Morgan Stanley Warns British Banks Could Drop 20% As Brexit Talks Fail

Tyler Durden

Fri, 12/11/2020 – 09:05

They really mean it this time.

British Prime Minister Boris Johnson is truly living up to his reputation as a tough negotiator as the government in London and its erstwhile partners across the continent are sounding the alarm: negotiations have yielded no progress, and with neither side willing to give ground, Johnson has warned businesses and the public to get ready for the “no deal scenario, which will see the UK plunge out of the EU without a deal as the clock strikes midnight on New Year’s Day.

European Commission President Ursula von der Leyen, Brussels’ bureaucrat-in-chief, has delivered a similar warning to the heads of the 27 remaining European Union member states. Both sides claim to want a comprehensive trade deal cover the roughly $1 trillion in bilateral trade annually, but Britain is unwilling to allow Brussels to dictate rules about climate and labor standards (among other things), while Brussels is anxious about Britain under-cutting European industry once London isn’t beholden to the European Court of Justice.

Yesterday, BoJo warned that the odds of a no-deal outcome were high. On Friday, Reuters quoted an anonymous EU official saying “the probability of a no deal is higher than of a deal”. To be sure, Johnson and von der Leyen have given negotiators until Sunday evening to break the impasse over fishing rights and common rules to ensure a level playing field.

“Situation is difficult. Main obstacles remain,” the EU official said of von der Leyen’s message. “To be seen by Sunday whether a deal is possible.”

Analysts have figured talks would go down to the wire, but the complete and utter lack of progress over the three stumbling blocks, is starting to really bother traders, who sent cable down a full percentage point on Friday morning in Europe. Deadlines have never carried much weight during the negotiations until this point, but if there isn’t a deal by Sunday and the two sides walk away, the market will almost certainly start pricing in the prospect of ‘no deal’. Certainly, it will take some convincing. As analysts at Rabobank said last week, the market has consistently refused to price in ‘no deal’, as investors have always assumed that, since a deal is in the best interest of both sides (at least, economically speaking), an agreement would likely be struck – even if it doesn’t come until the last minute.

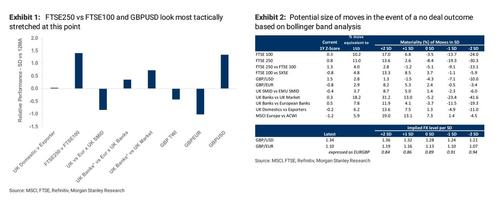

Graham Secker and Matthew Garman at Morgan Stanley see 6%-10% downside for the FTSE 250 in the event of “no-deal”, based on their bollinger band analysis.

Source: Morgan Stanley

Analysts at Citigroup believe British banking stocks could fall between 10% and 20% since no deal would be a serious negative surprise. To be sure, the team at MS still sees an agreement as the most likely outcome, they acknowledge that the odds of ‘no deal’ are rising.

“At this stage we think markets will react with a controlled degree of disappointment rather than distress given that the wider global macro outlook remains healthy, with a strong recovery expected next year,” Morgan Stanley said.

While a “no-deal” Brexit wouldn’t derail the economic recovery in Europe, it could create some uncertainties that might repel investors.

From an equity perspective, there has been “a healthy consensus” that a no-deal Brexit would be “avoided”. The team from Morgan Stanley said that even the prospect of “no deal” “has been absent in almost all of our investor conversations this year”. It’s just another reason to believe that no deal would represent a “genuine and negative ‘surprise'”.

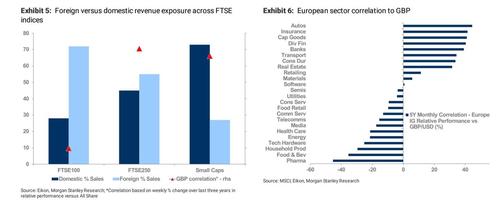

As far as rates are concerned, in the event of the UK and EU reverting to trade on WTO terms (which is what would happen if the two sides can’t agree on a new trade deal), Morgan Stanley’s economists expect a weaker 2021 recovery, accompanied by additional policy easing. A depreciating pound would almost certainly result from ‘no deal’. But that will impact things differently.

Source: Morgan Stanley

Specifically, in the near term, the MS team expects the MPC to cut rates to zero and increase the pace of QE. Looking further down the road, they would expect rates to go negative.

Some insist that BoJo’s recalcitrance is merely a show to placate his most fervently pro-Brexit supporters. However, others have cautioned that Europe’s demands simply aren’t acceptable to London, and that a ‘no deal’ outcome is virtually inevitable. Reuters reminds us that no-deal would damage the economies of northern Europe, send shockwaves through financial markets, cause massive traffic pileups at borders and generally sow chaos through delicate supply chains stretching across Europe.

To be sure, most Wall Street banks still believe a deal will be reached at the 11th hour. But most investment banks also thought that the Brexit referendum would fail. And we all remember how that turned out.

via ZeroHedge News https://ift.tt/3qPpBxa Tyler Durden