Futures Explode Higher As Odds Of Reflation Trade, Contested Election Collapse

Tyler Durden

Tue, 11/03/2020 – 22:38

It was supposed to be a Blue Wave… and if not a Blue Wave then at least a landslide victory for Joe Biden over Donald Trump. Well, not only is that not likely to happen, but suddenly it seems that Trump may be a decisive winner and not need Pennsylvania, with Betfair odds now 70% in his favor.

So what does that mean for a market that had almost entirely priced in a Biden/Blue Wave victory? Well, as we noted on Oct 31, when we pointed out the collapse in Nasdaq shorts, we said that a surge in the Nasdaq was imminent as the so-called dumb money reversed.

The “smart money” are officially idiots: after record shorts a month ago, specs puked into upward momentum and were flat into the worst week for tech since March. This means that NQ will now surge as specs go short again pic.twitter.com/dxcC8NmSkL

— zerohedge (@zerohedge) October 30, 2020

Fast forward to today, when this expected short squeeze has unleashed a massive Nasdaq short squeeze, that sent the tech index 4% higher at which point it was briefly halted as circuit-breakers were triggered.

There are two reasons for this:

- The lack of a Blue Wave means that no massive reflation trade is coming, and so instead we will get a re-deflation rotation, which is great for Treasurys and for growth/duration stocks such as tech.

- The lack of concerns about a contested election, means that all of the crash protection that traders had accumulated for just such an eventuality, will be unwound and stocks will surge, which is precisely what they are doing on Tuesday night as in addition to NQs, the Emini is also exploding higher.

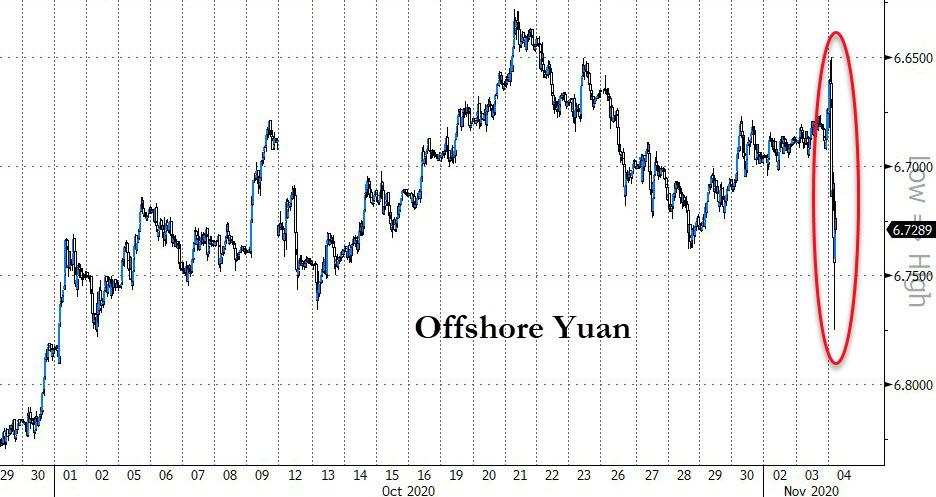

Meanwhile, since a pro-China Biden administration is not coming, the Yuan is plunging as the odds are now that we are facing 4 more years of escalating trade war with China.

Finally, after tumbling early as a result of the surge in the dollar, gold has recovered much of its losses, as no matter if it’s Trump or Biden, one thing is certain: much more fiscal stimulus is coming, and even more dollar debasement is just around the corner.

via ZeroHedge News https://ift.tt/3mPC2WZ Tyler Durden