Futures Fail To Rebound After Wednesday Rout On Growing Brexit, Covid Fears

Tyler Durden

Thu, 12/10/2020 – 07:46

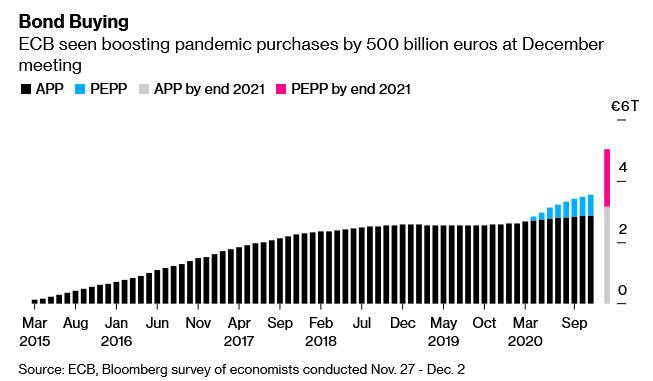

Futures tried and failed to rebound from Wednesday’s rout as fears that the Brexit process was coming unhinged and growing pessimism for a fiscal deal in Congress offset optimism for a swift roll out of a COVID-19 vaccines while concerns about a double dip were set to grow after a report that shows another increase in weekly jobless claims. Not even the ECB’s imminent reveal of another €500 billion in QE helped push stocks higher.

The furious November rally in global equities which pushed stocks to record highs as recently as Tuesday, slowed this week as the pandemic causes even more shutdowns and negotiations over a U.S. aid package seem bogged down. That has investors counting on continued easing and bond buying by central banks to support risk assets and possibly reflation into 2021, including the ECB decision today. Nasdaq 100 contracts turned lower, accelerating its biggest drop in a month on news that Facebook was being sued by U.S. antitrust officials. The social media giant slipped further in pre-market trading on Thursday. Airbnb Inc. priced its long-awaited initial public offering above a marketed range to value the company at about $47 billion.

“We’ve risen so far so fast that it’s making investors cautious,” said Michael McCarthy, chief strategist at stockbroker CMC Markets in Sydney. “The fall in tech stocks was a bit of a concern, given that they’ve risen in all market weather over the last six weeks, so to see them come off might signal that we’re looking at a short- term corrective move.”

Europe’s STOXX 600 index was flat, though London’s FTSE 100 did score its eighth straight gain as the Brexit uncertainty pushed the pound down 0.7% to $1.33 and 90.86 pence per euro. Gains in food and beverage shares were undercut by declines in technology stocks. STMicroelectronics NV dropped as much as 3.3%, extending Wednesday’s 12% plunge that followed the chipmaker’s disappointing medium-term outlook.

European Union and British leaders gave themselves until the end of the weekend to seal a new trade pact, with some $1 trillion in annual trade at risk of tariffs if they can’t reach a deal by Dec. 31, when transition arrangements end. “There’s still clearly some scope to keep talking, but there are significant points of difference that remain,” Foreign Secretary Dominic Raab told BBC TV. “(On) Sunday, they need to take stock and decide on the future of negotiations.”

News on the pandemic also added pessimism to markets. Germany’s latest measures have failed to contain the spread in Europe’s largest economy, while deaths in the U.S. surpassed 3,000 a day for the first time. The U.K.’s vaccination campaign hit a stumbling block after two people with allergies experienced reactions to the Pfizer shot.

The top highlight in Europe today is the ECB announcement, where as previewed, economists expect its 1.35 trillion-euro PEPP stimulus plan to be expanded by at least 500 billion euros and its duration extended by six months to the end of 2022, with risks skewed towards even more. The bank will announce its policy decision at 1245 GMT, followed by ECB chief Christine Lagarde’s 1330 GMT news conference. Traders will be also listening to what she says about the euro’s near 14% rise since March.

“The critical element is that there has been an impact on (euro zone) growth recently,” said Shoqat Bunglawala, head of global portfolio solutions for EMEA & APAC at Goldman Sachs Asset Management, referring to the second wave of lockdowns. “So we would expect to see some further support.

“Central banks are likely to remain in ultra-accommodative mode,” UBS Chief Investment Officer Mark Haefele wrote in a note predicting the ECB would boost its bond-buying program. “As a result, the hunt for yield is unlikely to get easier anytime soon,” they said, recommending emerging-market sovereign bonds among other debt issues.

Earlier in the session, the MSCI Asia index eased 0.4%, with Japan’s Nikkei ending 0.2% lower. Both are up more than 60% from March lows. S&P Dow Jones Indices then said it would remove 10 Chinese companies from its equities indices and several others from its bond indices overnight. It followed a move by Donald Trump’s outgoing administration to ban U.S. investors from buying certain Chinese securities.

In rates, Treasuries were slightly higher across the curve, following bigger gains for gilts, which gathered pace after U.K. Prime Minister Johnson said a no-deal Brexit looks more likely. Treasury auction cycle concludes with 30-year bond reopening. Yields lower by ~2bp at long end of the curve, with spreads slightly flatter; 10-year at 0.918% is lower by 1.8bp vs 6.2bp drop for U.K. 10-year.Euro zone government bond yields also continued to fall. Italian 10-year yields fell to a record low at 0.53%. Spain and Portugal’s hit 0.013% and -0.022% respectively.

In FX, the pound sank further after a report that talks between the EU and the U.K. are on course to end without a trade deal, barring a dramatic last-minute intervention. The euro erased earlier gains just before the European Central Bank policy decision that’s expected to add 500 billion euros ($605 billion) to its emergency bond-buying program.

In commodities, faith in the recovery appeared to be holding up with Brent oil futures up 0.8% at $49.23 a barrel and U.S. crude was up 0.9% at $45.96 a barrel. Gold nursed losses at $1,839 an ounce. “We think the market has certainly got confidence in the sustainability of this recovery,” Goldman’s Bunglawala said. Iron ore futures jumped to more than $150 a ton, while crude oil rose.

Looking at the day ahead, and the aforementioned ECB meetings and the EU leaders’ summit will be the highlights. Otherwise, we also have the FDA meeting in the US where they’ll discuss an Emergency Use Authorization for the Pfizer/BioNTech vaccine. Data releases include UK GDP and French industrial production for October, while from the US there’s the CPI reading and the monthly budget statement for November, along with the weekly initial jobless claims.

Market Snapshot

- S&P 500 futures up 0.2% to 3,679.75

- STOXX Europe 600 up 0.03% to 395.01

- MXAP down 0.5% to 193.92

- MXAPJ down 0.4% to 642.29

- Nikkei down 0.2% to 26,756.24

- Topix down 0.2% to 1,776.21

- Hang Seng Index down 0.4% to 26,410.59

- Shanghai Composite up 0.04% to 3,373.28

- Sensex down 0.3% to 45,959.06

- Australia S&P/ASX 200 down 0.7% to 6,683.12

- Kospi down 0.3% to 2,746.46

- German 10Y yield fell 1.0 bps to -0.615%

- Euro up 0.2% to $1.2103

- Italian 10Y yield fell 0.8 bps to 0.471%

- Spanish 10Y yield fell 0.6 bps to 0.015%

- Brent futures up 0.9% to $49.29/bbl

- Gold spot down 0.5% to $1,830.75

- U.S. Dollar Index down 0.1% to 90.99

Top Overnight News from BLoomberg

- Brexit negotiators have until Sunday to come up with a deal after talks over dinner between Prime Minister Boris Johnson and European Commission President Ursula von der Leyen ended without a breakthrough

- European Commission proposes contingency measures ensuring basic reciprocal air and road connectivity between the EU and the U.K., as well as allowing for the possibility of reciprocal fishing access by EU and U.K. vessels to each other’s waters after Dec. 31, according to statement

- China said it will sanction more U.S. officials and place new travel restrictions on American diplomats in retaliation for measures taken by the Trump administration over Hong Kong

- Switzerland’s foreign- exchange interventions to weaken the franc will be enough for the U.S. to qualify the country as a currency manipulator, though it has the option to hold back on the designation, according to people familiar with the matter

- In Europe, investors are starting to say their goodbyes to the bund market, worried that soon there may not be any place left for them as the the European Central Bank keps squeezing them out

- The investigation into Hunter Biden’s foreign business dealings has been underway since 2018, and involves not only the Justice Department but also the Internal Revenue Service, according to two people familiar with the matter who discussed the sensitive inquiry on condition of anonymity. The probe is focusing on Hunter Biden’s business dealings with China, as CNN reported earlier, and Joe Biden isn’t a target, according to a third person

- Steven Major, HSBC Holdings Plc’s global head of fixed-income research, has relocated to Hong Kong from London to boost the firm’s Asia business

- The U.K. economy grew just 0.4% in October, down from 1.1% in September, as new measures to control the pandemic kicked in, shuttering businesses in some areas and curbing household mixing in others

Asian equity markets were cautious amid headwinds from the soured mood on Wall St where the major indices pulled back from record levels amid frictions in US stimulus talks and lack of any breakthrough in Brexit negotiations across the pond, with the downturn led by hefty losses in the Nasdaq. ASX 200 (-0.7%) was pressured amid notable weakness in gold miners after recent losses in the precious metal and as tech stocks reflect the underperformance of their stateside peers, with the ongoing deterioration in Aussie-Sino ties also adding to the glum. This was after MOFCOM issued its ruling on anti-subsidies investigation on Australian wine imports and confirmed to collect anti-subsidy deposits from Friday, while Nikkei 225 (-0.2%) traded negative for most the session but with downside cushioned by favourable currency flows on Gotobi day and with SoftBank shares surging double digits which was attributed to paper profits from the DoorDash IPO. Hang Seng (-0.4%) and Shanghai Comp. (U/C) began subdued although the mainland bourse showed resilience and briefly recouped opening losses which also follows the recent jump in lending and financing data, while Hong Kong languished as its Chief Executive Lam faces a freeze-out from Japanese banks with US operations after Tokyo said it will abide by US sanctions. Finally, 10yr JGBs were higher on a rebound from support near 152.00 and following a similar mild recovery in T-notes with prices helped by the cautious tone in stocks, although gains were pared following mixed results and weaker demand at the 20yr JGB auction.

Top Asian News

- A $2.5 Billion Default Shows China Has no Mercy for Weak Firms

- SoftBank Soars on $11 Billion DoorDash Gain, Buyout Prospect

- Top Indian Hospital Chain Ready to Vaccinate 1 Million Daily

European equities (Eurostoxx 50 +0.3%) post mild gains ahead of today’s crunch ECB meeting with policymakers set to unveil another easing package, predominantly by expanding and extending its PEPP and adjusting its TLTRO offerings. Across the pond, US equity index futures have stabilised after yesterday’s tech-induced sell-off in the US which saw the Nasdaq close with losses of -1.9% (vs S&P -0.8%). That said, some of the hangover for IT names can be observed in Europe with the sector near the foot of the pile for the region, with Infineon and STMicroelectronics softer by 2% and 1% respectively. In the states, the US House has come together on passing the one-week stopgap funding measure to avoid a government shutdown and provide more time for discussions on government funding and pandemic relief, which the Senate plans to vote on today. Closer to home, last night’s meeting between UK PM Johnson and European Commission President von der Leyen has had little follow-through to equity markets. Sectoral performance in Europe is mixed with energy and consumer staples faring better than peers, whilst the aforementioned IT sector and beleaguered travel & leisure industry lag with the latter weighed on by Tui (-3.5%) after the Co. posted a EUR 3bln loss. As the session progresses and events in Frankfurt unfold, the banking sector may prove to be the one to watch. Corporate updates are once again on the light side with Ocado (-4.1%) one of the main standouts thus far to the downside despite raising its FY20 outlook with some desk highlighting moderating growth in Q3.

Top European News

- ECB Set to Pump More Cash Into Virus-Hit Economy: Decision Guide

- Russia to Conduct First Naval Drill with NATO Since 2012

- Hungary Exempts $2.3 Billion Bank Merger From Competition Probe

In FX, the Dollar sees another caged session in early European hours and in the run-up to the ECB policy decision (full preview available in the Newsquawk Research Suite), with the index constrained within a current intraday band at 90.973-91.136 ahead of yesterday’s 91.203 peak, Monday’s 91.241 high, the 21DMA (91.807) and the psychological 92.00 mark, whilst immediate downside levels consist yesterday and Monday’s lows at 90.688 and 90.612 respectively ahead of 90.500 and the YTD low at 90.471. Looking ahead to the session, several risk events are present for the Buck including ECB, COVID-relief talks at Capitol Hill, EUCO summit and the FDA EUA meeting (schedule available on the Newsquawk headline feed), whilst the data slate sees November CPI and the weekly IJCs.

GBP, EUR – Another subdued session for the Sterling in the aftermath of the meeting between UK PM Johnson and European Commission President Von der Leyen whereby the sides failed to narrow differences on outstanding issues but have given negotiators until Sunday to bridge the “very large gaps, with the two sides also intimating early morning that LPF remains the most contentious sticking point and the EU reportedly hardening its position on the matter according to Foreign Minister Raab. Cable has yielded its 1.3300 handle (vs. high 1.3412) after tripping reported stops just under its 21DMA (1.3318), to a current base matching Tuesday’s 1.3291 low ahead of Monday’s 1.3223 low. Elsewhere, EUR/USD trades on either side of 1.2100 in relatively contrained 1.2076-1.2108 range ahead of a risk-packed agenda with the ECB and EUCO meetings garnering full attention on both monetary and fiscal fronts. (full preview for both events can be found in the Newsquawk Research Suite). From a technical standpoint, support levels for the pair could include yesterday’s 1.2057 low ahead of 1.2050, the 1.2038 low set on 2nd Dec ahead of 1.2000 and below that the 21DMA at 1.1962. Upside levels consists of the psychological 1.2150, the YTD peak at 1.2177 ahead of 1.2200.

AUD, NZD, CAD – The non-US Dollars post gains to varying degrees, with the Aussie yet again propped as AUD/USD hover around YTD high and just under 0.7500, with NZD/USD also making headway above 0.7000 (0.7014-52 range), but with gains less pronounced vs. its Aussie counterpart as the AUD/NZD cross breached 1.0600 to the upside and resides towards the top of the current 1.0583-0631 range. The Loonie meanwhile meanders on either side of 1.2800 vs. the Buck (1.2791-2829 range) with the currency underpinned by firmer crude prices.

- JPY – Notwithstanding the cautious risk tone, the Yen trades on a softer footing as the pair briefly eclipsed 104.50 to the upside to a high of 104.57 (vs. low 104.21) with some player also citing Gotobi demand.

In commodities, WTI and Brent front-month futures eke modest gains in lockstep with price action seen across European equity future and with no fresh catalysts throughout the European morning ahead of a barrage of risk events including ECB, EUCO Summit, and state-side stimulus talks. Upside in WTI Jan picked up after breaching mild resistance at USD 46/bbl (vs. low 45.52/bbl) whilst Brent Feb makes headway above USD 49.50/bbl (vs. low USD 48.86/bbl). Elsewhere, spot gold and silver trade lacklustre with the former just above1830/oz (vs. high 1842/oz) and the latter south of USD 24/oz (vs. high 24.061/oz). In terms of base metals, Dalian iron ore futures continued to gain as the raw material continues to be propelled by Chinese demand coupled with Aussie-Sino woes, LME copper meanwhile tracks the modest gains seen in stocks.

US Event Calendar

- 8:30am: Initial Jobless Claims, est. 725,000, prior 712,000; Continuing Claims, est. 5.21m, prior 5.52m

- 8:30am: US CPI MoM, est. 0.1%, prior 0.0%; US CPI Ex Food and Energy MoM, est. 0.1%, prior 0.0%

- 8:30am: US CPI YoY, est. 1.1%, prior 1.2%; US CPI Ex Food and Energy YoY, est. 1.51%, prior 1.6%

- 12pm: Household Change in Net Worth, prior $7.61t

- 2pm: Monthly Budget Statement, est. $199.0b deficit, prior $208.8b deficit

DB’s Jim Reid concludes the overnight wrap

Today marks the final ECB meeting of the year, where the Governing Council is widely expected to announce a recalibration of their monetary policy stance. In their preview (link here), our European economists say that they expect the core of this package to involve an extension of the PEPP net asset purchase period and the TLTRO3 discounted interest rate period beyond their current expiry in June 2021. Their baseline sees this being extended 6 months to the end of 2021, though they say that a longer 12-month extension to mid-2022 is a possibility. They also expect a €400bn increase in the PEPP envelope and other moves on TLTRO3, though not a deposit rate cut. The meeting comes against a difficult backdrop for the ECB, with the single currency area still in deflationary territory, and with the euro having appreciated further since their last gathering to move above $1.20.

With markets anticipating additional stimulus, there was a further narrowing in spreads between core and periphery yesterday, with yields on 10yr bunds (+0.2bps) and gilts (+0.4bps) rising, whereas both Italian (-0.8bps) and Spanish (-0.8bps) yields fell to all-time lows of 0.58% and 0.02% respectively. Will Spain soon follow Portugal into negative yield territory at the 10yr part of the curve?

However the performance of the tech sector in the US was the biggest story of the day. Following news that Facebook (-1.93%) has been sued by US antitrust officials and a coalition of states, and also headlines that Tesla (-6.99%) was dramatically “overvalued” from a research analyst, the NASDAQ fell -1.94% on the day. The Facebook suit seeks to break up the tech company by unwinding the acquisitions of Instagram and WhatsApp. This comes after the October anti-trust suit filed by the US Justice Department against Google, though this differs by explicitly pursuing breaking up of the company.

Risk assets actually started off with a strong performance yesterday but renewed concerns over the likelihood of a US stimulus package led to an initial reversal midway in the session, before the anti-trust news dominated the end of trading. Equity indices took a hit after Senate Majority leader McConnell’s comments that the Democrats were moving the goalposts, and had “poured cold water” on his proposal. By the end of trading, the S&P 500 had fallen from an all-time intraday high to shed -0.79%, while the Dow Jones (-0.35%) similarly moved lower. Earlier European equities continued their steady recent rise with the Stoxx 600 climbing +0.32%, led by autos (+1.27%) and Media (+1.14%), while technology stocks (-0.35%) were the index’s biggest laggard.

On the topic of corporate actions, our quant team has launched a survey taking the temperature on private equity intentions and investments for 2021. If you are an asset manager that looks into this market and can offer some insight please take a few minutes to help our colleagues out. Link here.

As noted above fiscal stimulus discussions took a step backward yesterday. There are just nine days, including today, left in the congressional session and there remains confusion as just which bill the sides are discussing – the bipartisan bill that originated in the Senate or Secretary Mnuchin’s bill that he debuted earlier this week. It appears now that any pandemic relief deal will end up attached to the government-spending bill. The current funding for federal agencies runs out this Friday night, and the House yesterday passed a new one week continuing resolution to avoid a government shutdown. US Treasuries were up +3.3bps midday even after the “cold water“ stimulus deal headlines, however the anti-trust news saw Treasuries rally when risk markets faltered and yields finished +1.8bps at 0.936%. 10yr breakevens closed at their highest (1.909%) since early May of 2019.

The other important discussion yesterday was on Brexit, where last night UK Prime Minister Johnson met with European Commission President von der Leyen. The two leaders have given negotiators until Sunday to reach an agreement. Following a face to face dinner, von der Leyen tweeted, “We understand each other’s positions…They remain far apart. The teams should immediately reconvene to try to resolve these issues.” The pound is down -0.23% to $1.3368 this morning.

The meeting with Johnson came ahead of today’s summit of EU leaders, and we heard yesterday from the Polish Deputy PM that a compromise had been agreed by Poland, Hungary and Germany on the ongoing budget standoff that saw Poland and Hungary veto the long-term budget and recovery fund over rules that would make the disbursement of funds conditional on adherence to rule-of-law requirements. The deal with Germany (who hold the rotating presidency) would need to be agreed with other EU leaders, but according to the Polish Deputy PM that could happen at the summit, which runs into tomorrow.

Asian markets are trading without a clear direction this morning with the Nikkei (+0.04%) and Kospi (+0.05%) flattish while the Hang Seng (-0.17%) and Asx (-0.67%) are down but the Shanghai Comp +0.24% is up. Futures on the S&P 500 are trading flattish while those on the Nasdaq are down -0.24%. Yields on 10y USTs are down -1.2bps to 0.925%. In commodities, DCE iron ore futures are up +4.62% this morning.

Looking ahead, today is an important one on the vaccine front, as the US FDA will be holding a meeting that will discuss the Emergency Use Authorization request for the Pfizer/BioNTech vaccine. They’ve already published a report indicating that it’s highly effective in preventing Covid-19, and a successful approval would follow similar moves in both the UK and Canada (yesterday). However, though the vaccine has begun to be distributed outside trials, rising caseloads throughout the world have led to further warnings that people needed to reduce their social contact over the coming weeks, not least with Christmas ahead. Indeed Chancellor Merkel said to the Bundestag that “we need to make one more effort” and encouraged people to limit their social contacts, while here in the UK, there were further reports that London could be placed under Tier 3 restrictions soon given the recent rise in cases, which would involve the closure of bars and restaurants except for takeaway. I’ve booked a night out with my wife next week on the day the new tiering comes out and my area is in danger of also moving into tier 3. Across the other side of Atlantic, the White House coronavirus task force has recommended to President Donald Trump that the US start allowing in travelers from Brazil, the UK and 27 other EU countries. Under recommendations, travel restrictions on travelers from China and Iran wouldn’t be relaxed. This comes as the US witnessed the deadliest day of the virus yet and reported 3,125 fatalities in the past 24 hours.

Finally, there wasn’t a great deal of data yesterday, but we did hear that the number of US job openings in October rose to a three-month high of 6.652m (vs. 6.3m expected). That said, this is ahead of the more recent spike in Covid cases that the US has seen. Elsewhere, the Bank of Canada announced they were keeping rates on hold, in line with expectations.

To the day ahead now, and the aforementioned ECB meetings and the EU leaders’ summit will be the highlights. Otherwise, we also have the FDA meeting in the US where they’ll discuss an Emergency Use Authorization for the Pfizer/BioNTech vaccine. Data releases include UK GDP and French industrial production for October, while from the US there’s the CPI reading and the monthly budget statement for November, along with the weekly initial jobless claims.

via ZeroHedge News https://ift.tt/3m477pf Tyler Durden