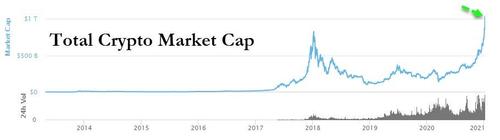

Crypto Assets Top $1 Trillion Market Cap As Novogratz Sees New Stimulus Checks Funding More Bitcoin Buying

Amid the chaotic scenes in DC yesterday, and confirmation that both Democrats won their Georgia Senate seats, cryptocurrency prices have accelerated higher once again, crossing the stunning level of $1 trillion in total market capitalization for the first time in history…

“The more that people perceive that their assets, particularly their liquid assets such as fiat currencies are eroding in value, the more they will look for alternatives,” said Geoffrey Morphy, president of Canadian crypto mining company Bitfarms Ltd.

Bitcoin has crossed another milestone, topping $38,000 for the first time…

Source: Bloomberg

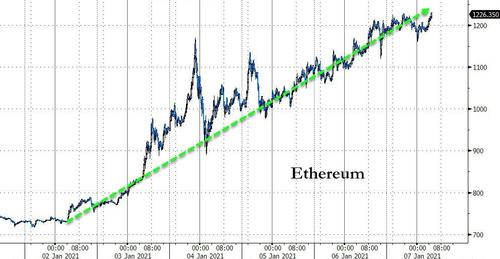

Ethereum also surged higher, breaking back above $1200 for the first time since Jan 2018…

Source: Bloomberg

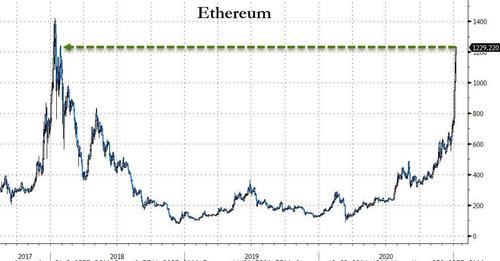

As ETH nears its own record high from early 2018…

Source: Bloomberg

Among the many reasons for cryptos recent rise, Galaxy Digital’s Mike Novogratz told CNBC this morning that the latest round of stimulus checks – and promises of even more to come under a Biden administration and now Democrat rule – could be further fuel for the rise in Bitcoin…

“A lot of that [stimulus] will find it’s way into the markets. Certainly, when it comes into young people’s hands, they’re going right to their Robinhood accounts. One of the most unique things last time was seeing how many people bought Bitcoin with the exact amount of stimulus. Boom, boom.”

“When it comes to the young people’s hands they are going right to their @RobinhoodApp accounts,” says @Novogratz on stimulus driving market gains. “One of the most unique things last time was seeing how many people bought #bitcoin with the exact amount of stimulus. Boom. Boom.” pic.twitter.com/DuazhcEeUC

— Squawk Box (@SquawkCNBC) January 7, 2021

Finally, we note that while currently, the consensus is expecting a gradual and orderly increase in prices as the economy continues to recover; as Morgan Stanley notes, the move in asset prices like Bitcoin suggest markets are starting to think this adjustment may not be so gradual or orderly. We concur. With global GDP output already back to pre-pandemic levels and the economy not yet even close to fully reopened, we think the risk for more acute price spikes is greater than appreciated. That risk is likely to be in areas of the economy where supply may have been destroyed and ill prepared for what could be a surge in demand later this year—e.g. restaurants, travel and other consumer/business related services. The best inflation hedges are stocks and commodities in the intermediate term. However, inflation can be kryptonite for longer duration bonds which would have a short term negative impact on valuations for all stocks should that adjustment happen abruptly.

Tyler Durden

Thu, 01/07/2021 – 10:35

via ZeroHedge News https://ift.tt/3hQRkcQ Tyler Durden