WTI Holds Gains After Big Crude Draw, Gasoline Demand Slides

Tyler Durden

Wed, 11/04/2020 – 10:35

After some notable volatility overnight, oil prices are higher ahead of this morning’s official inventory data as OPEC+ talks on delaying a January oil-output increase gathered momentum.

This week’s inventory and production data will be heavily influenced by Hurricane Zeta which caused the shut-in of around 85% of Gulf crude production.

API

-

Crude -8.01mm (-600k exp)

-

Cushing +981k

-

Gasoline +2.45mm (-1.1mm exp)

-

Distillates -577k (-2.4mm exp)

DOE

-

Crude -7.998mm (-600k exp)

-

Cushing +936k

-

Gasoline +1.541mm (-1.1mm exp)

-

Distillates -1.584mm (-2.4mm exp)

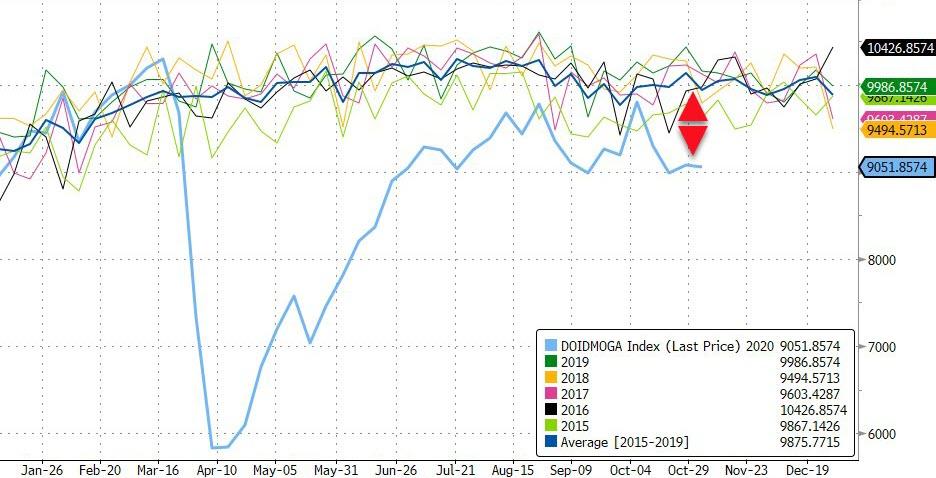

After last week’s surprise build and API’s surprise draw, analysts expected a modest draw in official crude stocks, but instead got a 8mm barrel draw (same as API) – the most since August…

Source: Bloomberg

Gasoline supplied (implied demand) seems to be stubbornly stuck around 10% below average, and mobility data is not showing any signs of improvement.

Source: Bloomberg

Bloomberg Intelligence Senior Energy Analyst Vince Piazza:

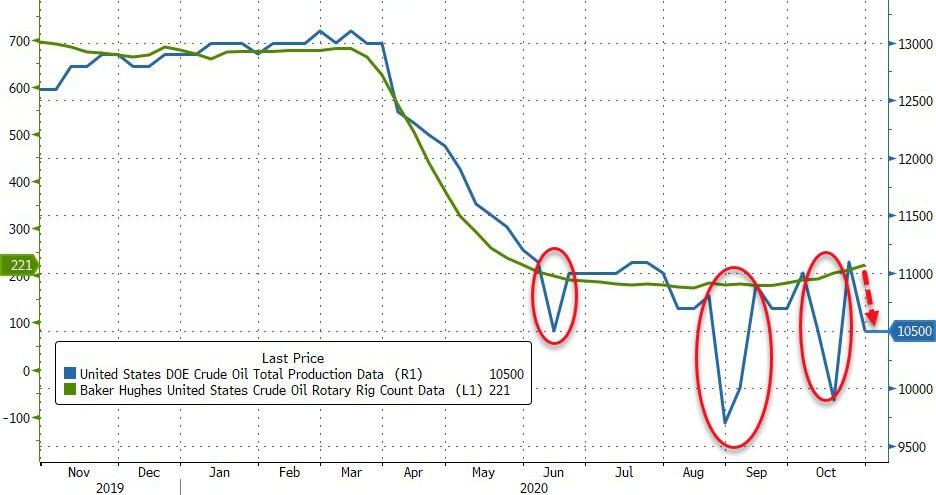

Storms coming through the Gulf of Mexico — temporarily crimping volume and flows — can offer intermittent aid for balances amid rising concerns about demand weakness and a tenuous economic backdrop. Oil production is recovering to above 11 million barrels a day due to a rebound in completion crews, while a crude-export increase may be temporary and storage levels could actually be rising, with Cushing about 79% full.

Given Hurricane Zeta’s impact, last week’s production data is likely to be fnorked as it dropped 600k b/d…

Source: Bloomberg

WTI was trading around $38.20 ahead of the print…

Notably, China may be helping (taking advantage of low prices), as the communist country raised its monthly American crude purchases 21% to 21.4m bbl in September, keeping its spot as the top buyer for the fifth month,according to U.S. Census Bureau and EIA data compiled by Bloomberg.

As Bloomberg Intelligence’s Energy Analyst Fernando Valle warns, “the return of lockdowns in Europe is a threat to U.S. refiners, as gasoline imports on the East Coast could rise in coming weeks. Several, including PBF Energy and CVR Energy, have announced plans to idle units in the next few months in a bid to ease supply, primarily of diesel. Inventories remain a major concern and there needs to be a demand-led recovery to restore balance to refined-product markets.”

via ZeroHedge News https://ift.tt/2TTznPS Tyler Durden