“I’m Not Ruling Out” A Trump Re-Election – JPM AM CIO Fears ‘Remote Risk’ Of “American Horror Story”

Tyler Durden

Thu, 11/19/2020 – 08:27

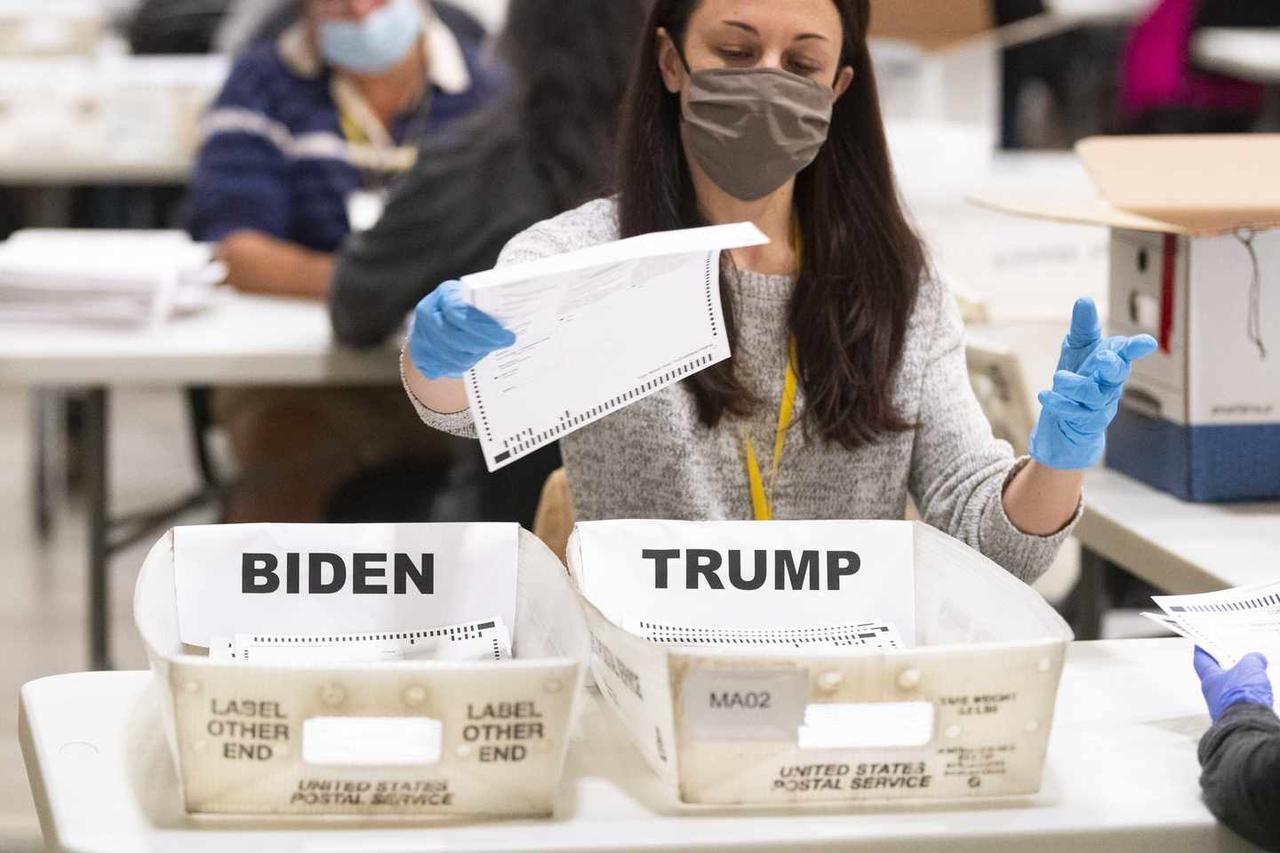

While the mainstream media has unequivocally called the election for Joe Biden, and the establishment lackeys (and their social media minders) around the world refuse to even mention (or allow the mention) of widespread voting irregularities (don’t says systemic fraud or you will be burned at the stake of Salem’s conspiracy theorists), there is one man willing to step out on to the ledge and – while hardly supportive of President Trump’s efforts – explain/admit that the current president may still have a path to re-election (and just what that might mean for America).

JPMorgan Asset Management CIO Michael Cembalest pulls no punches in his latest note to investors. The title alone ” The remote risk of an American Horror Story: Constitutional mayhem on January 6th” sends shivers down the spines of those with their heads firmly in the sand, unwilling to admit to themselves there is, perhaps, maybe, possible, some ‘there’ there in the Trump campaign’s various legal approaches.

The Constitution, the Courts, the Congress, and electoral fraud allegations

-

Could one or more states submit competing slates of electors? Only North Carolina expressly grants the legislature a role in certifying electors. Other legislatures, despite constraints in their state constitutions and statutes, might assert authority to act under Article II of the Constitution and submit a competing slate of electors. While there’s no explicit authority granted to them, a Governor or Secretary of State could also submit a competing slate. Competing slates that are contrary to the popular vote could be invalid under the federal Election Day statute, and may also violate voting rights the Supreme Court recognized in Bush v. Gore. Competing slates are extremely rare: it only happened once in the 20th century (Hawaii, 1960)

-

Competing slates would be dealt with via rules spelled out in the Electoral Count Act (ECA) of 1887: on January 6th, the newly seated Congress would resolve them. In case of a split Congress, the prevailing view is that ECA tiebreaker rules generally require Congress to adopt whichever slate was signed by the Governor of the state in question. Governor affiliations: Democrats in MI/PA/WI/NV, Republicans in GA/AZ

-

US-China historian Graham Allison wrote that the GOP could declare the ECA unconstitutional on the grounds that federal statutes cannot constrain the power the Constitution grants to chambers of Congress to count and determine validity of electoral votes. As the argument goes, counting must proceed under the 12th amendment, and if the House and Senate disagree on competing slates, VP Pence (as presiding officer of the joint session of Congress in which electoral votes are counted) could cast the deciding vote. In the nightmare scenario for markets, the ECA is jettisoned by the Senate, the GOP declares Trump as the victor by flipping 3 states, Democrats disagree and refuse to participate in the Jan 6th session, all of which sets up the prospect of dueling inaugurations, an outcome narrowly averted in 1876 and which led to the 1887 Act

-

Allison’s scenario assumes that Senate Republicans discard the ECA, despite the fact that it was created to address competing slate outcomes. In any case, let’s do the math: due to Senate seating rules, its composition on Jan 6th will be 51-R and 48-D, since one Georgia runoff election will not be seated yet and the other will still be GOP irrespective of the outcome (since it was a special election). So, if 2 or more GOP Senators respect the ECA when resolving competing slates, Gubernatorial tie-breakers would remain

Another remote risk: Attorney General Barr could in theory direct investigators to seize or impound election records to investigate voter fraud, which would slow down canvassing and recounts. Usual DoJ policy would hold off until after the election is settled before investigating fraud for prosecution or civil enforcement proceedings. But if this happened, it could prevent a state from meeting the Dec 14th Electoral College deadline. However, states have already begun to certify results and once results are certified, even if DoJ seizures interfere with recounts, initial certifications would likely stand as the basis for appointing electors

On recounts, Georgia plans to complete it in time for its Secretary of State to certify election results by Nov 20 (a deadline a court may be able to extend); early results show few vote changes so far. Recounts might also be requested and conducted in Pennsylvania (Biden +0.8%), Wisconsin (Biden +0.7%) and Nevada (Biden +2.7%). Historically, recounts have not changed outcomes with margins this large

Cembalest’s Bottom line is simple: a LOT of very unorthodox things have to happen for Trump to be re-elected.

Based on the uncertified vote results, Trump would have to reverse or impede results in three states to prevent Biden from reaching 270 electoral votes (EV). Biden unofficially has 306 EV, so Trump would need to flip three states via one of the avenues described above (see table on following page for EVs by state and other data)

How remote are these risks? Ed Foley of Ohio State (the constitutional election law expert cited by Allison) wrote his own article last week entitled “Relax. Biden will be sworn in on Jan. 20”, and another expert that I have been working with agrees with him. Among their arguments: the high hurdle needed to prove sufficient levels of unlawful ballots for courts to set aside the outcome in that state

Even so, I’m not ruling anything out.

Trump fired the top US election security official last night, and his campaign lawsuits are petitioning judges to prevent state certification of results due to fraud and other improper conduct. The RNC hasn’t signed on to many of these lawsuits, and some Trump law firms are reportedly abandoning him. But anything is possible, particularly since a senior DoJ official who oversees voting investigations stepped down from his role after Attorney General Barr authorized US attorneys to probe alleged fraud. The departing DoJ official stated to colleagues that the new DoJ policy abrogates the forty-year old Non-Interference Policy for ballot fraud investigations

There’s just one more thing that the JPMorgan Asset Management CIO is worried about:

Contingent Elections

Since most scenarios I can think of entail one candidate or the other reaching 270 EVs; and/or since if any state’s EVs are not submitted by the December 14th deadline, such EVs would most likely be removed from the numerator and denominator of the Electoral College equation. As a result, a candidate would need to obtain a simple majority of all remaining EVs to win.

What about the Supreme Court?

First, the Court could hear appeals on state challenges, such as late-arriving absentee ballots in PA (too few to change the outcome); complaints on transparency of vote counting (judicial relief could entail recounting certain counties); illegal acceptance of certain votes (votes in question too small to change the results); and complaints that the voting process suffered from pervasive irregularity and fraud (most of these claims have been rejected by lower courts over the last 2 weeks)

Second, what if the Court heard a challenge to constitutionality of the ECA? Such a lawsuit would probably fail: the ECA does not violate the rights of any person in particular, therefore no one has standing under Article III of the Constitution to contest it. Furthermore, since the Constitution grants sole authority to chambers of Congress to count and determine the validity of electoral votes, a federal court (including the Supreme Court) lacks jurisdiction under the Political Question Doctrine to constrain Congressional authority

Finally, Cembalest explains why all this matters (aside from policy shifts of course) to the average investor:

Democracies can/should enforce the rule of law to ensure that only lawfully cast ballots are counted. However, the devil is in the details of how this is achieved; markets might react negatively if the US as the world’s reserve currency nation is seen as sliding down a path toward electoral illegitimacy due to post-election maneuvers by political parties. In the chart, we show equity market valuations vs constraints on government power.

Simply out, as the chart above shows, a modest decline in the rule of law, if it cost 3x-4x multiple points on earnings, could result in a de-rating of US equities.

via ZeroHedge News https://ift.tt/3pIsS0R Tyler Durden