Stocks’ Surge Suggests Trump Win, Dollar Dives As Gold Thrives

Tyler Durden

Tue, 11/03/2020 – 16:01

For the second day in a row, stocks soared with Small Caps leading the way (up over5% in 2 days) followed by The Dow (some weakness into the close)…

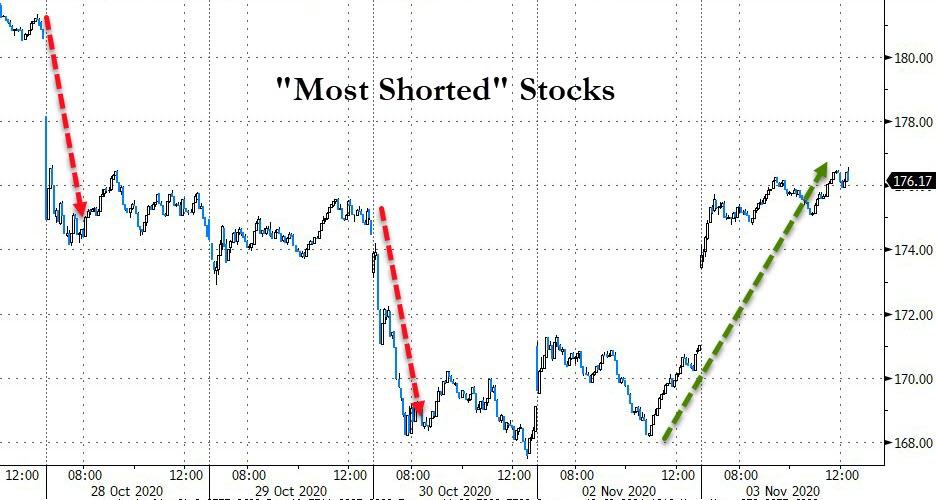

As yet another short squeeze is unleashed…

Source: Bloomberg

This impressive two-day rally into Election Day is pushing the S&P 500 Index’s performance over the past three months into positive territory – a comeback for the indicator which turned negative last week – and that’s good news for Trump.

A rising market has tended to precede a victory for the sitting party 86% of the time since 1928.

Source: Bloomberg

The theory proved spot on in 2016: Amid all the polls showing Hillary Clinton’s dominant lead over Trump, the equity benchmark fell for nine straight days before the election week, cementing its three-month performance into negative territory.

And all this as the odds of a blue-wave tumble…

Source: Bloomberg

But hey, the sun’ll come out tomorra, betcha bottom-dollar…

The Russell 2000 is as its strongest in almost two month against Nasdaq…

Source: Bloomberg

And then there’s this – China-exposed stocks have been notably underperforming domestically-focused US stocks in the last two days…which could suggest a Trump win…

Source: Bloomberg

VIX tumbled back below 35…

As Stocks rallied, bonds were sold with another big burst of selling as Asia closed and Europe opened…

Source: Bloomberg

With 10Y Yields within a tick of 90bps – the highest since June 8th (breaking and closing above the 200DMA)…

Source: Bloomberg

The yield curve (2s10s) closed at its steepest since Jan 2018…

Source: Bloomberg

The dollar tumbled on the day, breaking back below its 50DMA (1169)…

Source: Bloomberg

And HKD plunged after the Ant Group IPO was suspended, putting pressure on capital flows…

Source: Bloomberg

Bitcoin bounced back above $13,500 today…

Source: Bloomberg

Gold surged back above $1900, erasing last week’s plunge…

WTI rallied once again, back above $38 intraday, ahead of tonight’s inventory data…

Finally, do not panic, unless you fear the ‘casedemic’…

Source: Bloomberg

And if you want an indicator for sentiment tonight – follow short-dated yuan volatility… a rise implies Trump more likely to win…

Source: Bloomberg

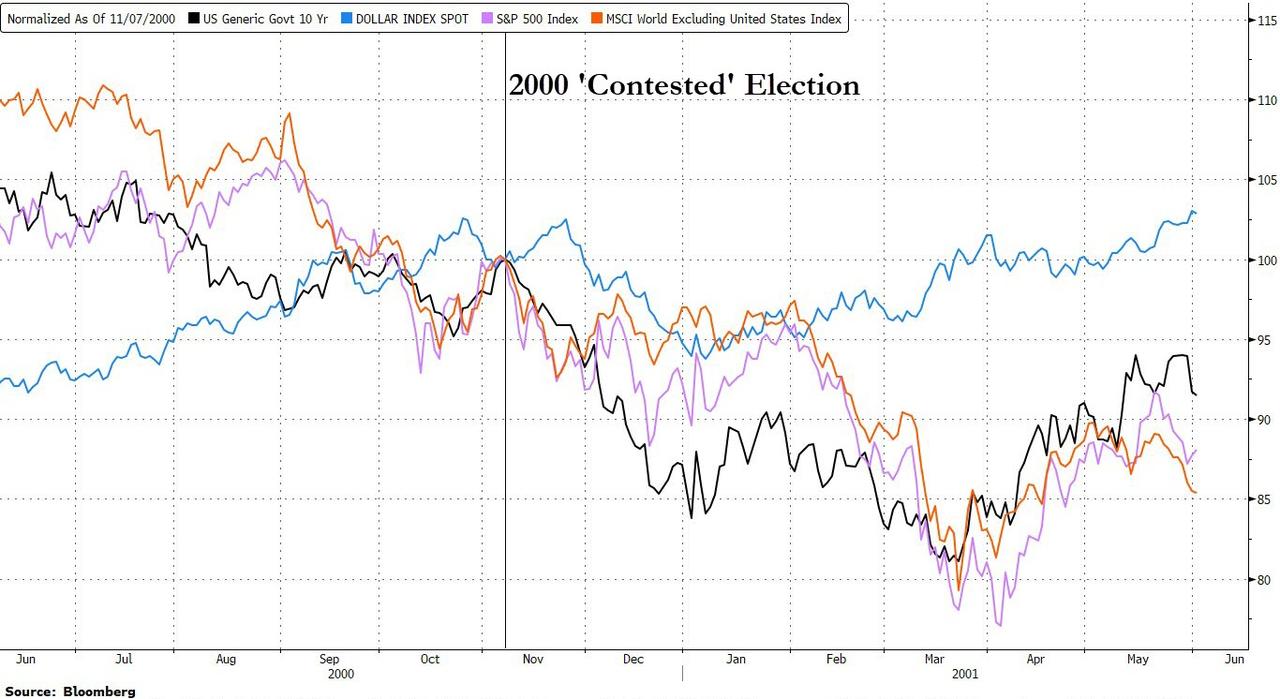

And if tonight is “contested”, 2000 suggests bonds rally as stocks get slammed…

Source: Bloomberg

via ZeroHedge News https://ift.tt/2JCxhlz Tyler Durden