“Widowmaker” Nat Gas Trade Plunges On Mild Start To Winter

Tyler Durden

Wed, 12/09/2020 – 07:40

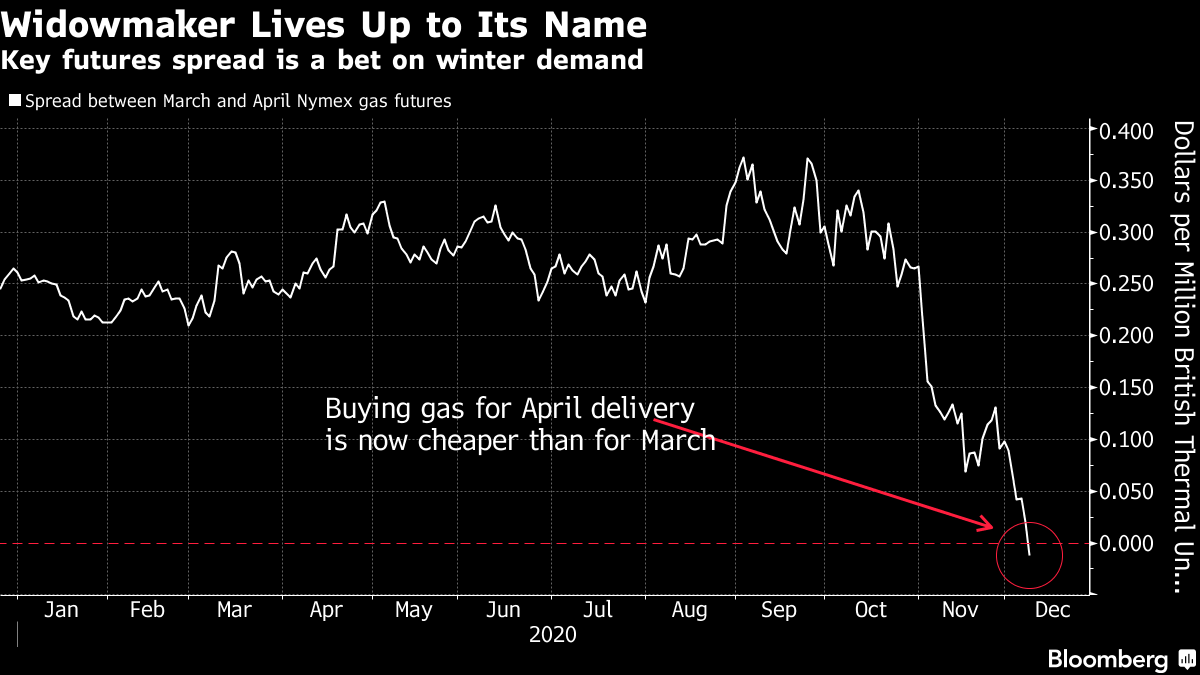

The spread between March and April natural gas futures collapsed to zero on Tuesday. The spread is critical in gauging how tight supplies will be for the North American winter. In one of the earliest collapses to less than zero, for the first time since 2015, this suggests traders are forecasting a mild winter that will dent energy demand.

Bloomberg calls the collapse in the spread the “widowmaker.” It’s a signal that traders are giving up on hopes of a frigid U.S. winter.

“It’s a significant event,” said Gary Cunningham, a director at Stamford, Connecticut-based Tradition Energy. “We may end winter with very strong gas inventories.”

Nat gas prices have tumbled since the start of November as persistent mild weather has caused inventories to rise rather than draw down with seasonal trends.

On Monday, we attributed the plunge in nat gas future prices on new weather models suggesting “December could end top 3 warmest all time.”

Earlier in the heating season, there was the anticipation of a colder winter, pushing prices up – but with the Lower 48 states now 25% through the winter heating season with mild temperatures expected – demand will be lackluster.

Now, there is some good news – mild weather will greatly help restaurants as many have resorted to outdoor dinning and the use of propane heaters.

via ZeroHedge News https://ift.tt/33W6TKE Tyler Durden