Shorting The Robinhood “Herd” Can Produce Consistent Returns, New Paper Finds

Tyler Durden

Sat, 11/14/2020 – 18:00

We previously reported that one of the most profitable strategies on Wall Street was taking the other side of whatever the hedge fund consensus has been.

We have also bore witness to a market so insanely rigged by the Federal Reserve that retail investors conditioned to “buy the dips” at all costs have routinely outperformed hedge funds, who, unlike retail investors, probably still stop for at least half a second to consider the notion of an iota of risk, which of course no longer exists and immediately puts hedge funds at a disadvantage now – as we noted back in May.

And while hedge funds continue – err, sucking, to use the technical term – it looks like the replacement strategy is now fading whatever positions are popular among the Robinhood retail “herd”, according to Bloomberg.

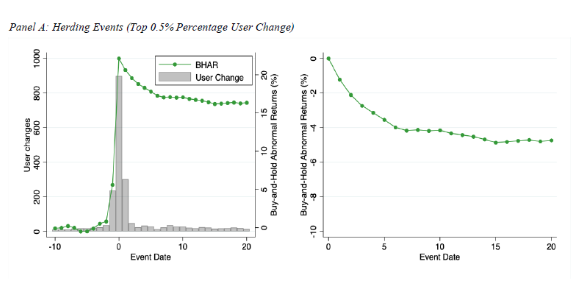

The herd mentality of Robinhood users results in excess returns of 14% on average when traders first pile in, but then eventually leads to a reversal of over 5% the next month, according to a new study.

The reasoning is simple: the app’s simple interface appeals to simple traders, who are easily wowed by the most “attention grabbing” names – all together. Users are more likely to buy securities on the app’s “Top Mover” list more aggressively than other names, the researchers noted.

Behavioral finance pioneer Terrance Odean, who helped author the study, said: “Robinhood users are more subject to attention biases. The combination of naïve investors and the simplification of information is associated with herding episodes.”

The paper concluded that selling a security after a “herding event” and then buying it back five days later would deliver a 3.5% return consistently. For securities where the “herding event” was more extreme, the returns were “nearly double”.

Researchers believe that hedge funds are using similar strategies, as they noted a spike in short interest in names where Robinhood “herding events” had taken place. Perhaps this is why Point72 and other funds were scrambling to get Robinhood user data after the site decided it would prevent tracking sites and hedge funds from accessing data about how many users owned particular stocks on its platform.

Cohen’s firm reached out to other platforms “just hours” after Robinhood restricted access to its API, we noted. Additionally, the owner of Robintrack.net, the website that aggregated data from Robinhood, told Business Insider he had “seen evidence that Point72 and quant hedge fund D.E. Shaw” were trying to scrape the site’s data.

The study concluded: “How information is displayed can both help and hurt investors. The simplified user interface influences investors decision.”

via ZeroHedge News https://ift.tt/3kwbZTa Tyler Durden