Work From Home Threatens Commercial Real Estate Valuations

Tyler Durden

Fri, 12/11/2020 – 06:17

Authored by Patrick Hill via RealInvestmentAdvice.com,

“I don’t see any way of avoiding a great deal of pain in the commercial real estate market in 2021. It is almost inevitable. My friends at the Federal Reserve and FDIC are becoming increasingly uncomfortable with what’s going on in the commercial real estate world.”

Cam Fine, Former President of Independent Community Bankers of America

WFH Threatens Commercial Real Estate Valuations

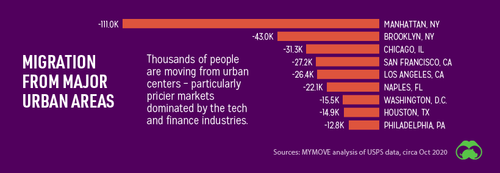

Investors hold $3.4T in commercial real estate debt via bonds, direct loans, and securitized loan bundles. Core city commercial real estate valuations could decline if millions of employees work from home (WFH) permanently. Most analysts assume that once virus infections are contained or ended by vaccinations, workers will flock back to cities. The question is: will tens of thousands of workers commute to offices after buying homes in exurbs and other states? The following chart shows the top metro areas for migration based on USPS move data. Information services and banking centers are hotspots of migration to suburbs or other regions. A total of 238k workers have moved out of the top five urban areas since the pandemic started.

Source: Visual Cap – 12/1/20

Migration to secondary regions will become permanent once workers feel comfortable, and managers see WFH productivity at pre-pandemic levels or higher.

The largest WFH segment is those workers living outside of cities and working from home but not relocating. A survey of 238 corporations reported that 44% of their employees work from home currently.

Understanding this historic migration requires a review of a variety of different factors. So, we will examine six major migration events, business losses, and work style changes which are likely to impact commercial real estate values:

-

Professionals Who WFH Buy Distant Homes

-

City Properties Lose Value

-

City Based Small Business Sales Decline 40 – 50%

-

The Commercial Real Estate Unwind

-

Regulators Are Concerned About Commercial Real Estate Debt

-

Cities Will Have A Long Transformation

We will start our analysis by examining the suburban boom as professionals move to less expensive regions looking for more living space.

Professionals Who WFH Buy Distant Homes

The massive migration of professionals from cities to suburbs creates economic winners and losers. This suburban migration will permanently shape consumer and business buying patterns for many years.

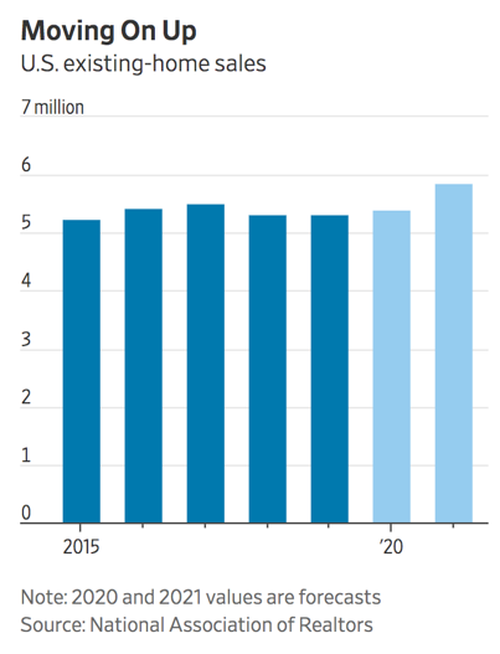

Professional moves triggered by continuing work-from-home policies are pulling forward housing sales to a 14-year record high.

Sources: National Association of Realtors, Wall Street Journal – 11/11/20

Affluent professionals with incomes higher than pre-pandemic buyers were 25% of all home purchasers than just 14% of buyers in February. Wealthy buyer demand triggered a 14.8% jump in median home prices to $311,800 versus a year ago. Professional migration is strong in major cities like New York and San Francisco, where from 11 – 15% of all job holders have moved permanently.

For example, in the San Francisco Bay Area, professionals are moving to Arizona, Texas, Oregon, and Utah, where homes are 25 – 50% less expensive. Housing sales drive purchases in household furnishings, and appliances sales are up 13.4% over last year. Most buyers financed their home purchase with 20% down payments. So, buyers were planning their investment before the pandemic. They pulled forward their purchase with the opportunity to keep a well-paying job and move to a less expensive area. Sales of existing homes will begin to fall as pending home sales fell 1.1 % in October for the second consecutive month.

The pulling forward of future home sales will likely result in a sales decline by the 1st or 2nd quarter of 2021. For workers who moved, they face a possible reduction in income. As 30% of S & P 500 executives say, they will reduce employee wages for remote workers in less expensive regions. Today, the bottom 80% in income have tight budgets. So, moderate-income workers will not be entering the home market until their income recovers sufficiently to purchase a home.

City Properties Lose Value

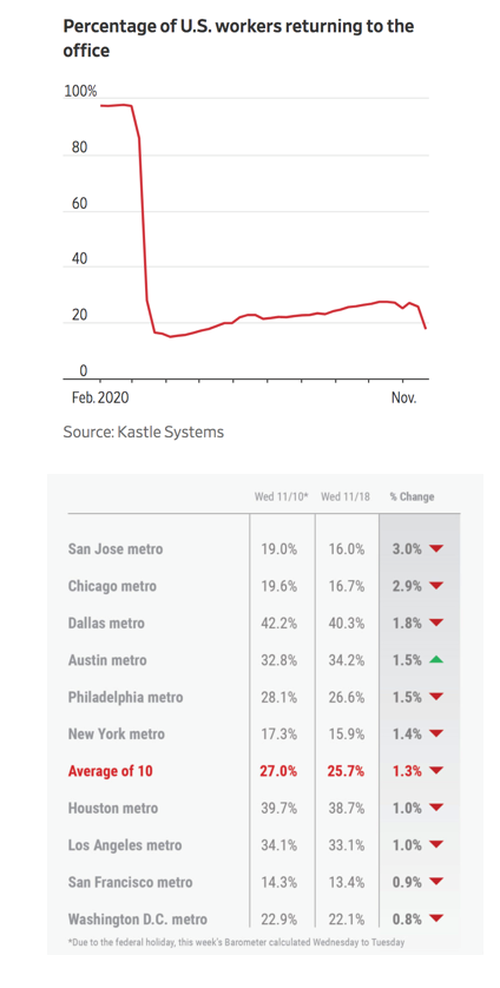

WFH policies are creating ghost areas in dense office cities like San Francisco and New York. Bloomberg estimates 1.6M workers commute into Manhattan daily. Yet, downtown Manhattan has become a ghost town. Kastle Systems, a building security firm, provides weekly reports of key fob check-ins for 2,681 buildings in the U.S. New York City has an average occupancy rate of just 15.9%. Manhattan office space for rent is at the highest level since 2003.

Other less dense cities like Dallas have an occupancy rate of 40.3% and Los Angeles a 33.1% rate. The average occupancy rate across ten cities is 25.7% for the week of November 18th. For the nation, the occupancy rate reached a peak in the summer of 27% and fell to last month’s level of 20%. Nine of the ten cities have declining occupancy rates.

Source: Kastle Systems – 11/23/20

The Squeeze Is On

Commercial property companies are squeezed between mortgage and lease payments as companies delay payments and reduce office space. U.S. banks hold $2Tr of property loans. In 2008, banks wrote off $110B in commercial real estate losses or 25% of their total losses. 2008 was significantly smaller in scope than the demand/supply shock of the present recession. If the current WFH migration shift becomes permanent or even slowly recovers, the loss in office property values alone could reach 20 – 25% Barclays Bank estimates. Property values for hotels and retail have fallen even further by 40 – 50%.

However, with the announcements of vaccines, some property owners have obtained bridge loans hoping that commuters return by the end of next year. Yet, there still considerable risk that the WFH migration may signify a change in work location and consumer buying behavior. A permanent shift to remote work and online consumer spending will undermine segments of commercial real estate debt valued at $3.4T.

City Based Small Business Sales Decline 40 – 50%

Core city small businesses report 40 – 60% declines in sales. Sales declines range across various small companies who depend upon commuters to buy their services or products. Restaurants, hotels, and personal services such as hair salons, barbershops, gyms, and laundries report the most significant losses. Adding to small business income strain is the requirement that many of these businesses close for shelter in place rules or drastically cut their operational capacity.

In most major cities, restaurants had to maintain 6-foot social distancing and cut capacity to 25 – 50% for indoor dining. Due to soaring virus infection rates, San Francisco has ended indoor and outdoor dining allowing only meal pick up for the foreseeable future. Each day, cities are announcing more social activity restrictions to contain the outbreak of the virus.

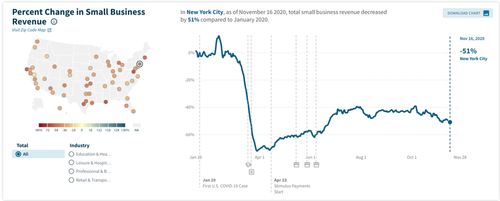

New York City small business revenue declined 51% from January to November 16th of this year and continues to fall. Note that across the U.S., in cities like San Francisco, small business revenue declined about 60%, and others like New Orleans by 60%, Washington D.C. 65%, Detroit 45%, and Boston 50%.

Source: Opportunity Insights – 11/16/20

PPP is Running Out

The end of the Paycheck Protection Program (PPP) on July 31st has left many small businesses with mounting debt to vendors and leaseholders. Thousands of small businesses in core cities with high rents and drastically reduced income are likely to default on commercial property owners’ leases. Small business chain franchisees run 55% of all hotels and 84% of restaurants. Both sectors employ a total of 6M workers. Ninety-six percent of franchise small businesses received PPP grants. The grants or loans helped them to continue operating until their PPP funds ran out. Franchisees pay rent to chain corporations who often own the local hotel or restaurant buildings. Owner-operators squeezed by 40 – 50% declines in revenue have been delaying rent payments to chain landlords. There is a significant risk for city location operators that an enduring loss of commuters will force them to close.

The Commercial Real Estate Unwind

Small businesses short on cash reserves and lacking the ability to go to bond markets or qualify for bridge loans are likely to default first. Their defaults will send the first cash squeeze wave through commercial property holders and their banks. In the future, thinly financed office property owners not able to handle businesses defaulting on their loan payments will begin to fold. The first indication of a soft office space market in core cities is starting to appear. San Francisco and New York office space prices are down 20 – 25% from last January. Long-term property vacancy rates will possibly snapback by 15 – 20% upon virus containment. But, cities like New York may continue to have 30 – 35% vacancy rates for years to come.

With high vacancy rates, property values drop. In the future, loans based on increased property values will go underwater and are called. It looks like déjà vu of the subprime mortgage collapse. Just like that crisis, JPM Chase and Goldman Sachs have securitized about $550B in commercial real estate debt sold to investors. One significant difference from that crisis is that most of the home market was solid, even with the sub-prime market collapsing. Plus, in 2008, the economy was expanding, and unemployment was at 5%. Today, the economy is in a deep recession. The unemployment rate is 9 – 13%, and 20.4M workers are on continuing unemployment assistance. Are regulators concerned about this immense risk to commercial real estate values and debt? Yes.

Regulators Are Concerned About Commercial Real Estate Debt

The Federal Deposit Insurance Corporation (FDIC) has identified 356 banks concentrated in the commercial real estate market. Most of these banks are community banks rated as concentrated in commercial real estate based on their loan to capital base and growth of loans. Some core community banks are already under regulatory guidance.

With $60B in assets, Manhattan-based Signature Bank has 60% of its loan portfolio in commercial real estate but has raised loan loss provisions by $53M in the last month. Valley National Bank, Wayne, NJ, has $42B in assets with an 81% increase over three years in its New York metro commercial real estate portfolio. These banks are leveraging low-interest rates to make bets on commercial real estate.

Eric Rosengren, President of the Federal Reserve Bank of Boston, has voiced concerns about banks bingeing on low-interest borrowing. In recent presentations, he has warned about commercial property values being artificially “inflated by more than a decade of ultra-easy money.” Fed Chair Jerome Powell testified to a House committee last September that smaller banks have more exposure to the commercial real estate market and have less financial resources to deal with the stress to balance sheets. Powell implied that the Fed would rescue community banks if necessary.

When Will Workers Return?

Of concern for investors is how long it will take to see any weakness in commercial real estate markets. In the last recession, commercial real estate losses did not peak until three years after the 2008 recession peak. The three-year delay allowed regulators to provide liquidity to cushion the impact. With so many real estate loans outstanding in core city centers, regulators may not have as much time to mitigate the effects. Loan delinquencies have increased by five times to 10.2%. To reduce delinquencies, some loans were rolled over to bring the delinquency rate down to a still-high 8.2%. Regulators, banks, and property owners anticipate a quick return of workers to core inner cities are safe. How and when might workers return to city centers?

Cities Will Have A Long Transformation

Forecasting the number of workers who return to their offices is problematic. It is difficult to predict due to rapidly changing work lifestyles, housing, and social trends. There are indications of what the future may be if workers decide to leave core cities permanently. A recent survey of the San Francisco labor market found that 15% of all workers made long term moves.

However, some executives see synergy in employees working together face to face. There will be a push-pull between workers desiring to WFH and management. For example, JPM Chase CEO Jamie Dimon wants all employees back at their offices when it is safe to create a ‘creative combustion’ environment. Yet, other companies like Microsoft and Facebook are offering their employees the ability to WFH permanently. We expect that cities for information services companies, that up to 50% of the workers will opt for WFH.

For consulting companies, personal services, or event-oriented businesses, probably 75 – 80% of workers will return. Hard-hit businesses like hotels and restaurants are not likely to call back workers until business picks up, maybe by Q3 of 2021. A July survey by the Society of Human Resource Management of 283 corporations with 4.4M workers found executives expect 20% of their employees to WFH permanently. This about half of the current 44% working from home. Thus, if 20% of employees WFH will mean a 20% reduction in office space requirements nationwide. In the same survey, employers expected to bring back only 16% of permanently laid-off workers. Managers will look for ways to reduce office space costs by increasing the number of employees who WFH. Executives will find WFH an excellent way to increase profit margins. Thus, corporations are interested in leveraging WFH culture and are doing it with fewer employees overall.

Summary – The Commercial Real Estate Market Faces Significant Headwinds

The commercial office real estate market faces significant headwinds for at least the next several years. The lengthy transition is due to companies working out their new WFH and office cultures. Certainly, once it is safe, many workers will want to return to the office. Plus, some managers will require them to return to the office. An underlying concern is that the small business sector is on a financial cliff, barely holding on. The New Jersey Federation of Small Businesses reports that 31% of all small businesses’ were closed either temporarily or permanently in November.

If there is long-term unemployment resulting in a drop in consumer spending, then the economy may take several years to return to pre-pandemic levels. A stimulus bill will mitigate the short-term financial squeeze for businesses and leaseholders. But, the funding will not change the migration to WFH. More likely, if employees feel the economy is stabilizing, they are more likely to move and request a WFH option. A possible second wave of WFH employees looking to move will likely increase the office vacancy rate for many cities for years to come. Thus, new moves will cause a continuing increase in vacancy rates and further devaluation of properties.

via ZeroHedge News https://ift.tt/379wjq9 Tyler Durden