Here Are The Top 5 Consensus Trades As We Enter 2021

At the start of every year, the Wall Street consensus is infatuated with a set of ideas, narratives and trades, which shape markets for the next few months, quite often repricing violently especially since so many of them end up being dead wrong. 2021 is no exception, and as Reuters summarizes among the top trades which investment banks and asset managers believe will dominate financial markets in 2021, are: i) Dump the dollar!; ii) Buy emerging markets! iii) Stay sustainable… oh and pray that central banks bail you out when everything blows up.

1. King Dollar (Keeps) Falling

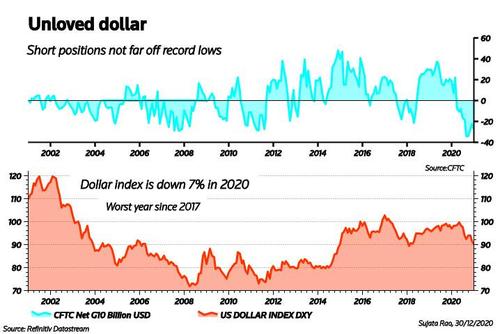

Covid ended a decade of dollar strength (after first creating a supernova surge in the value of the greenback as a $12 trillion dollar short squeeze shockwave which was short circuited by the Fed printing trillions), and expectations are for 2021 to bring more greenback pitfalls. BofA’s December investor survey showed ‘shorting’ the dollar was the second most crowded trade. Another gauge – U.S. Commodity Futures Trading Commission data – shows $30 billion in net dollar shorts, swinging from last December’s $17 billion net long.

The reasoning, says Peter Fitzgerald, chief investment officer for multi-asset and macro at Aviva Investors, is that no central bank can “out-dove the Fed”. In other words, when the Federal Reserve cut interest rates near 0%, it kicked away the dollar’s yield advantage over peers. And it still has room to ease policy. Any future reduction in trade and political tensions, likely under a Biden administration, would also be dollar-negative

How much and for how long will the dollar fall? Analysts polled by Reuters predict weakness to endure until mid-2021, capped by COVID-19 uncertainty. But PIMCO notes dollar declines are fastest after deep recessions, with five instances of 8%-10% annual depreciations recorded between 2003 and 2018. Vaccines and rebounding economies will “hasten the dollar’s fall from grace”, PIMCO predicted.

2. Re-emerging markets

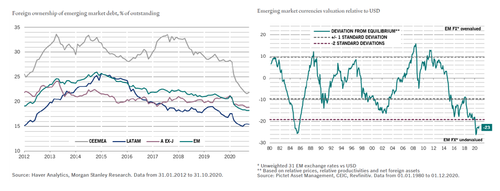

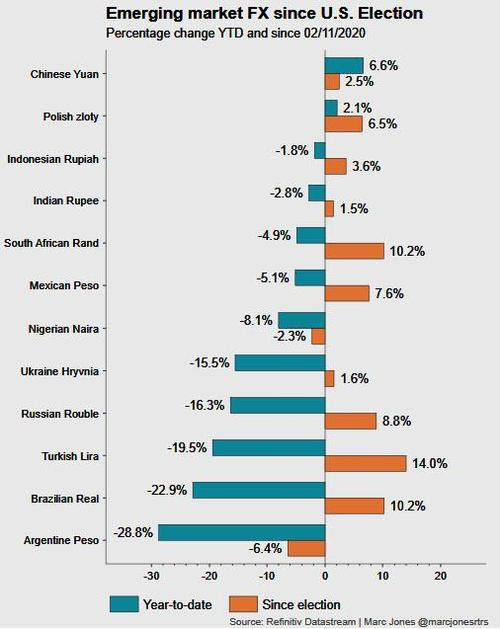

With developing economies seen benefiting from recovering global trade, tourism and commodities, a weaker dollar and a more predictable White House, Morgan Stanley’s message is: “Gotta Buy EM All!” The bank is recommending currencies from China, Mexico, Brazil, South Africa and Russia, alongside bonds from Ukraine and Mexican oil firm Pemex. Goldman Sachs and JPMorgan are also backing EM for 2021, with the BofA survey showing the sector the main overweight. Pictet says EM currencies have 25% of undervaluation to recoup.

Additionally, debt in emerging market currencies will net investors 6.2% next year, more than the S&P500, BofA expects. The sentiment swing towards a sector that’s languished for a decade is driven of course by hopes of a China-led growth recovery but also the lure of higher emerging market interest rates, given 0% or negative yields across richer countries.

Understandably, according to the Institute of International Finance (IIF) investors are shovelling money into EM assets at the fastest rate in nearly a decade. But some remain wary. Higher Treasury yields could spark a 2013-style “taper tantrum”, Citi suggested. Investment-grade credit ratings are at risk in some countries such as Romania or Mexico, while more debt defaults are likely in weaker nations.

3. (Central) Banking on It

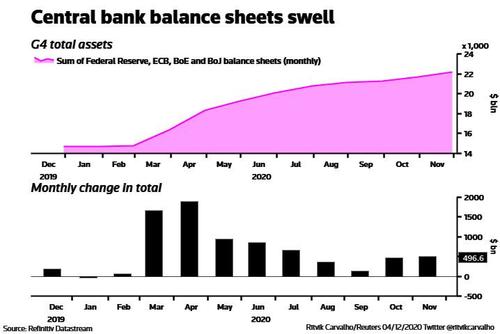

Perhaps we should have started with this one because underpinning virtually all 2021 bets is the view that the Federal Reserve, European Central Bank, Bank of Japan, Bank of England and People’s Bank of China will keep the cheap money flowing. As we reported previously, central banks worldwide spent $1.3 billion an hour since March on asset purchases, according to BofA. There were also 190 rate cuts in 2020 year – roughly four every five trading days. But with global GDP seen expanding 5.4% next year – the most since 1973 – it might be hard to justify pushing the pedal further to the metal, especially if inflation creeps higher.

And not much policy room is left anyway. JPMorgan estimates that over 80% of sovereign bonds from richer nations pay negative yields after factoring in inflation. Many investors including BlackRock are now underweight the sector. Still, the Big Five’s asset purchases should total $3 trillion, Pictet predicts, down from this year’s $8 trillion but enough to keep bond yields extremely low.

A note of caution from JPMorgan – consensus forecasts in the past 10-15 years have correctly called the direction of Treasury yields only 40% of the time. Which means that the most likely outcome is for sharply lower yields by year end.

4. ESG – Here For “Good”

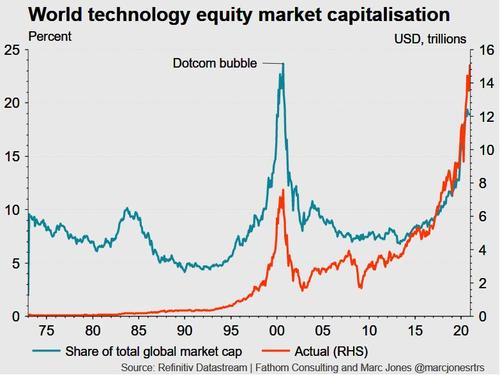

The assets of funds investing in environmental, social and governance (ESG) principles doubled this past year to over $1.3 trillion, and the IIF predicts the pace will accelerate in 2021, especially if U.S. President-elect Joe Biden pursues a greener agenda (the irony, as we explained in September, is that most “ESG” investments are really just a handful of mega-cap tech stocks). Virtue signaled “concerns” about pollution, climate change and workers’ rights (by corporations whose bottom line is to literally minimize workers’ rights) are the main drivers. But the IIF also points out 80% of “sustainable” equity indices outperformed non-ESG peers during the pandemic-linked selloff, while renewable energy has been the runaway outperformer since then.

BlackRock describes ESG as “the tectonic shift transforming investing” (perhaps referring to the impact its own top-line is expected to see), forecasting “persistent flows into sustainable assets in the long transition to a less carbon-intensive world.” In any case, for now it’s working: two-thirds of ESG fund assets are in equities, but sustainable debt has grown 20% in 2020 to more than $620 billion. Governments are stepping up green debt issuance while central banks are eyeing more sustainable bond-buying and reserve strategies

5. Biden Time on Tech

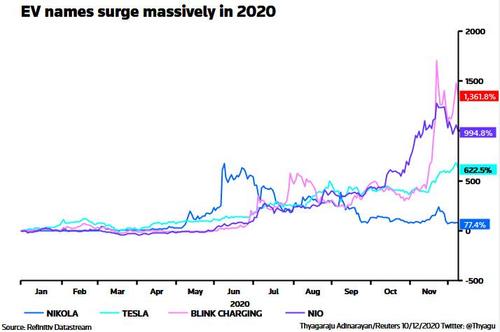

According to Reuters, many of the above investment strategies are premised on a very different approach to trade and geopolitics under Biden. He has vowed the United States will be “ready to lead” again on the global stage, but BofA cautions that China, North Korea or Iran may look to test him early on with “provocative actions”. In some areas – big data, 5G, artificial intelligence, electric vehicles, robotics, and cybersecurity – Biden’s policies might be just as combative as Trump’s.

That may speed up the move towards what’s dubbed ‘splinternet’, with dual or multiple tech systems. Tech and e-commerce companies account for a quarter of U.S. corporate profits, while tech comprises 40% of MSCI’s emerging equity index. So watch this space.

Tyler Durden

Tue, 01/05/2021 – 08:00

via ZeroHedge News https://ift.tt/3pTigvw Tyler Durden