Deutsche: “There Is Increasing Demand To Use Bitcoin Where Gold Was Used To Hedge Dollar Risk And Inflation”

Tyler Durden

Wed, 11/18/2020 – 22:30

From Deutsche Bank’s Jim Reid

A divergent world post vaccine news

There has been some consolidation in the S&P 500 after last week’s vaccine euphoria. The index is ‘only’ 1% above where we closed last Wednesday. However, remember this index has many mega-cap growth stocks that have benefited from the pandemic so it won’t be the best index to track when looking at what the vaccine hope is doing to markets.

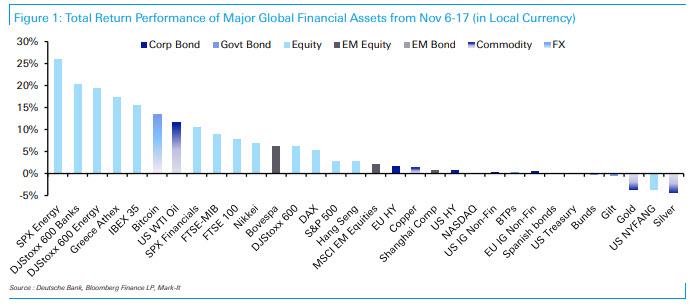

Looking at a broader sweep of selected global assets since the start of last week, just before the initial Pfizer/BioNTech vaccine news, it’s clear there has been a big divergence and bias towards cyclically-exposed assets. The Energy complex has soared along with financials (especially in Europe). European equities have notably out-performed the US.

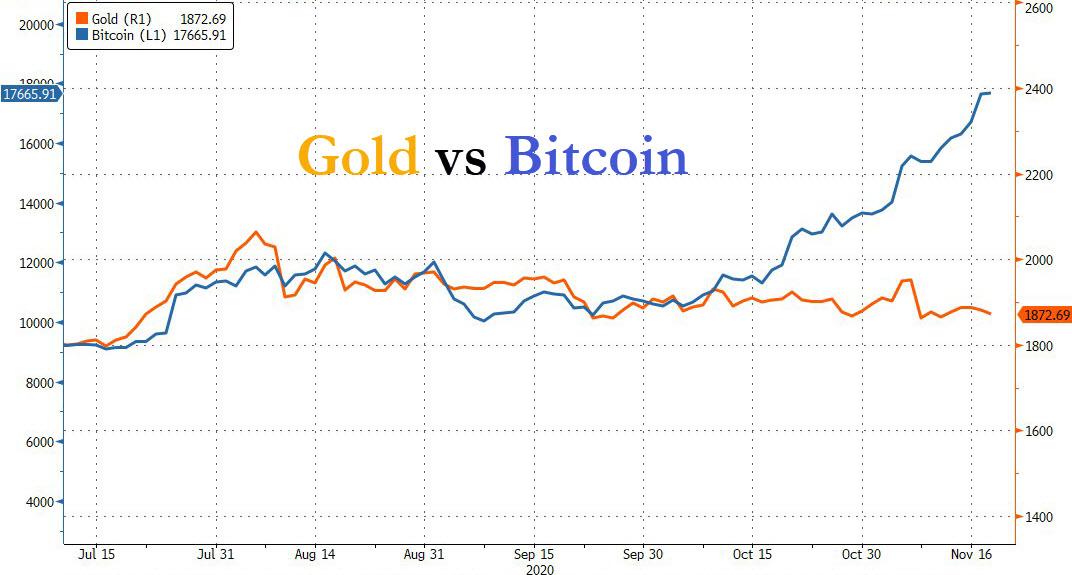

One of the worst performers has been tech with the US NYFANG index -3.8% since the vaccine news. This index is up +77.5% YTD in total return terms, so any normalisation could weigh on the overall US indices given their importance. One of the oddities has been the dramatic divergence between Gold (-3.6%) and Silver (-4.4%) on the one hand and Bitcoin (+13.4%) on the other. Bitcoin is up another +3% overnight and seems to be creating momentum of its own. It’s up over 70% over the last six weeks as more and more investors are starting to see it emerge as a credible asset to invest in.

There also seems to be an increasing demand to use Bitcoin where Gold used to be used to hedge Dollar risk, inflation and other things.

via ZeroHedge News https://ift.tt/32X5CCu Tyler Durden