Sign Of Caution? Corporate Insiders Absent In Pre-Election Dip-Buying

Tyler Durden

Tue, 11/03/2020 – 12:50

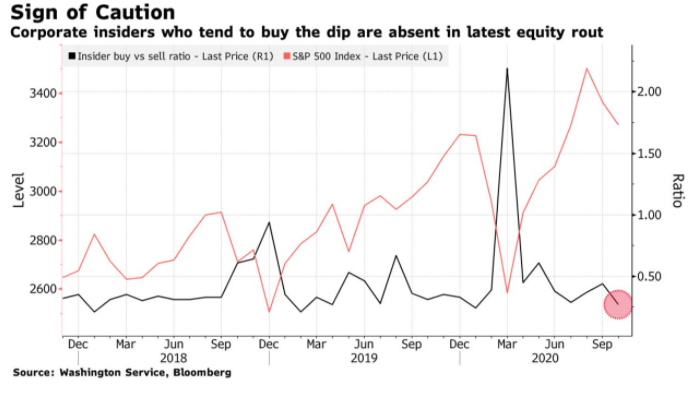

In August, corporate insiders unloaded their own stock as S&P500 screamed to an all-time high price, with a forward P/E multiple surpassing the dot com peak of 27x. Corporate execs, at the time, were dumping their stock into unsuspecting Robinhood traders. Months later, “Wall Street suits” as Barstool Sports’ Dave Portnoy has coined, have yet to purchase these shares back, in a meaningful way, that would ultimately suggest the market is overpriced.

Corporate insiders, the same ones who bought the dip during the corona-crash in March, have yet to hit the big green buy button in October. As to why, well, it could be due to valuation concerns or election uncertainty.

According to Bloomberg, citing data compiled by the Washington Service, shows only 380 corporate insiders bought shares of their own companies last month, the second-lowest rate in more than two years. While sellers also backed off, they did so at a more moderate pace than buyers. Resulting in the insider buy vs. sell ratio to slump to levels not seen since early 1Q20.

The lack of corporate insider buying comes as “large speculators” under the Commodity Futures and Exchange Commission have boosted their net positions in S&P 500 e-mini future to levels not seen since 2019.

Malcolm Polley, president and chief investment officer at Stewart Capital Advisors LLC., said what’s troubling is that corporate execs who know their companies better than anyone else aren’t buying – this is a worrisome sign about future expectations.

“What they’re telling you is, our stock is not cheap and may be expensive so it doesn’t make sense for us to buy the dip,” Polley told Bloomberg. “While earnings have certainly improved versus Q2, the rate of improvement going into Q4 and Q1 of next year will probably slow pretty dramatically.”

Bloomberg said corporate execs bought $74.3 million worth of shares in October, down 43% over the previous month. Selling by execs dropped 29% to $1.67 billion.

As equity bulls continue to pile into stocks, anticipating new rounds of fiscal and monetary support, along with a “V-shaped” economic recovery, Citigroup’s Panic/Euphoria Model still shows market sentiment is in “euphoria” territory.

Tobias Levkovich, Citi’s chief U.S. equity strategist, said the market is still highly exposed to shocks such as earnings misses. He noted that the number of S&P 500 companies firms experiencing upgrades has likely peaked around 70%, a warning that earnings revision momentum may have slowed.

“The crowded nature of concentrated ownership forces us to think about a kind of prisoners’ dilemma game theory, whereby we have to worry about others’ actions affecting our holdings,” Levkovich wrote in a note. “Until a couple of months ago, we had to contend with their buying activity, and the trend may be changing.”

The lack of corporate insiders purchasing their own stock is suggestive valuations are still expensive, and maybe a robust economic recovery is not around the corner.

via ZeroHedge News https://ift.tt/3elbLgn Tyler Durden