Rabobank: Here’s How We Could Be Stuck With COVID Forever

By Michael Every of Rabobank

You don’t have to be Einstein

One of the most frequently used ‘clever’ quotes for journalists and analysts alike is that the definition of insanity is to keep doing the same thing over and over again and yet expecting different results. This is considered clever both because it is true and because it was said by Einstein, and some of his genius apparently rubs off by association. Well, you don’t have to be Einstein to see what madness we face around us at the moment on multiple fronts.

Lockdowns are being extended again in Europe, and in the UK most so. Once again, one must ‘stay at home’. Unless one needs to go shopping; or exercise; or has an essential job – which is a very long list. The police won’t be enforcing these rules in all probability, and parts of the public won’t comply. So it is the worst of all lockdowns, destroying the economy, but not virus transmission – which is the ONLY way to handle this matter once and for all.

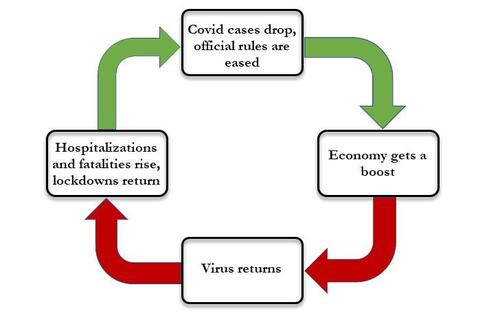

Since Covid-19 first appeared, the objective logic was always clear: shut *everything* down for a short time to stop ALL transmission, and then only open up selectively with others who have been as careful. Instead, we see draconian yet loopholed regulations (“because markets”) that don’t get the virus R rate and total cases to 0; and then we rush to open up again and repeat the infection cycle all over again. I repeat, you really don’t have to be Einstein to see this.

Of course, now we have the vaccine – except if a vaccine-resistant strain were to emerge, as happens with other corona viruses. As noted yesterday, South Africa is worried enough about this already being true. OK Einstein – what should one do in the interim, and what are we doing instead? That’s right: maintaining international travel with South Africa, and more broadly, and just hoping this is *not* the case. “Because markets”.

“What’s that huge fin in the water, guys?”

“Could be a dolphin, or it might be a shark. Let’s keep swimming until we find out which.”

Yes, it’s a tail risk (or a fin risk), but if the virus mutates before we vaccinate everyone, then we start this loop all over again. OK, we can tweak the vaccine. Yet doing so, re-producing it, and then re-distributing it again would take at least another six months, time in which these more transmissible Covid variants would have to mutate again among an even larger host-base of infected individuals. In short, we would be stuck in this pattern forever. This is no way to win a war against a virus; I refer readers to the story yesterday about leadership failing upwards.

Meanwhile, politics is still very much the driver of markets at the moment, which is something that markets also don’t seem to ever learn. Let’s start with US-China relations, where the NYSE has just decided it will not be delisting Chinese telcos after all, despite an executive order saying they have to do so for firms which are linked to the Chinese military. Markets obviously love this. Not so much national security types across the spectrum who argue telcos are a key component of hybrid national power; or those that see access to the USD and US markets as a ‘weapon’ that is unilaterally being holstered here. You don’t have to be Einstein to see that this is no way to win a Cold War, if we are going to be having one. – but it is a move very much in the pre-Trump US “because markets” foreign policy tradition. (See here for a view of that.) Long USD it isn’t.

Elsewhere, Saudi Arabia and Qatar are building bridges, or rather not having to, because at one point the Saudis were allegedly considering digging a moat around their estranged neighbor. Now the borders will reopen as the Middle East starts to come together – against Iran. On which, Tehran has started to enrich uranium to 20%, a move that has even prompted the EU to say this would be a “considerable departure” from the Iran nuclear deal’s terms; and to which the rest of the world thinks: “And what is the EU going to do about it- sign a bilateral investment deal?” Don’t rule that out for the EU foreign policy geniuses. Just to top things off, yesterday Iran seized a South Korean vessel in the Straits of Hormuz. Is anybody seems in the mood for real risk off?

Meanwhile, everyone is focused on Georgia today instead, where two Senate run-off votes will either give see a 50-50 tie or the Republicans retain a slim majority. Hilariously, markets are moving on the recent surge in the Predictit election odds from ‘Dem zero’ to a 50-50 toss-up for both seats. Slow hand clap, Mr Market: with Trump allegations of electoral shenanigans in Georgia, how would Democrats *not* be in a strong position? And if the allegations are false, it just shows Democrats are extremely competitive there – a near zero chance of victory was mad. The market concern is a ‘blue wave’ means more fiscal spending, and so faster Fed rate hikes or less easing, and a stronger USD. Yet with Democrats like Manchin seated, one would again have to be mad to assume a 50-50 Senate would just turn on the taps. (At which point the whole ‘Great Reflation!’ story is also shot down after its umpteenth insane iteration.) Long USD it might be as a knee-jerk today, however.

Another Einstein anecdote. The physicist became an American citizen late in his life after fleeing the Nazis, then acted as the sponsor for the logician Kurt Gödel to do the same. Gödel, being the logician of incompleteness theorems that he was, anecdotally nearly blew up his 1947 US citizenship interview by pointing out a loophole in the constitution that could allow it become a dictatorship, requiring Einstein to shut him up. This was related to Article V and the power to amend the constitution. In 2021, a day ahead of Congress convening to elect the US president, we see a similar discussion in some quarters over the power of the 12th amendment and the badly-worded Electoral Count Act of 1887 that –constitutionally or unconstitutionally?– supersedes it. In short, theoretically the Vice President has the sole undisputed power to count or discount electoral college votes – which can de facto mean voting for a winning (vice) president once means you get them twice because the VP can count the electoral college the way that suits them to get a second term.

These are truly shark-infested waters. However, if you are looking for a fin/tail-risk trade in an area of politics that markets don’t grasp at all, this would be it. But that’s a story for tomorrow. Today it’s Georgia….and not the virus, “because markets”.

To conclude, here are some Einstein quotes better than one we all use all the time. In today’s world it seems the second beats the first:

“The important thing is not to stop questioning. Curiosity has its own reason for existing.”

“If A is a success in life, then A equals X plus Y plus Z. Work is X; Y is play, and Z is keeping your mouth shut.”

Tyler Durden

Tue, 01/05/2021 – 09:15

via ZeroHedge News https://ift.tt/3pNhYpR Tyler Durden