DoorDash Shares Open At $182, Up Nearly 80% In Dizzying Debut

Tyler Durden

Wed, 12/09/2020 – 12:45

After reaching $102/share last night – conferring a fully diluted valuation of roughly $41BN – a flurry of pre-debut reports Wednesday morning appeared to suggest that DoorDash’s anticipated valuation was moving higher minute by minute. And when it finally debuted at just before 1245ET on Wednesday, its opening price was $182.

DOORDASH OPENS AT $182, IPO AT $102

— zerohedge (@zerohedge) December 9, 2020

After starting out around $102/share last night (itself more than 30% higher than the $75/share expected over the weekend), reporters were gauging the valuation at between $195 to $200 a share just before the action started.

At $102/share, DoorDash’s fully diluted valuation would be roughly $41BN, more than double its most recent private valuation, while raising more than $3.4BN for the company on the day.

Despite the fresh memories of Uber and Lyft’s immediate post-IPO struggles, and DoorDash’s own admission that it might never become profitable, the company’s debut, which immediately preceeds Airbnb’s IPO by a day, is one of the highlights of the busiest weeks for deals of the year.

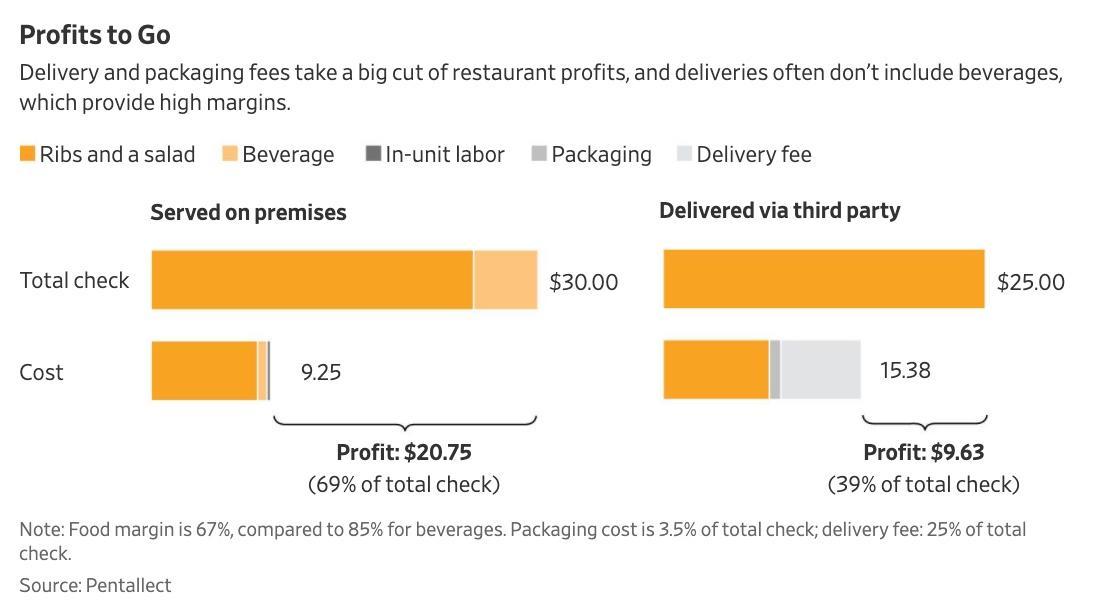

Though DoorDash isn’t the first food-delivery company to debut on US markets (Uber’s Uber Eats is the standard), the company has roughyl 50% market share in the US. Still, questions about the viability of the business model remain, as WSJ reported in a deep-dive series on the prospects of third-party delivery that the economics of the industry present a difficult conundrum for delivery drivers, restaurants and even customers.

As one NYT reporter reminds us, SoftBank was once criticized for overpaying for DoorDash (Though DoorDash is hardly the only company for which SoftBank overpaid).

this is almost double their opening price

im old enough to remember when the chatter was “how is doordash going to live up to it’s sky-high valuation b/c of the Softbank investment”

COVID really did change everything https://t.co/kisId4DC6s

— rat king (@MikeIsaac) December 9, 2020

Another Twitter analysts reminded us that DoorDash is hardly the only food delivery competitor. In fact, it’s a pretty crowded space, where valuations seem wholly disconnected from reality.

Just a reminder on competition and crowded spaces:

By the time DoorDash was founded, GrubHub, Caviar, Postmates, and OrderAhead all existed and were venture funded.

Didn’t matter. Today, DoorDash is going public at 4x of those competitors combined validation.

— Yuri Sagalov (@yuris) December 9, 2020

According to DD’s S-1, DoorDash reported its first quarterly profit ever earlier this year. And like Uber and Lyft before it, some analysts have warned that DD, once it achieves enough market share, will squeeze both restaurants and its drivers as it grows increasingly desperate to produce profits.

With DoorDash posting its first profitable quarter for a food delivery company leading up to its IPO, I’ll repeat something I’ve said before:

Order directly from restaurants whenever possible

1/ Here’s why

— Jamie Wilde ☕ (@jamiekaywilde) December 9, 2020

2/ DoorDash currently has 50% of the food delivery market, and 58% in the suburbs

In May, I wrote that whichever delivery giant gained the majority of the market would have two choices to make the sector profitable…

— Jamie Wilde ☕ (@jamiekaywilde) December 9, 2020

3/ First choice: Redirect the money it’s spending on SUMMER25 promo codes toward improving order quality and buttressing restaurants’ bottom lines

Second choice: Take advantage of their position by focusing on their $$$, not restaurants’/delivery drivers’

— Jamie Wilde ☕ (@jamiekaywilde) December 9, 2020

4/ Considering DoorDash is still charging restaurants commissions as high as 30% per order, I’d warrant they went with the second option

That 30% makes it hard, if not outright impossible (depending on the order), for restaurants to net any profit

— Jamie Wilde ☕ (@jamiekaywilde) December 9, 2020

5/ My take: While I don’t think there’s a problem with paying for a middle man to courier coffee, restaurants need a better deal

P.S. If you order directly from a restaurant, don’t click on their Yelp phone # (oftentimes, that’ll give a cut to Yelp)

— Jamie Wilde ☕ (@jamiekaywilde) December 9, 2020

via ZeroHedge News https://ift.tt/37URyv8 Tyler Durden