WTI Tanks After Massive Crude, Product Builds; Gasoline Demand Slump

Tyler Durden

Wed, 12/09/2020 – 10:36

Oil prices shrugged off major product inventory builds (reported by API) to move higher overnight with WTI back above $46 after two tiny Iraqi oil wells were attacked and markets globally rose on the prospect of additional U.S. stimulus.

Obviously, demand, or the lack of it, remains the prime driver of sentiment, balances and prices, and bloated inventories remain a drag on market recovery, and this is not unique to U.S. markets.

API

-

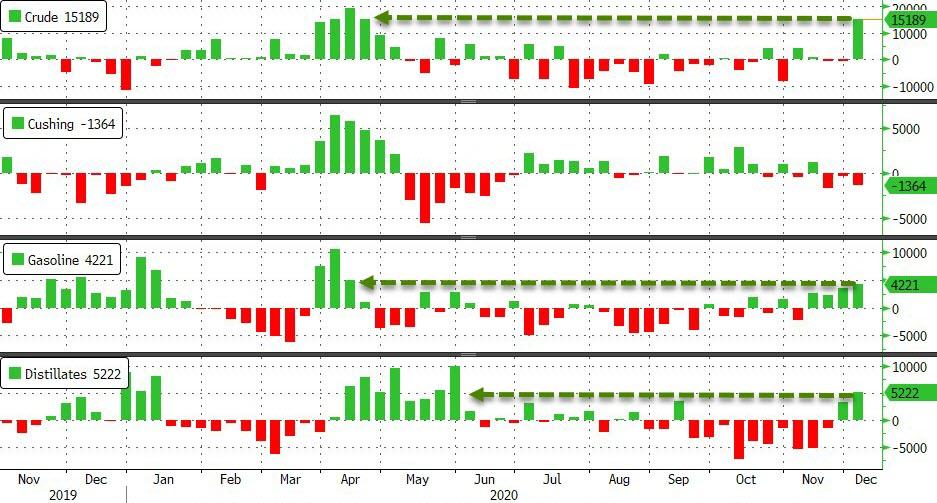

Crude +1.141mm (-700k exp)

-

Cushing -1.845mm

-

Gasoline +6.442mm – biggest build since April

-

Distillates +2.316mm

DOE

-

Crude +15.189mm (-700k exp) – biggest build since April

-

Cushing 01.364mm

-

Gasoline +4.221mm – biggest build since April

-

Distillates +5.222mm – biggest build since May

In a shocking print, the DOE data showed a massive 15.189mm barrel crude build last week, with both Gasoline and Distillates also seeing major builds…

Source: Bloomberg

US Crude Production was unchanged last week…

Source: Bloomberg

WTI traded around $46.00 ahead of the official DOE data and tumbled on the huge build…

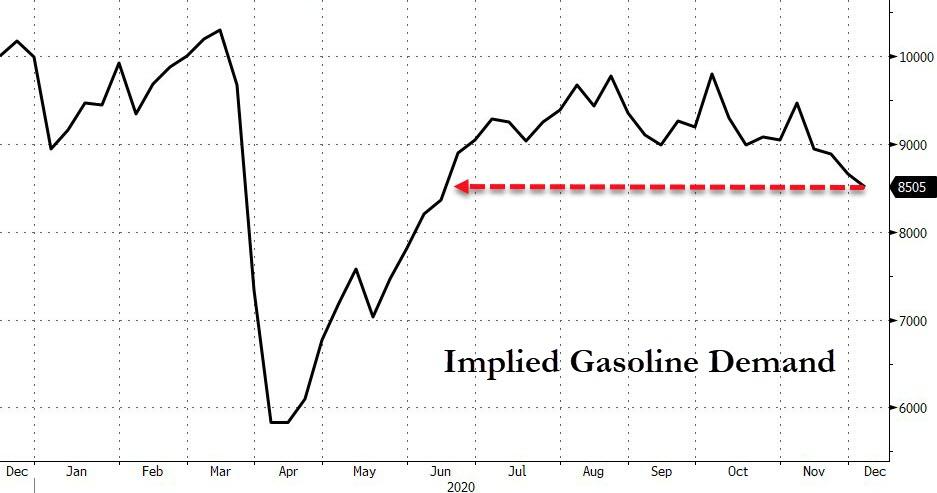

Bloomberg Intelligence Energy Analyst Fernando Valle warned that Gasoline margins continue to struggle amid an extended slump in demand, driven both by seasonal effects and renewed lockdowns, and we believe there’s more pain to come.

Diesel may also come under pressure as air travel over the holidays is expected to be muted, while brick-and-mortar retail sales fall much faster than the pickup in e-commerce.

via ZeroHedge News https://ift.tt/33YpkhM Tyler Durden