Record Large 2-Year Treasury Auction Prices At Record Low Yield

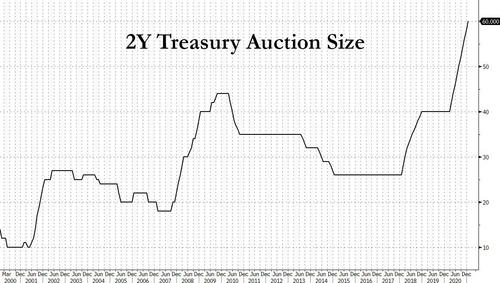

On a day when all the attention has been on the berserk moves in stocks, we were at least (mercifully) spared more fireworks out of the bond market today, when the Treasury sold a record $60 billion in 2Y notes …

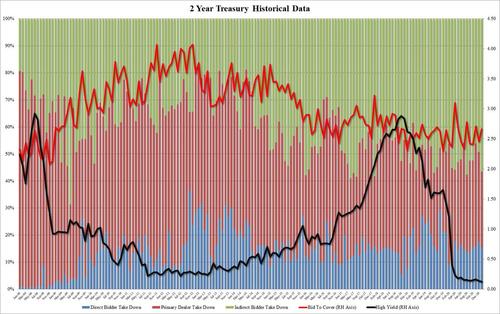

… at a record low yield of 0.125%.

The stop was 1.2bps below December 0.137% high yield, and was 0.2bps through the When Issued 0.127%.

The Bid to Cover was solid, rising from 2.453 last month to 2.668, and also well above the 6-month average of 2.52.

The internals were especially impressive, with Indirects taking down 56.5%, up from 49.2% last month, and solidly above the 50.6% recent average. And with Directs taking down 15.65% – in line with recent months – Dealers were left holding on to 27.9% of the auction, the lowest since April 2020.

Overall, a stellar auction to start a new week of coupon issuance, which sees 5Y and 7Y sales ahead of the Fed’s Wednesday announcement on Wednesday.

Tyler Durden

Mon, 01/25/2021 – 13:15

via ZeroHedge News https://ift.tt/2M2E1dU Tyler Durden