The Curse Of The Third 10%-Plus Year

The Third Year Curse

Jessica has written several times about the seeming market anomaly that the S&P 500 rarely posts three or more consecutive +10 percent years.

Since 1928 (93 years), it’s happened only 5 times:

-

World War II (4 years): 1942 (+19 pct), 1943 (+25 pct), 1944 (+19 pct) and 1945 (+36 pct)

-

Korean War (4 years): 1949 (+18 pct), 1950 (+31 pct), 1951 (+24 pct) and 1952 (18 pct)

-

Start of Vietnam War (3 years): 1963 (+23 pct), 1964 (+16 pct), and 1965 (+12 pct)

-

Late 1990s Bull Market (5 years): 1995 (37 pct), 1996 (+23 pct), 1997 (+33 pct), 1998 (+28 pct) and 1999 (+21 pct)

-

Post-Financial/Greek Debt Crisis (3 years): 2012 (+16 pct), 2013 (+32 pct) and 2014 (14 pct)

That’s the whole list, across almost an entire century of US equity returns… The famous bull market of the 1980s did not see 3 consecutive +10 percent years. Nor did the 1970s, when the S&P 500 rose by 78 percent over that inflationary decade. Even the post-1932 snapback from the Great Depression bottom for US stocks failed to string together 3 years in a row of +10 percent returns in the 1930s.

We’re closing 2020 with a 15 percent price return, and 2019 was 31 percent, so why would one think that there’s enough left in the tank for another +10 percent year in 2021?

-

Do we really think investors haven’t figured out that corporate earnings will rebound sharply in 2021?

-

… Or that they don’t believe the Federal Reserve is serious about keeping interest rates low across the curve?

-

Those factors explain 2020’s return, especially the lift off the March 23rd bottom. But they do nothing useful to defend the view that 2021 will see the S&P 500 return another +10 percent.

Some thoughts about what a real “surprise” would actually be next year that could propel US stocks:

-

S&P earnings could be more like $50/share in Q3 and Q4 2020, rather than the $45-$46/share Wall Street currently has in its models. This is our “base case” surprise, something that is likely to happen but not yet fully incorporated into stock prices. Earnings leverage through a cyclical bottom (both on the way down and back up again) is always hard to call, which is why markets always swoon at the start of recessions and rip at the bottom of economic downturns.

-

US vaccine rollout and adoption could be faster than expected, supporting the idea earnings might be better than expected since consumer confidence will recover more quickly.

-

Congress and the Biden administration might agree on multiple large fiscal stimulus packages over the course of 2021, taking the risk out of next year’s earnings estimates even if we don’t get to $50/share in Q3/Q4. Also, some of that cash would end up in equities, as 2020’s $1,200/person cash payments did.

-

Worth noting: the Georgia Senate races could be a negative surprise for markets if both Democrats prevail. This would swing the upper house to 50/50, making Democrat VP Harris the tie breaking vote on issues like tax policy.

Takeaway: if we had to guesstimate, we’d say 80% of all the baseline good news expected in 2021 is already incorporated in an S&P 500 at 3,700 in late December 2020. If all we get is a sub-1.5 percent 10-year yield and a 2H earnings run rate of $90/share, then the “Third Year Curse” will likely prevail.

On a separate note, you’ve probably looked at this chart many, many times in the last decade. It is, of course, the Shiller Price-Earnings multiple for the S&P 500, which uses rolling 10-year average earnings for the “E” to approximate underlying corporate profitability across an economic cycle.

With that 33.9x multiple at present, US equities look dramatically overvalued by long run historical norms.

The only other red dot on that graph is Black Tuesday 1929, when the Shiller PE was actually lower than today. Scary stuff…

But… Let’s remember that the Shiller PE ignores a lot of important variables:

Interest rates. Stock prices reflect discounted future cash flows, and discount rates vary with risk free rates. It makes no sense to compare 2020 to prior periods, at least as naively as the Shiller PE does, without acknowledging that 10-year Treasuries yield 1.0 percent now and were higher at any other point on that graph.

Index composition. Every sector in the S&P 500 has its own fundamentals and therefore its own valuation. We don’t expect Technology to trade for the same multiple as Energy, for instance.

Consider the 1980 – present part of this time series. That’s the rightmost third of the graph, when the Shiller PE rose from 10x to that current 34x reading.

- In 1980, Energy was 26 percent of the S&P 500; now it is 2 percent.

- In 1980, Technology was 8 percent of the index; now it is 28 percent.

- That’s actually the biggest market story of the last 4 decades, and the Shiller PE misses it entirely.

Rate of change. This is one place where a careful reading of historical Shiller PEs does deliver useful investment conclusions, but we rarely see it mentioned. Look carefully at the run-up to Black Tuesday 1929, Black Monday 1987 and the peak of the dot com bubble in 2000.

In all 3 cases, the Shiller PE more than doubled in the 5 years before its peak. From 1925 – 1929, it went from 10x to 30x. From 1983 – 1987, it went from 8x to 17x. From 1995 to 1999, it went from 20x to 44x.

To show the same speculative fervor now the S&P would have to trade for 48x trailing 10-year earnings, not the 34x multiple we have today. That would be an S&P 500 at 5,200, in case you’re wondering.

Takeaway: US equity valuations remind us of the pre-Socratic Greek philosophical statement “No man steps in the same river twice, for its not the same river and he’s not the same man”. A stock index that is 26/8 percent Energy/Technology should not have as high a multiple as one that is 28/2 percent the other way. And an investor in 2021 faces a different rate environment from one in 1980. In the end, we should really just concern ourselves with how fast the river is rising and not step in if the waters are moving too quickly.

Finally, forget forecasting 2021 – where will markets be in 2030?

To our thinking, the decade of the 2020s actually starts Friday because the Gregorian calendar has no “year zero”. That means 2020 was the last year of the 2010s, at least to the letter of the law. And yes, we’re aware the late great Prince saw things differently.

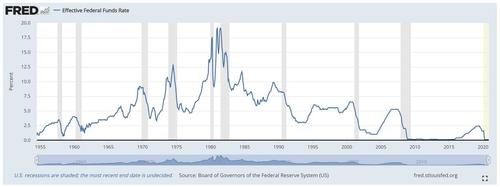

To look forward, let’s start by looking back; here is the Effective Fed Funds Rate from 1954 to the present day. The important bit for our purposes is towards the right side. There you will see that Fed Funds were 0 – 25 basis points for 7 years, from December 2008 to November 2015. This remarkable stability has no precedent in the post-World War II historical record, either in terms of level or duration.

We know that the bulk of the Federal Open Market Committee sees rates remaining at zero for 2021 – 2023, in eerily similar fashion to much of the last decade, because that’s what was in their December 2020 “Dot Plot”. Add in the 9 months of 2020 with zero rates, and the 2020s will see zero interest for at least half as long a time as during the 2010s. Fed Funds Futures markets price rate policy in much the same way. As of today, every contract with at least one trade on the books expects rates to stay at 0 – 25 basis points through September 2022.

This observation leads to a fork in the road when it comes to equity returns in the 2020s.

Path #1: The Fed, and Fed Fund Futures, are wrong and rates will rise sooner than either one expects. This is the inflation-driven bear case for stocks. Anyone who was investing in 1994 or 2000 (see chart above if you weren’t) knows what equities do when the Fed starts to raise rates after a long period of easy policy. There’s a bit of patience at first, but eventually fears of a policy mistake seep into the market narrative. And Q4 2018 shows how unforgiving investors are in the current day to such a possibility.

Path #2: Rates will remain at zero for at least the next several years, replicating the 2010s experience. In that case, equities have a chance to generate reasonable returns as long as corporate earnings recover (more on this in Point #4 below). There are, however, some other issues to consider:

-

This is not 2010 – 2012, when US energy production was the hot investment theme. In 2011, Energy’s share of the S&P was 13 percent, not far-off Technology’s 18 percent. Capital impatient with zero interest rates was almost as likely to take a flyer on a fracking project as a Series A venture capital round.

-

We’re seeing where capital goes in 2020, and it’s basically to one place: technology. It might be electric vehicles, or online shopping/learning/working anywhere in the world. Four billion smartphone users can’t be wrong, and capital still sees them as the most important investment opportunity out there.

Takeaway: when we get to year end 2030 and look back at the last 10 years, we’re most likely to consider either:

#1 How anyone in 2021 (including the Fed) could have thought inflation was dead given all of 2020’s fiscal/monetary stimulus or …

#2 … how ultra-low Fed policy rates forced a tidal wave of capital into funding the disruptive technologies we all take for granted as we start 2031.

Tyler Durden

Thu, 12/31/2020 – 12:40

via ZeroHedge News https://ift.tt/2MpdQOr Tyler Durden