WTF Chart Of The Day

Tyler Durden

Thu, 11/19/2020 – 10:40

A funny thing continues to happen in American stock markets. While business media channels fill their days with ‘breaking news’, market-moving headlines, and investor-challenging interviews (what did billionaire XXX do today?), it appears it’s all entirely useless when it comes to ‘real world’ investing.

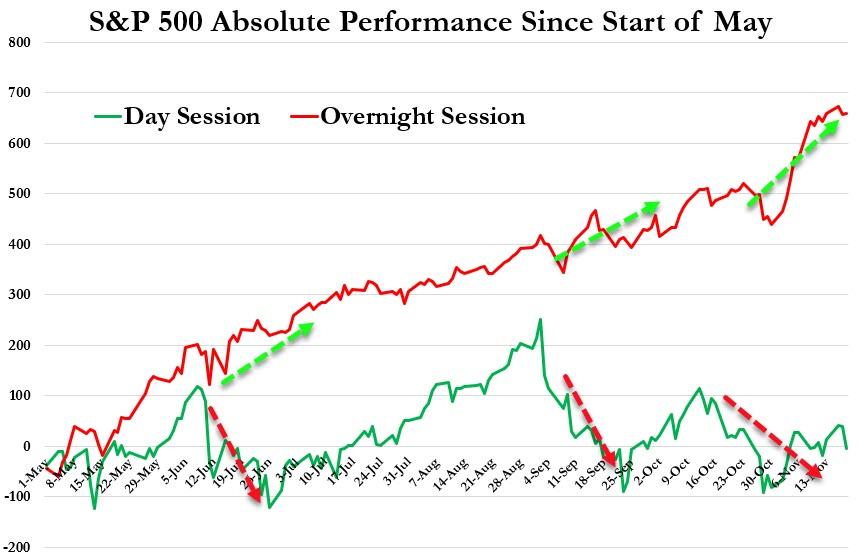

The buy-at-the-open, sell-at-the-close strategy is unchanged since the start of May. The buy-at-the-close, sell-at-the-open strategy is up a stunning 660 points over the same period.

Most notably, the strategy is having seen yet another renaissance since the election (daytime -5pts, nighttime +133pts)…

Traditionally, “investors benefit from receiving as much information as possible, and there’s a lack of information outside of market hours,” Todd Rosenbluth, head of ETF and mutual fund research at CFRA told Bloomberg, but it’s been different this year.

In fact “for late-night traders, this yeas has been like no other,” Paul Hickey, co-founder of Bespoke Investment Group, told Bloomberg.

“Holding the market overnight this year was a very risky trade. A lot of the uncertainty is behind us. Investors willing to take the risk to hold the SPY for 17.5 hours are again being rewarded more.”

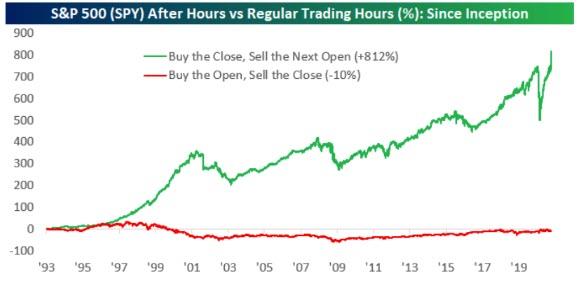

But, while this has been a very successful trade since May (even adjusted for risk), it is a time-tested strategy for dramatic outperformance.

If a trader bought the SPY ETF at the open and sold it at the close every day beginning in 1993, she’d be down 10% over the time span, data compiled by Bespoke Investment Group show. Buying it at the close and selling at the next open, and then repeating it the next day, would have brought over 800%, the data show.

As we previously reported, JPM’s Nikolaos Panigirtzoglou attempted to explain this massive divergence in performance between regular and extended trading hours, noting that “the arrival of important news after US hours and during European trading hours, including both US and non-US economic data as well as better virus-related news in Asia and Europe.”

Frankly, in a world in which even other JPM strategists admit that neither news nor data matters any more – and only central banks do – we find this explanation to be self-serving BS (after all, the last thing we want is for JPM to analyze the root causes of the massive intervention by the Fed which starting last September was to bail out none other than JPMorgan itself), but whatever is the true reason for the ongoing overnight surge in the Emini, whether it is “important news and better virus news” when US markets are closed as JPM claims, or simply because that’s when central banks are most active in propping up markets, it doesn’t matter: as long as the divergence persists, and allows those who have noticed the “worst kept secret in the market” to literally keep printing money by buying the US close and selling the open, everyone remains happy.

Trade accordingly, night owls!

via ZeroHedge News https://ift.tt/2HeIZSi Tyler Durden