A Series Of Fortunate Events For The ECB

By Chiara Zangarelli of Nomura

Over the past two weeks some key euro area economic data releases have printed to the upside, with the surprise indices (such as that computed by Bloomberg) having remained highly elevated. Strong inflation (however temporary that may prove to be, given it is the result of one-off and base effects), for example, and modestly better-than-expected GDP data in the euro area present risks to the consensus view that further monetary policy easing will be needed later this year and may instead lead the ECB down a wait-and-see path in 2021.

Inflation

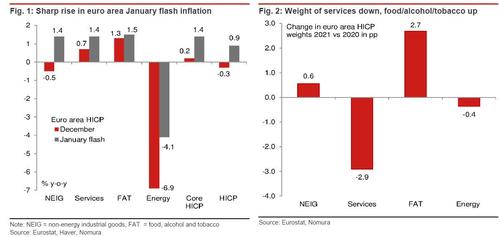

Euro area HICP inflation rose strongly in January, with all of the big four surprising to the upside. The most notable rise came from Germany, where inflation rose to 1.6% y-o-y from -0.7%, but there were significant rises too in France (to 0.8% from zero), Italy (to 0.5% from -0.3%) and Spain (to 0.6% from -0.6%). Overall, euro area inflation in January rose to 0.9% from -0.3%, an upside surprise of 0.3pp, while core inflation rose to 1.4% from 0.2% in the previous month, an upside surprise of 0.5pp.

The particularly sharp rise in German inflation was due to some policy-specific factors such as the reversal of the VAT cut that had been in place since the middle of last year, and the implementation of the climate package. In addition, it appears that inflation was also boosted by a change in weights within the HICP basket. As required by Eurostat (see here), most statistical institutes in Europe changed their HICP weights in January 2021 in response to changes in consumption patterns linked to the pandemic. As explained by ECB Executive Board member Schnabel in her recent interview with Deutschlandfunk, the significant shift in individual goods’ weights within the basket makes it “very difficult to compare the [inflation] figures over time”.

Modest effect of the second virus wave on Q4 GDP

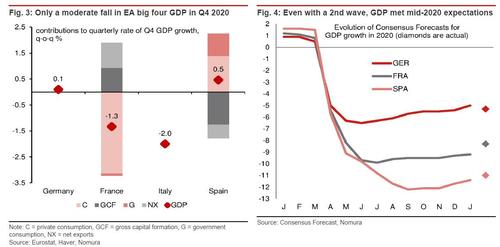

Euro area GDP was also published this week and showed that the second COVID-19 wave had – in Q4 at least – only a modest effect on output, falling by 0.7% vs. Q3. Activity in two of the euro area big four economies surprised consensus on the upside: French GDP fell by only 1.3% q-o-q, which was far less than either consensus or we had been expecting, while in Spain output rose by 0.4% q-o-q rather than the 1.4% fall expected. In Germany and Italy the GDP figures were broadly in line with consensus.

While it may be tempting to conclude that GDP has not fallen as much as might have been the case, economists’ forecasts published in the middle of 2020 for the major euro area economies were actually fairly accurate (Figure 4). That said, forecasts made in the middle of 2020 did not generally take into consideration the scale of the second wave of the virus – thus in some sense GDP has surprised to the upside at the end of 2020 because output has grown as expected, but with far worse virus conditions than foreseen.

There may be a number of reasons why this second wave of the virus did not have such a large impact on the economy as might have been expected. First, lockdowns have not been as tight: either restrictions have been less onerous than last spring or they have been in operation for a shorter period of time. Also, this time around firms and households seem to have adapted to the new restrictions better, following their experiences last spring. For any given decline in mobility it seems reasonable to think that economic agents are getting better at adapting to sequential lockdowns. Last but not least, compared with last spring, the manufacturing sector in Europe is now performing far better.

Monetary policy implications

The well-above-expectations rise in euro area January inflation and the limited decline in Q4 GDP potentially pose substantial risks to our view that the ECB will further expand its PEPP envelope in H2 2021.

ECB Executive Board member Schnabel said in an interview published on Sunday (with Deutschlandfunk) that the central bank is “expecting the inflation rate to pick up in the course of this year. We must be careful, however, not to mistake these short-term developments for a sustained increase in inflation. We are faced with very weak demand. And it does not look like this is going to fundamentally change. This is why we continue to be more worried about inflation being too low rather than too high”.

At the same time, sanctioning further monetary stimulus when inflation is trending higher (in Germany inflation could rise to as much as 3% y-o-y in H2 2021) and output is rebounding (which it should if the virus retreats as we expect) could prove difficult, for the hawks in particular but even among some of the doves on the Governing Council. However much the rise in inflation is seen to be temporary and related to one-off factors (policy and weight changes), the move higher adds further uncertainty to the inflation outlook. In an environment of rising inflation and increased uncertainty, the possibility of the ECB adopting a ‘wait-and-see’ approach throughout 2021 is very real.

ECB chief economist Lane, in an interview with Süddeutsche Zeitung published on Monday said: “We expect economic growth and inflation in the euro area to return to their pre-pandemic levels before the end of this year. Prior to the pandemic, inflation was hovering around 1 per cent, but with a dynamic where inflation would, over time, rise closer towards 2 per cent, it was not a crisis situation. If economic developments are reasonably stable and moderate, monetary policy should be similarly stable and moderate”.

While an increase in the PEPP envelope later this year remains our base case for now, further upside surprises in inflation and/or output could raise the risk of the ECB ultimately refraining from adding further stimulus this year – whether that be through additional asset purchases, lower interest rates or adjustments to the central bank’s other non-standard policy measures.

Tyler Durden

Wed, 02/03/2021 – 22:50

via ZeroHedge News https://ift.tt/3oKP1d9 Tyler Durden