FOMC Minutes Show Fed Discussing 2013-Like Taper To Bond-Purchases

Two days after Atlanta Fed President Raphael Bostic says the central bank might taper its bond purchases later this year if the distribution of vaccines boosts the U.S. economic outlook.

“I am hopeful that in fairly short order we can start to recalibrate,” Bostic said in an interview with Reuters Monday

“If we determine things have strengthened appreciably, that we have made significant progress, then we will think about the next appropriate action”

But who’s gonna monetize the debt cries Washington?

And so, all eyes are on today FOMC Minutes for any signs that The Fed is about to start stealing the jam out of the market’s donut.

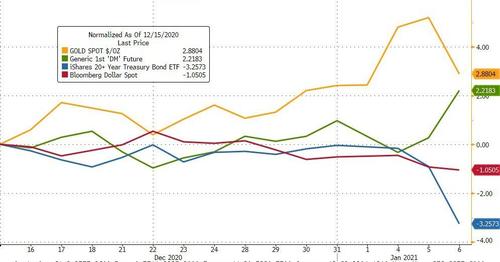

Since the Dec 16th FOMC meeting, Gold and stocks are higher while the dollar and bonds are lower…

Source: Bloomberg

Or is Crypto really exposing the reality to The Fed?

Source: Bloomberg

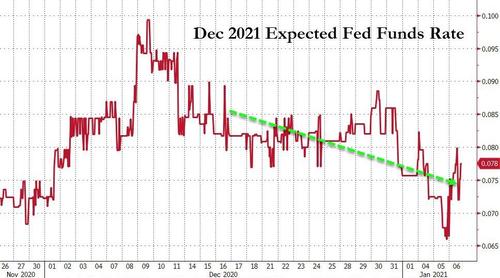

Expectations for Fed Funds this year have dovishly dropped since the last FOMC meeting also…

Source: Bloomberg

And so, as we noted above, with a shitload (technical term) of fiscal stimulus delivered and (post-Georgia) teed up for more, will the Fed use these Minutes to preview when the dreaded (hand-off) tapering will happen?

Or is the break of the psychological 1.0% yield level have them preferring to keep the dream of Yield Curve Control alive with their signaling from these Minutes?

But of course, as the image suggests, Powell has already answered all these questions – they’ll keep rates low and printing billions for longer and longer than you can imagine – which suggests today’s Minutes should be a nothing-burger.

Well, first things first, they did mention the taper:

A number of participants noted that, once such progress had been attained, a gradual tapering of purchases could begin and the process thereafter could generally follow a sequence similar to the one implemented during the large-scale purchase program in 2013 and 2014.

Some participants noted that the Committee could consider future adjustments to its asset purchases – such as increasing the pace of securities purchases or weighting purchases of Treasury securities toward those that had longer remaining maturities – if such adjustments were deemed appropriate to support the attainment of the Committee’s objectives.”

But, on the other hand, some suggested extending the duration of their buying:

Regarding the decisions on the pace and composition of the Committee’s asset purchases, all participants judged that it would be appropriate to continue those purchases at least at the current pace, and nearly all favored maintaining the current composition of purchases, although a couple of participants indicated that they were open to weighting purchases of Treasury securities toward longer maturities.

But bubbles are on their mind:

A few participants underlined the importance of continuing to evaluate the balance of costs and risks associated with asset purchases against the benefits arising from purchases.

And with regard to the USDollar:

The positive vaccine news also supported risk sentiment abroad, leading many global equity price in-dexes to advance and the U.S. dollar to depreciate fur-ther.

And on the COVID Economy:

Participants agreed that the path of the economy would depend on the course of the virus and that the ongoing public health crisis would continue to weigh on economic activity, employment, and inflation in the near term and posed considerable risks to the eco-nomic outlook over the medium term

Participants observed that the economy continued to show resilience in the face of the pandemic, though it was still far from having attained conditions consistent with the Committee’s dual mandate. They noted that the economic recovery thus far had been stronger than anticipated—suggesting greater momentum in economic activity than had been previously thought—but viewed the more recent indicators as signaling that the pace of recovery had slowed. With the pandemic worsening across the country, the expansion was expected to slow even further in coming months. Nevertheless, the positive vaccine news received over the intermeeting period was viewed as favorable for the medium-term economic outlook.

Several participants pointed out that readings on high-frequency economic indicators, such as individual mobility indexes and online restaurant reservation data, might already be registering the effects of the recent rise in virus cases.

On household income and spending

Participants noted that household spending on goods, especially durables, had been strong. Participants com-mented that the rebound in consumer spending was due, in part, to fiscal programs such as federal stimulus pay-ments and expanded unemployment benefits. These measures had provided essential support to many house-holds. The support to incomes provided by fiscal pro-grams, combined with reduced spending by households on some services, had contributed to a historically large increase in aggregate household savings.

On Uncertainty

“Market participants had highlighted that uncertainty nevertheless remained high and had pointed to several prominent risks to the economic outlook. These risks included the possibility that the vaccine rollout might not proceed as smoothly as anticipated, the potential for adverse developments in negotiations concerning the United Kingdom’s withdrawal from the European Union, and the potential for deterioration in already strained sectors, such as those involving small businesses and certain segments of commercial real estate (CRE).”

The staff observed that the uncertainty related to the fu-ture course of the pandemic, the measures to control it, and the associated economic effects remained elevated. In addition, the staff continued to judge the risks to the economic outlook as being tilted to the downside. The recent sharp resurgence in the pandemic suggested that the near-term risks had risen, while the recent favorable developments regarding vaccines pointed to some re-duction in the downside risks over the medium term.

Full Minutes below:

Tyler Durden

Wed, 01/06/2021 – 14:06

via ZeroHedge News https://ift.tt/3pVjFSe Tyler Durden