Futures Tumble On Stalled Stimulus Talks, Brexit Chaos

Tyler Durden

Fri, 12/11/2020 – 07:41

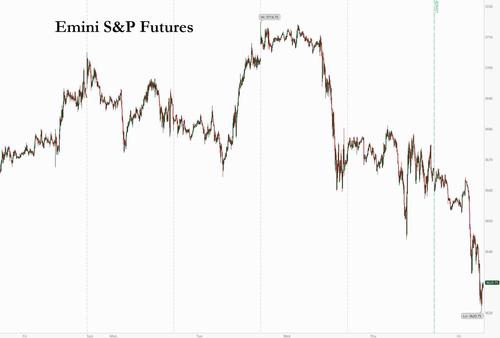

Global markets dropped on Friday as Brexit negotiations appeared on the verge of collapse, while delays over a new fiscal stimulus package and surging coronavirus infections hit risk appetite pushing S&P futures and sterling lower as Treasurys rose and the dollar and the dollar jumped most in two weeks.

At 7am, Dow futures were down 213 points, or 0.7%, S&P 500 E-minis were down 28. points, or 0.8%, and Nasdaq 100 E-minis were down 92.75 points, or 0.7%. Global stock markets were also subdued, with the MSCI world equity index, sliding into the red after scaling record highs earlier this week as the UK became the first country in the world to begin a mass COVID-19 vaccination program. Cyclical stocks led declines in premarket trading on Friday, with energy, industrial and financial sectors all lower. Wells Fargo and JPMorgan slid more than 1%, while industrial bellwethers Boeing and 3M fell 1.6% and 0.9% respectively. Mastercard dropped 1.4% after the UK Supreme Court gave the green light for a $18.5 billion class action against the company for allegedly overcharging more than 46 million people in Britain over a 15-year period.

Global markets slumped after the latest episode in the neverending drama that is Brexit, when Prime Minister Boris Johnson said on Thursday there was “a strong possibility” Britain and the European Union would fail to strike a trade deal. Britain and the EU have set a deadline of Sunday to find an agreement, before Britain’s exit from the bloc on Jan. 1. The odds of a disorderly Brexit rose to 61% on Friday from 53% a day before, according to the Smarkets exchange.

With fresh lockdowns in many states and the US economy rapidly sliding into a double dip, investors are hoping for more fiscal relief to sustain a nascent economic recovery. But an agreement remains elusive after Nancy Pelosi said wrangling over a spending package and coronavirus aid could drag on through Christmas. It wasn’t all bad news: on Thursday, a panel of outside advisers to the FDA voted overwhelmingly to endorse emergency use of Pfizer’s COVID-19 vaccine, sending shares of the drugmaker up 1.9% in premarket trading.

European equities fell, with the broad Euro STOXX 600 down 1.2% and indexes in Paris and London losing 1.2% and 1% respectively on the abovementioned Brexit fears and after Germany said the continent’s biggest economy had record virus cases and deaths. Sanofi dropped on news that its Covid-19 shot failed to produce a strong enough response in older people. The FTSE 250 index underperformed, with Brexit-sensitive stocks declining and travel and leisure names pulled lower by concerns about higher restrictions on London. U.K. Prime Minister Boris Johnson warned businesses and the public to get ready for a no-deal Brexit as negotiations with the European Union falter.

Earlier in the session, Asian shares rose led by energy shares and putting the regional benchmark stock gauge on course for a sixth straight weekly gain. The MSCI Asia Pacific Index was up 0.3%; Hong Kong-listed Cnooc rallied 6.1%, recovering from recent declines following its addition to a U.S. blacklist. China Petroleum & Chemical climbed 4.5% as oil prices headed for a weekly advance, while in India, Oil & Natural Gas Corp. surged as much as 14% after Morgan Stanley upgraded the stock. Meanwhile, investors in China’s stock market are getting uneasy after a stellar year as insiders step up share sales and concerns about liquidity surface. The Shanghai Composite Index’s 2.8% drop this week has made it the second worst-performing major equity benchmark globally. Malaysia’s equity benchmark rallied 1.8% on Friday to be the top performer in Asia, as the ringgit erased virus-fueled losses for the year to climb to the strongest level since July 2018.

As Bloomberg notes, stocks were choppy this week as the fate of an additional relief package in Washington remained unresolved as Democrats and Republicans continue to negotiate. A disappointing jobs report and a strong 30-year auction of Treasuries on Thursday signaled investor caution over whether fresh economic stimulus will come before year-end. On the other hand, stellar demand for recent U.S. initial public offerings suggested investors remain upbeat on equities, even as job data pointed to weakness in the world’s biggest economy. Shares of Airbnb Inc more than doubled in their stock market debut on Thursday, valuing the home rental firm at just over $100 billion in the biggest U.S. initial public offering of 2020. DoorDash stocks doubled in their first day of trading.

In rates, Treasuries followed gilts higher during London session after Bank of England Governor Andrew Bailey said the central bank had a lot in its armory in the event of Brexit disruption. Yields dropped by 1bp-2bp across intermediates; 10-year almost 2bp lower at 0.888%, near low end of 0.88%-0.974% weekly range and ~8bp lower on week. U.K. 10-year ~4bp lower on the day, nearly 20bp on week.

In FX, the dollar rebounded the most in two weeks, rising 0.2% against a basket of six major currencies; the pound lost 0.5%, and was set to end five straight weeks of gains as currency traders weighed an expected hit to the British economy should the sides fail to agree a deal. “Investors are right to be worried,” said Olivier Marciot, a portfolio manager at Unigestion. “If there is no deal, there will be implications. There could be some sort of correction.” Emerging-market currencies were poised for a sixth week of gains, thanks in part to the dollar’s recent weakness. The euro held not far from two-and-a-half-year highs of $1.2140 after the European Central Bank delivered a fresh stimulus package that was broadly in line with market expectations on Thursday.

In commodities, oil prices were flat after Brent hit levels not seen since early March on Thursday, as coronavirus vaccination rollouts fuelled hopes that crude demand would pick up in 2021. Brent crude rose 0.1% to $50.36 per barrel.

Looking at the day ahead, data releases from the US include the November PPI reading and the University of Michigan’s preliminary consumer sentiment index for December, while from Europe there’s Italian industrial production for October. Central bank speakers include the ECB’s Holzmann, Hernandez de Cos and Centeno, along with the Fed’s Quarles and George.

Market Snapshot

- S&P 500 futures down 0.5% to 3,651.25

- STOXX Europe 600 down 0.7% to 390.32

- MXAP up 0.3% to 194.85

- MXAPJ up 0.2% to 644.89

- Nikkei down 0.4% to 26,652.52

- Topix up 0.3% to 1,782.01

- Hang Seng Index up 0.4% to 26,505.87

- Shanghai Composite down 0.8% to 3,347.19

- Sensex up 0.2% to 46,054.37

- Australia S&P/ASX 200 down 0.6% to 6,642.58

- Kospi up 0.9% to 2,770.06

- German 10Y yield fell 2.5 bps to -0.628%

- Euro down 0.08% to $1.2128

- Italian 10Y yield fell 2.0 bps to 0.451%

- Spanish 10Y yield fell 2.0 bps to 0.002%

- Brent futures down 0.6% to $49.97/bbl

- Gold spot little changed at $1,837.04

- U.S. Dollar Index up 0.1% to 90.91

Top Overnight News from Bloomberg

- European Commission President Ursula von der Leyen warned that a no-deal split with the U.K. is the likeliest outcome on Dec. 31 as last-ditch talks to try to reach a deal before Sunday continue in Brussels

- Germany’s daily coronavirus cases and deaths rose the most since the pandemic began, increasing pressure on authorities to impose a hard lockdown over the holiday season

- London Mayor Sadiq Khan beefed up the policing of Covid rules and announced more community testing in the capital in an effort to avoid having the city placed under the U.K.’s toughest virus restrictions

- Sanofi and GlaxoSmithKline Plc, two of the world’s biggest vaccine makers, delayed advanced trials of their experimental Covid-19 shot after it failed to produce a strong enough response in older people, pushing its potential availability to the end of next year

- Wall Street’s biggest banks are predicting the coronavirus-hit world economy will crawl through the early days of 2021 before bouncing back as vaccines and more fiscal stimulus flow into it

- The average forecast from strategists is that the Stoxx Europe 600 Index will climb 6.6% from Wednesday’s close. After a year that’s seen the index plummet 36% in just a few weeks and then claw back most of those losses, it’s an outlook that seems downright undramatic

- A group of 30 asset managers overseeing a combined $9 trillion of assets said they will support efforts to limit global warming by running carbon-neutral investment portfolios by 2050 or sooner

- After wobbling in November, when several European nations imposed fresh lockdowns to combat the spread of Covid-19, demand for gasoline and diesel is accelerating again, according to an index compiled by Bloomberg News tracking dozens of high frequency indicators for road usage, and traffic in countries accounting for more than 70% of global petroleum consumption

Courtesy of Nesquawk, here is a breakdown of the latest developments in global markets:

Asian equity markets traded mixed following a similar subdued performance on Wall Street where sentiment was mired by an increase in jobless claimant numbers and as congressional leaders remained at loggerheads on COVID-19 relief, with rampant infections stateside and no-deal Brexit concerns across the pond also contributing to the cautious tone. ASX 200 (-0.6%) was pressured by underperformance in healthcare after CSL abandoned trials of its COVID-19 vaccine as it generated antibodies that caused false positives on HIV tests, although losses in the index were initially tempered by strength in tech and with mining names buoyed by upside in iron ore and nickel prices. Nikkei 225 (-0.3%) was dragged by currency effects and amid weak same-store sales from convenience store operators Seven & I and Lawson, while KOSPI (+1.0%) was underpinned after preliminary data showed South Korean Exports during the first 10 days in December jumped 26.9% Y/Y. Hang Seng (+0.5%) and Shanghai Comp. (-1.1%) were varied with Hong Kong lifted by notable gains in the energy giants, although the mainland was subdued after the PBoC drained CNY 350bln liquidity for the week and China’s Foreign Ministry announced reciprocal sanctions to target members of US Congress. Finally, 10yr JGBs eked mild gains amid the mostly uninspired risk appetite and with prices spurred by the BoJ rinban operation in which the central bank was in the market for over JPY 1.3tln of JGBs in 1yr-10yr maturities.

Top Asian News

- Sri Lanka Debt Concerns Mount After Downgrade Deeper Into Junk

- China Toymaker Joins Global IPO 1st-Day Pop Party with 79% Jump

- Chinese Authorities Detain Bloomberg News Beijing Staff Member

- Singapore’s Sea Raises $2.6 Billion in Upsized Stock Offering

European equities (Eurostoxx 50 -1.3%) have extended on opening losses as Brexit jitters continue to resonate ahead of Sunday’s self-imposed “deadline”. More specifically, losses after the cash open accelerated after EU Commission President von der Leyen stated that after her meeting with UK PM Johnson on Wednesday, a no deal Brexit is now the most likely option. Although this has echoed comments from other officials in recent days, as Sunday nears and differences remain unresolved, markets will continue to price in the likelihood of an no deal outcome. Accordingly, analysts at Morgan Stanley suggest that a no deal outcome could trigger a 6-10% sell-off in the FTSE 250 and 10-20% decline in banking stocks amid a move into NIRP for the BoE. These fears have subsequently weighed on the likes of Natwest (-6.7%), Lloyds (-4.2%) and Barclays (-3.7%) and overshadowed yesterday’s announcement by the PRA that it judges there is scope for banks to recommence some distributions. Other risks on the horizon, albeit of greater interest stateside is the ongoing logjam on Capitol Hill amid ongoing divisions in stimulus discussions and with the Senate still to vote on the stopgap bill to avert a government shutdown heading into today’s midnight deadline; equity index futures in the US are softer, with the e-mini S&P lower by 0.5%. Sectors in Europe trade lower across the board with telecoms lagging amid losses in Ericsson (-5.5%) after the Co. launched legal action filed against Samsung in the US for non-compliance to FRAND commitments. Sanofi (-2.5%) have acted as a drag on the CAC after the Co. and GSK (+0.6%) announced a delay in their adjuvanted recombinant COVID-19 vaccine programme, in order to improve the immune response in the elderly. Rolls Royce (-6.3%) sit at the foot of the Stoxx 600 after it downgraded its 2020 cashflow forecast and continued to warn over the challenging outlook for the industry.

Top European News

- Italy to Buy Majority Stake in Steel Mill From ArcelorMittal

- Germany Eyes Hard Lockdown After Record Covid Cases, Deaths

- EU Warns No Deal Is Likeliest Outcome of Talks: Brexit Update

- EU Chiefs Back Tough Emission Goal After Last- Minute Scuffle

In FX, sterling sees another session of losses amid compounded Brexit pessimism telegraphed by various sources – whereby EU’s von der Leyen reportedly told leaders she has ‘low expectations’ that they can reach a Brexit deal and that a no deal scenario is the most likely outcome following her dinner with UK PM Johnson and heading into Sunday’s newly set deadline. Further, BoE’s Governor Bailey stated the Central Bank has a lot in its arsenal to tackle disorderly markets, but there are limits to what the BoE can do. Cable has receded from its overnight high at 1.3324 (21 DMA) to a current intraday base at 1.3186 with the next support levels on watch the 50 DMA at 1.3150. The EUR meanwhile experienced a pullback following verbal intervention from ECB GC member Villeroy who highlighted that the central bank is vigilant on the exchange rate and all instruments are available on this if needed, in turn prompting EUR/USD to a current low of 1.2115 from a 1.2162 high – but with losses somewhat cushioned by the EUR/GBP cross extending gains to levels just shy of 0.9200 from its 0.9116 daily low.

- DXY – The index trades firmer but remains contained sub-91.000 within a tight 90.613-989 range as the Sterling’s slip provides support for the Buck, whilst State-side stimulus and government funding remains up in the air. Senate Majority Leader McConnell last night poured cold water on COVID-relief hopes as reports stated the official does not see a path on the two main sticking points but wants a narrow package, although talks are set to continue today behind the scenes. Meanwhile, the Senate ended up not voting on the government funding stopgap bill with the today’s deadline to avert a shutdown nearing.

- JPY, AUD. NZD, CAD – Notwithstanding the firmer Buck, the Yen stands as the G10 gainer amid the deteriorating risk sentiment triggered by a barrage of downbeat Brexit commentary. USD/JPY resides around 104.00 having had briefly dipped below the level to a current low at 103.93 from 104.27 at best. High-beta FX have lost steam and reside towards session lows as the risk environment eroded in early European hours. AUD/USD waned from its overnight peak at 0.7572 to a low at 0.7521, whilst its Kiwi counterpart yielded its 0.7100 handle to print a base at 0.7075 (vs. high 0.7112). USD/CAD meanwhile remains sub-1.2800 but off its 1.2719 low and closer to the 1.2771 intraday high.

- TRY – A double whammy for the Turkish Lira amid two separate geopolitical developments whereby the US is reportedly mulling CAATSA sanctions over Turkey’s purchase of the Russian-made NATO-incompatible S-400, whilst the EU is considering restrictions amid Turkey’s behaviour in the Easter Mediterranean. USD/TRY rose from its 7.8861 base to eclipse 8.000 before waning off highs.

In commodities, WTI and Brent front-month futures trade choppy within tight ranges but with upside limited amid the subdued risk sentiment on the back of pessimistic Brexit updates. Nonetheless, crude futures hold onto a bulk of yesterday’s gains with Brent Feb still north of USD 50/bbl (vs. high 57.74), just off yesterday’s 51.06 best, whilst WTI Jan trades sub-47/bbl after reaching a high of USD 47.72/bbl yesterday. New flow for the complex has remained light throughout the European morning, but note the JMMC will now be meeting on the 16th Dec, a day earlier than scheduled. The upcoming JMMC meeting will see a review secondary source data alongside current market fundamentals before proposing policy recommendations – thus no policy decision will be taken at this meeting. The findings of the gathering are likely to be overlooked as the overall environment is little changed since the start of the month. Elsewhere, spot gold and silver see lacklustre trade once again with the former meandering around USD 1835/oz and spot silver trading sub-24/oz. In terms of base metals, Dalian iron ore futures soared almost 10% spurred by Chinese demand and Sino-Aussie woes, with some traders also citing a cyclone which could affect loadings in Australia. LME copper meanwhile sees losses in tandem with the firmer Buck and deteriorated risk sentiment.

US Event Calendar

- 8:30am: PPI Final Demand MoM, est. 0.1%, prior 0.3%

- 8:30am: PPI Ex Food and Energy MoM, est. 0.2%, prior 0.1%

- 8:30am: PPI Ex Food, Energy, Trade MoM, est. 0.2%, prior 0.2%

- 8:30am: PPI Final Demand YoY, est. 0.7%, prior 0.5%

- 8:30am: PPI Ex Food and Energy YoY, est. 1.5%, prior 1.1%

- 8:30am: PPI Ex Food, Energy, Trade YoY, prior 0.8%

- 10am: U. of Mich. Sentiment, est. 76, prior 76.9

DB’s Jim Reid concludes the overnight wrap

It’s been a pretty strange 24-48 hours in many ways. We’ve had a IPO market in the US that’s partying like its 1999 while US jobless claims spiked higher, Covid-19 restrictions mount, US stimulus talks still appear gridlocked, Brexit trade talks are not looking encouraging, and with a sober reminder of the structural problems Europe faces yesterday as the ECB expanded its stimulus package yet further and seemingly locked in negative rates for longer.

Ahead of the ECB, Spanish 10-year yields were briefly admitted into the “10yr negative yield” club, which is not that exclusive at the moment. On my calculations in Europe they briefly joined Switzerland, Germany, Slovakia, Netherlands, Denmark, Austria, Finland, Belgium, France, Ireland, Slovenia, Sweden and Portugal. See my CoTD yesterday here where we showed the Spanish dip in the context of 230 years of constantly positive yields until yesterday including a peak yield of over 70% in 1819! If you want to be on the daily chart email, please send a message to jim-reid.thematicresearch@db.com.

Sovereign bond yields rose a bit after the ECB though and the euro strengthened as markets were somewhat underwhelmed by the ECB’s latest package of stimulus measures. To be fair, they had been well flagged. To run through the main headlines, the ECB expanded their PEPP programme of bond-buying by a further €500bn to €1.85tn, with the purchases extended by 9 months until March 2022. Furthermore, their TLTRO III programme, which offers cheap loans for banks was extended until June 2022, and four pandemic emergency longer-term refinancing operations (PELTROs) will also be offered next year. However, what markets didn’t like was the fact that President Lagarde said that this additional envelope “need not be used in full”, and sovereign bond yields rose after the decision was announced. By the close, both 10yr bunds (+0.2bps) and OATs (+0.6bps) had reversed their morning gains, though they’d pared back some those losses by the end of the session, and the euro was up +0.47% against the US Dollar.

The fresh stimulus from the ECB came as their latest forecasts revised down their medium-term inflation projections, with the most recent inflation data showing the single currency bloc remained mired in deflationary territory. Though the ECB’s 2021 forecast for HICP remained at +1.0%, the 2022 reading was downgraded two-tenths to 1.1% and the new 2023 reading was still only at 1.4%, so somewhat less than their aim of “below, but close to, 2% over the medium term”. Furthermore, investors’ expectations of future inflation didn’t seem to be helped much either by the latest action, with five-year forward five-year inflation swaps down -2.0bps to 1.23%.

With that backdrop, global equity markets had a mixed performance yesterday. By the close, the S&P 500 had fallen slightly (-0.13%) in spite of a buoyant performance from energy stocks, which came as both Brent Crude (+2.84%) and WTI Oil (+2.77%) rose to post-pandemic highs of $50.25bbl and $46.78/bbl, respectively. Remember when they were negative in the early days of lockdown! Technology stocks, in particular hardware (+0.84%), actually rose on the day. The majority of the underperformance took place in the Autos (-2.59%), Telecoms (-1.80%) and Transportation stocks (-1.37%). 15 of the 24 S&P 500 industry groups moved lower on the day, and the Dow Jones was down -0.23%, as Europe’s STOXX 600 also experienced a -0.44% decline.

Stimulus talks continued with the congressional calendar-end quickly approaching. Yesterday, Treasury Secretary Mnuchin and House Speaker Pelosi both indicated progress was being made toward a new Covid-19 relief deal; however, both sides continue to differ on state and local taxes as well as the liability protections for employers. Democratic Congressional leaders continue to put their weight behind the bipartisan bill that originated in the Senate over Treasury Secretary Mnuchin’s bill. With a new deadline to get a funding deal done by the end of next week, House Minority Leader McCarthy said, “next week will be the week we get it done.” US 10yr Treasuries gained slightly throughout the day with yields down -0.3bps at 0.906%.

In a concerning sign in the face of the lack of stimulus progress, the weekly initial jobless claims in the US rose to 853k (vs. 725k expected) for the week through December 5, which is their highest level since mid-September, and raises the prospect that the labour market progress seen in recent months is slowing significantly. Indeed, the +137k increase in claims from the previous week was the largest one-week jump since the pandemic began back in March.

Overnight Asian markets are mixed with the Hang Seng (+0.46%) and Kospi (+0.84%) up while the Nikkei (-0.34%), Asx (-0.61%) and Shanghai Comp (-0.93%) are down. Futures on the S&P 500 are also down -0.10% and European equivalents are pointing to a weaker open as well. In Fx, the US dollar is down -0.18% overnight after yesterday’s -0.29% move lower.

Here in the UK, the BoE indicated yesterday that it is easing its ban on dividends with the PRA saying that “An extension of the exceptional and precautionary action taken in March is not necessary” and added, “There is scope for banks to recommence some distributions should their boards choose to do so, within an appropriately prudent framework.” The BoE approach is in contrast with developments at the ECB where the central bank is leaning towards extending their own dividend ban well into next year, though with some exceptions for the strongest lenders. European banks were one of the laggards yesterday (-2.09%) on this news and an ECB meeting that reminded investors of the tough yield/rates environment and offered up limited Xmas treats for the sector.

On Brexit, Prime Minister Johnson issued a warning last night – after European markets had closed – that businesses and the public should be prepared for the UK to leave the EU single market without a trade deal in place. While the government is still actively seeking a deal with the European Commission, the Prime Minister continues to see major obstacles. Johnson sees a, “strong possibility we will have a solution that’s much more like an Australian relationship with the EU than a Canadian relationship with the EU.” This would mean that the UK would rely on the rules of the WTO and could face tariffs and quotas when the transition ends on New Year’s Eve.

On the topic of no-deal scenarios, the European Commission put forward some contingency measures on reciprocal air and road connectivity with the UK, as well as fishing access, in the event that a no-deal outcome to the trade talks does indeed come to pass. Regardless of the somewhat negative tone to yesterday’s proceedings, discussions are currently continuing in Brussels ahead of the new Sunday deadline, where President von der Leyen has said a “decision will be taken.” Interestingly, it’s getting more vague about what the specific disagreements are. There is a possibility that politicians from both sides are keen to massively downplay the chances of a deal only to pull one out of the hat by Sunday or at least say one is starting to emerge. We will see.

Through all of this, Sterling ended the session as the worst-performing G10 currency yesterday, falling by -0.78% against the US Dollar and -1.27% against the euro. Furthermore, volatility is being increasingly priced into the exchange rate, with 1 week implied sterling/dollar volatility rising for an 8th consecutive day to its highest level since the start of the pandemic back in March. Paradoxically, however, other UK assets performed relatively strongly, with the multinational-dominated FTSE 100 gaining +0.54% on the back of sterling’s depreciation, while 10yr gilt yields fell -6.0bps as the perceived likelihood of monetary stimulus rose in response to the economic shock of a no-deal outcome.

One European deal did get done yesterday, with EU leaders finally coming together on the massive €1.82 trillion seven-year budget and recovery package to support the region’s economies through the pandemic and beyond. The delegations from Poland and Hungary had been the two dissenting voices after initially agreeing to the budget due to a “rule of law mechanism” they felt might be used to target them for potential breaches of the bloc’s democratic standards. Under the compromise, the European Commission will draw up guidelines for using the new “rule of law” standard and what would trigger it, and no country can be in violation until then.

Elsewhere, the Pfizer/BioNTech vaccine passed a committee of independent vaccine experts with a vote of 17 to 4, with one abstention. They concluded that the benefits of the vaccine outweigh the risks in those 16 and older. The FDA authorization could follow within a few days, after which shots could be immediately distributed across the US. Part of the panel was concerned that there was not enough data on 16 and 17 year olds and some pediatricians were said to be uncomfortable voting for the shot on those grounds. The shots will be distributed to the states, who will make the final decisions about which residents get inoculated first. Advisers to the CDC have recommended health-care workers and elderly care facility residents be prioritized, followed by the elderly. Shares of Pfizer gained +2.46% in after-market trading following the news.

Here in the UK there was rising speculation that London was set for Tier 3 restrictions, following data which showed that it had the highest regional case numbers in England. The measures in England are next being reviewed on December 16, while in Wales it was announced that secondary schools would move online from the start of next week because of the high number of cases. Elsewhere, it was reported that the French PM was set to announce an 8pm curfew from December 15. While in Germany, it was announced that Berlin would close non-essential shops and extend the school break until January 10. Denmark announced that the partial lockdown would be extended to additional municipalities. Meanwhile, in the US, Virginia announced a limited nightly stay-at-home order until January 31 while Pennsylvania announced that it is temporarily suspending indoor dining at bars and restaurants until January 4. Ohio has also extended its night curfew until January 2. Across the other side of world, South Korea has further strengthened social distancing rules and has limited restaurant hours while ordering closure of high-risk facilities such as nightclubs and karaoke bars.

Finally, the US CPI data for November showed month-on-month inflation of +0.2% (vs. +0.1% expected), which meant the year-on-year number remained at +1.2% (vs. +1.1% expected). In the UK, GDP expanded by just +0.4% in October, which was the economy’s slowest monthly growth since the economic rebound from the pandemic began. And in France, industrial production for October was up +1.6% (vs. +0.4% expected), bringing the year-on-year number up to -4.2%.

To the day ahead now, data releases from the US include the November PPI reading and the University of Michigan’s preliminary consumer sentiment index for December, while from Europe there’s Italian industrial production for October. Central bank speakers include the ECB’s Holzmann, Hernandez de Cos and Centeno, along with the Fed’s Quarles and George.

via ZeroHedge News https://ift.tt/3qQFfZ9 Tyler Durden