Euro Turns From Foe To Friend In Everything Rally

Tyler Durden

Thu, 12/10/2020 – 03:30

By Michael Msiak and Vassilis Karamanis

This time around, the revenge of the euro is proving no threat to Europe’s ferocious stock rebound, as the likes of Goldman Sachs Group Inc. project more gains in the region’s everything rally.

Even as the currency climbs above $1.20 to the dollar – a level that has spurred European Central Bank verbal intervention in the past — the Euro Stoxx 50 is fast retracing pandemic losses. It’s down less than 6% for the year.

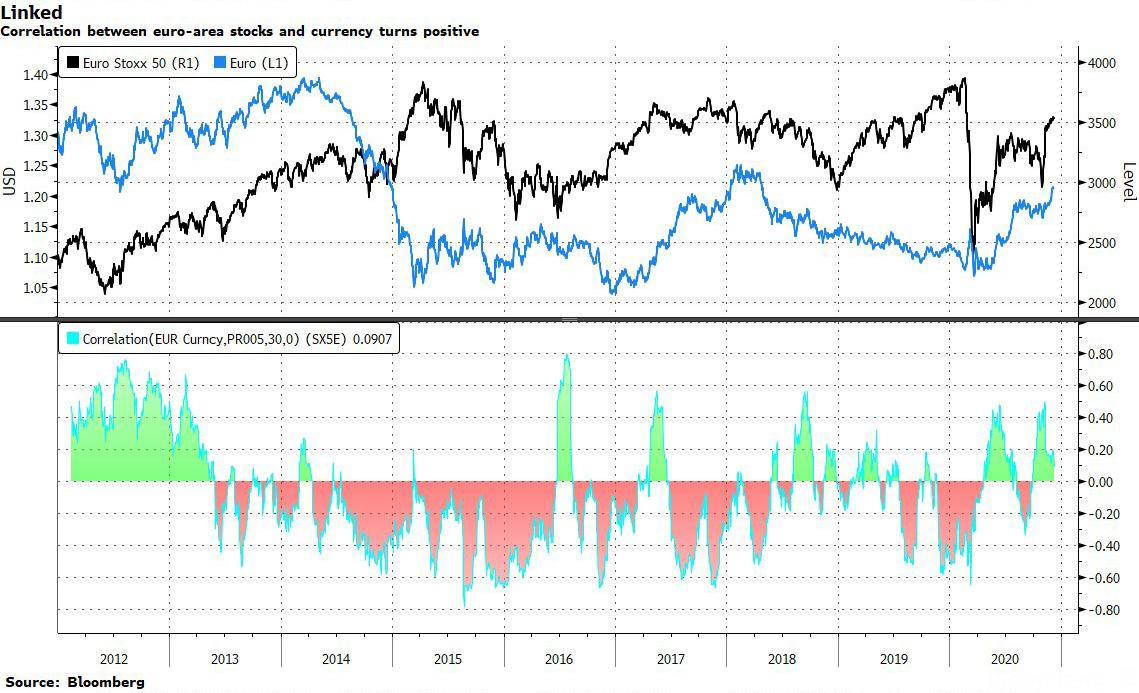

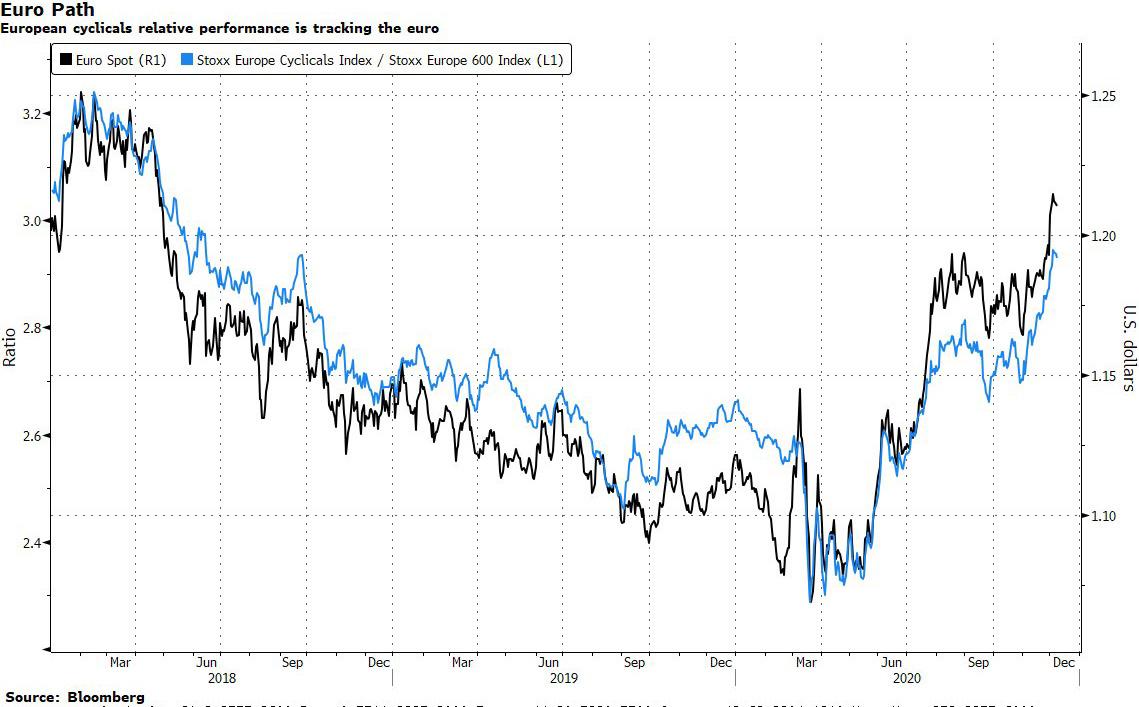

A strong exchange rate typically hits exporters that have an outsize weighting in the benchmark. Now, cyclical companies are on a tear thanks to the global economic recovery and rising animal spirits. Domestic names look ready to join the party. The last time that stocks and the euro rose in concert for an extended period of time was between July 2012 and May 2014.

“A stronger euro is not necessarily a negative for European stocks,” Goldman Sachs strategist Sharon Bell said in a note last week, pointing to the positive correlation between shares and the single currency over the past two months. Economic growth matters more for earnings than foreign-exchange rates for now, she added.

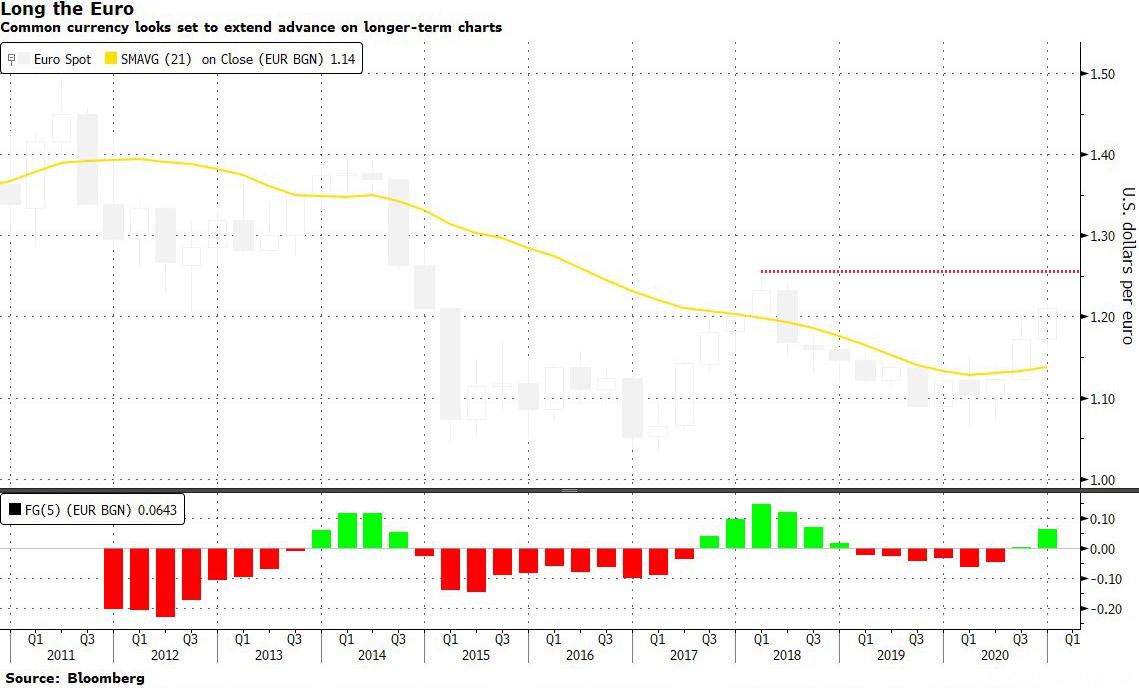

The common currency is heading for its best year since 2017, buoyed by a revival in reflation trades on higher growth and vaccine bets. Positioning, chart patterns and options gauges suggest the euro is poised to extend its advance in 2021. Goldman economists, for example, expect it to appreciate toward $1.25 as the region’s consumption and investment cycle rebounds.

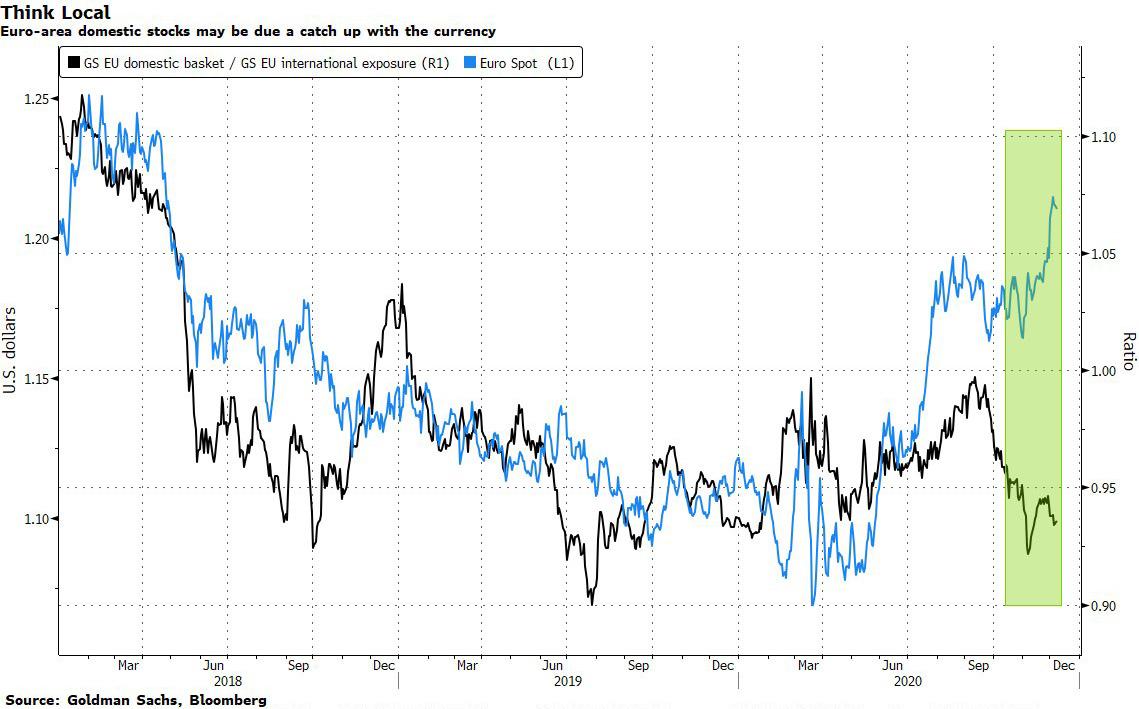

European cyclicals that are tracking moves in the exchange rate have the potential to outperform anew while domestic companies also have catch-up potential, according to the U.S. bank.

The pain threshold? A Bloomberg survey in August signaled that a rapid move toward $1.30 could cause problems for stock benchmarks. Of course, the flip side of the stronger euro is a weakening dollar that’s loosening international financial conditions and greasing the wheels of commerce.

“A weak dollar is directly linked to boosting global trade,” says Jefferies strategist Sean Darby. “This is not just emerging market economies, but Europe too, which have a high percentage of trade as a percentage of GDP,” he added.

One risk for euro bulls comes from the ECB, which may imminently seek to temper the appreciation trend.

“At their Dec. 10 meeting, the ECB Council will likely expand and extend – possibly to 2023 – the PEPP operations, and repeat their unhappiness with the strong euro,” says Stephen Jen, CEO and Co-CIO of Eurizon Slj Capital.

Still, with institutional investors adding to their long positioning in recent months, plenty of traders are girding for more currency gains as optimism returns – helping bullish stock sentiment along the way.

via ZeroHedge News https://ift.tt/2LdiVIT Tyler Durden