The Greatest Short Squeeze In History

From the lows in March, the “most shorted” stocks in the market are up a stunning 207% – by far the largest such surge in the history of the data…

Source: Bloomberg

But that is nothing compared to the short-soul-crushing damage that Elon Musk’s Tesla has wrought in markets this year.

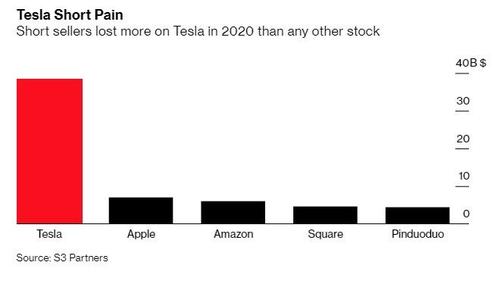

With TSLA stock up over 740% in 2020, Bloomberg reports that Tesla bears have seen more than $38 billion in mark-to-market losses this year, according to data from S3 Partners. By comparison, the next-biggest loss for short sellers was on Apple Inc., at just under $7 billion, S3 data shows.

This “is not only the largest mark-to-market loss for any stock this year, it is the largest yearly mark-to-market loss I have ever seen,” said Ihor Dusaniwsky, a managing director at S3 Partners.

Many of TSLA’s short-sellers have been squeezed out of their positions by the endless surge with short interest falling to less than 6% of the float from nearly 20% a year ago, according to S3 data.

In July, CEO Musk tweaked the noses of Tesla critics by selling limited-edition red-satin shorts with the company’s logo – or what he called “short shorts.” Fans have posted pictures of themselves wearing them as Tesla’s stock has rallied, and Musk tweeted a picture of a pair as a Christmas greeting.

Tesla short shorts are starting to be delivered & worn in public. Here, @Sofiaan was spotted washing his car in a pair. #TeslaShortShorts Thanks Sofiaan, they look stunning! pic.twitter.com/oCsD7SzH4x

— Tesla Owners Austin (@AustinTeslaClub) October 28, 2020

“The short squeeze has been going on all year. It’s been an angled straight line down,” Dusaniwsky said. “The big thing about Tesla as opposed to any other stock is that the vast majority of retail shareholders will never be sellers. They love the stock, they love the car, they love Elon Musk and they are adamant long shareholders.”

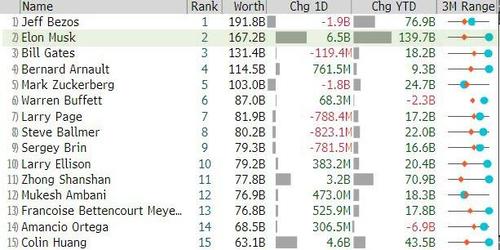

And as short-sellers have languished, Elon Musk, who holds 18% of the company’s stock, has seen his net worth explode to make him the second richest man in the world

We wonder, as infamous short-sellers like Jim Chanos remark on how “painful” this position was, just how much of Musk’s massive wealth gain should be attributed to this…

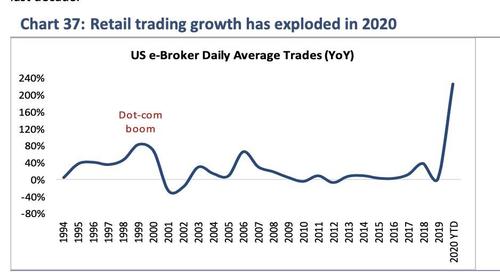

Flush with Government “stimulus,” individuals shifted their bets from sports to stocks.

Tyler Durden

Thu, 12/31/2020 – 13:08

via ZeroHedge News https://ift.tt/2WYJgNz Tyler Durden