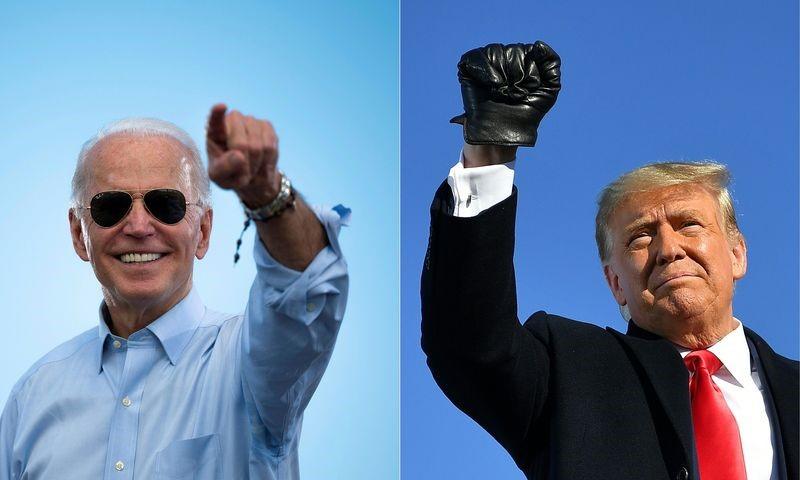

Covfefe vs. Malarkey

Tyler Durden

Tue, 11/03/2020 – 10:15

By Michael Every of Rabobank,

So here we are: US Election Day. There are so many ways to describe what is about to happen, from the short term and tactical to the long-term and strategic – and it’s a very busy market for that kind of thing: Blue Wave; Red Wave; Wave goodbye to business as usual.

Has anyone staked a claim to “Covfefe vs. Malarkey” yet? Which sounds like a bitter American divorce; which in many ways it actually is. Yes, there is still bipartisan support in Washington, DC, but mainly for actions against China, which are polarizing; on most domestic fronts, we see nothing but that polarization.

It’s certainly going to be a long day as we wait to see which political, cultural, geopolitical economic, and geoeconomic memes will be replicated at the ballot box by the 116 Americans left who haven’t already voted. That’s a joke of course: turnout today will be huge. It’s going to be an even longer wait if this all ends up in the court room, as threatened. Which probably will happen unless turnout today is so crushing for either party that the other has no choice but to concede.

As I typed this line, a Bloomberg headline flashed by: “Trump and Biden both claim victory” even before Election Day polling booths have opened. Yes, it’s going to be a long, long day; or perhaps week; or even weeks. So let’s have some Election Day entertainment until we get the results in from key Florida counties, which will give us the first indication of what has happened.

Woody Allen once wrote, and I have more than once lifted:

“We stand today at a crossroads: One path leads to despair and utter hopelessness. The other leads to total extinction. Let us hope we have the wisdom to make the right choice.” So is it really “Oy Vey vs. Oy Gevalt”?

George Bernard Shaw argued:

“Democracy substitutes election by the incompetent many for appointment by the corrupt few.” Which sums up the human condition nicely.

Joseph Stalin –who Shaw was a *big* fan of– noted:

“It is enough that the people know there was an election. The people who cast the votes decide nothing. The people who count the votes decide everything.” No anxious waiting for Florida when Uncle Joe was running the vote: markets would probably prefer that method if they ever got a vote on it.

J. O’Rourke wrote:

“We will win an election when all the seats in the House and Senate and the chair behind the desk in the Oval Office and the whole bench of the Supreme Court are filled with people who wish they weren’t there.” Right now it’s just much of the electorate who feel like that.

Imelda Marcos, channeling modern markets, claimed:

“Win or lose, we go shopping after the election.” Except for once many US shops are boarded up and the National Guard are standing by.

Which segues well to the final thought from anarchist Emma Goldman:

“If voting changed anything, they’d make it illegal.” Will we see a surge in youth Democrat turnout to show that ain’t the case, or in older, rural, Republican voters to make the same point in the inverse?

Anyway, that’s killed 5 minutes of this market purgatory as we all wait to find out if it’s “Make America Great Again”, with its 1950s and 1980s retro, or “Build Back Better”, with its “Make 2012 Great Again” retro, which triumphs.

Meanwhile, there has been market action. Down in Australia the RBA cut rates from 0.25% to 0.1%, as expected, dropped its 3-year yield target to 0,1%, stated rates are on hold there for at least three years (longer, says I), and announced an expansion of QE to AUD100bn across the 5-10 year part of the curve over the next six months. Negative rates were again stated as being incredibly unlikely, but further expansions in QE were very clearly placed on the table if they are needed. And all the signs from every other economy which has gone this route are that this will be needed.

Naturally, AUD didn’t move at all, because much of this was already priced in; but let’s see how the currency responds when the next tranche of AUD100bn QE is inevitably rolled out. On which note, the list of Chinese bans on Aussie exports continues to grow and grow. Iron ore is the biggie still waiting.

Australia’s populist One Nation party leader Pauline Hanson once infamously replied that the solution to low economic growth and rural exports was to “print more money” (in this case, to drive down the exchange rate and make Aussie products more competitive). She was widely derided for this idea – which has arguably now official policy in both Australia, and the world over, just dressed up in economic technobabble. Unless one believes that any of this QE is going to be reversed ahead? In which case I have a lovely bridge to sell you. Hardly used. Beautiful views of utopia in all directions. Anyway, the Queensland state election just held saw One Nation suffer a sharp drop in support in its home base: so populism needs to stay ahead of the establishment, it seems.

Well, that’s another 5 minutes gone. The rest of the day is up to you, sorry.

via ZeroHedge News https://ift.tt/2U2LH0h Tyler Durden