Jeremy Grantham “Accidentally” Nets $200 Million From SPAC Deal He Calls “Reprehensible”

Tyler Durden

Thu, 12/10/2020 – 12:45

Today in “financial world hypocrisy” news…

Investor Jeremy Grantham has made about $200 million from a personal investment in a battery maker called QuantumScape after it merged with a blank check company and went public via SPAC – a financial instrument that Grantham has referred to as “reprehensible” and “very very speculative” while speaking to the Financial Times.

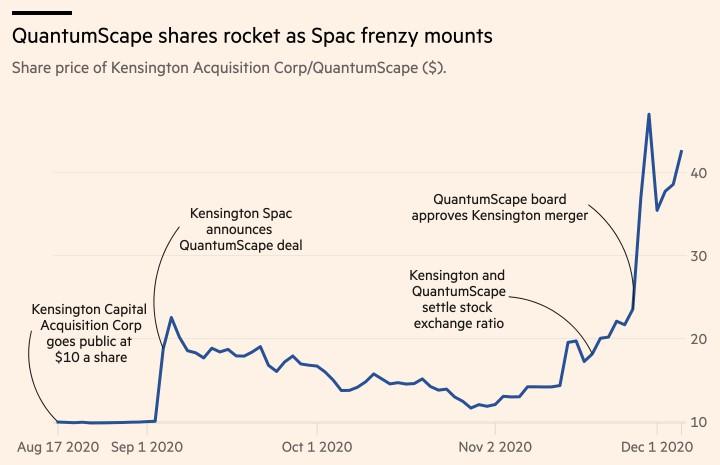

Seven years ago, his firm invested $12.5 million in the green technology company, which started as a Stanford University spinoff. While saying he was a big believer in the company, he was also apparently surprised to learn about the gains he has made on his investment after the company merged with a SPAC set up by Canadian firm Kensington Capital Partners.

He told FT: “This is unlike anything else in my career. This was by accident the single biggest investment I have ever made. It gets around the idea of listing requirements, so it is net a useful tool for a lot of successful companies. But I think it is a reprehensible instrument, and very very speculative by definition.”

The “speculative” and “reprehensible” investment is on track to be one of the most lucrative investments of his career.

The SPAC valued QuantumScape at $3.3 billion but the newly listed entity’s stock price nearly rose 4x after it started trading. The company now has a market value of about $16 billion, despite the fact that commercial production of its batteries is “years away”.

The company has also been backed by Bill Gates, Volkswagen, and Silicon Valley venture capital firms Kleiner Perkins and Khosla Ventures.

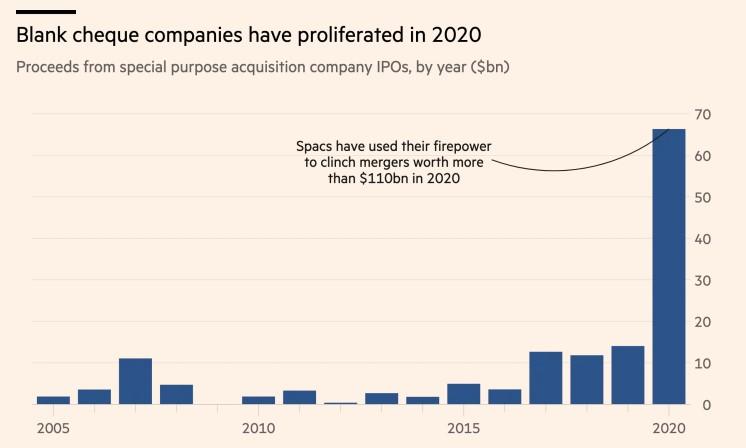

This comes amid a larger SPAC boom that has seen more than 200 blank check companies listing so far this year, raising over $66 billion, according to FT. SPAC sponsors usually take about 20% of the equity in the vehicle and future investors face a far worse threat of dilution from warrants that are issued than with normal going public transactions.

Michael Klausner, a professor at Stanford Law School said: “They are enormously expensive. Someone is getting . . . 20 per cent of the company for free. The structure has an enormous amount of dilution built in that someone will pay for and so far it has been the Spac shareholders who seem to be haplessly paying for it.”

Grantham has said that SPACs are indicative of “historic stock market euphoria” that can be compared to the “Roaring Twenties” or the dotcom bubble of the late 1990s.

Far be it for us to point this out, but what he doesn’t seem to realize is that the Fed wasn’t doing in the 1920s or 1990s what it is doing now. This means that unfortunately, what Grantham sees as “historic euphoria” could just simply be the norm going forward, as sick and twisted as that is.

Regardless, if Grantham is that sick to his stomach over the idea of SPACs, we wonder if he’d considering donating all of his proceeds from the investment toward an investor advocacy or education fund? We won’t hold our breath.

via ZeroHedge News https://ift.tt/2K9Q8o8 Tyler Durden