Futures Tumble, Cryptos Crumble As Yield Blowout Accelerates

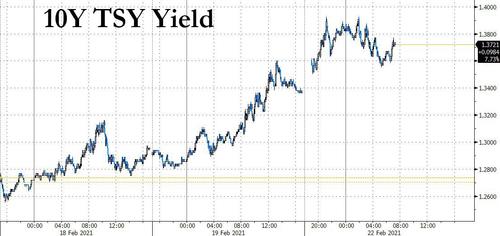

After a week when everyone was focusing on the i) blowout in bond yields and ii) how much worse it could (and would) get, it got worse on Monday, when the 10Y yield jumped from Friday’s close of 1.34% to 1.39%…

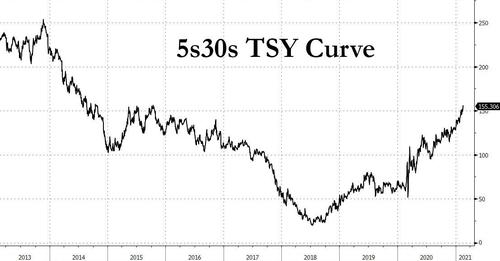

…. while the 5s30s (the gap between 5- and 30-year yields) blew out to the highest level in more than six years…

Following a weekend in which the main news was “The Big Short” Michael Burry predicting Weimar-style hyperinflation, there have also been real-life indications of soaring price pressures to back up the market moves. Last week we saw 6-sigma beat in retail sales and PPI, hinting a scorching overheating in the US economy, while PMI surveys indicated record inflationary pressures. Even in Europe, the prospect of inflation is being entertained. It’s so bad that even sworn bond bulls such as HSBC strategist Steven Major abandoned his recommendation to buy U.S. long bonds, saying he “cannot ignore” the reflation trade.

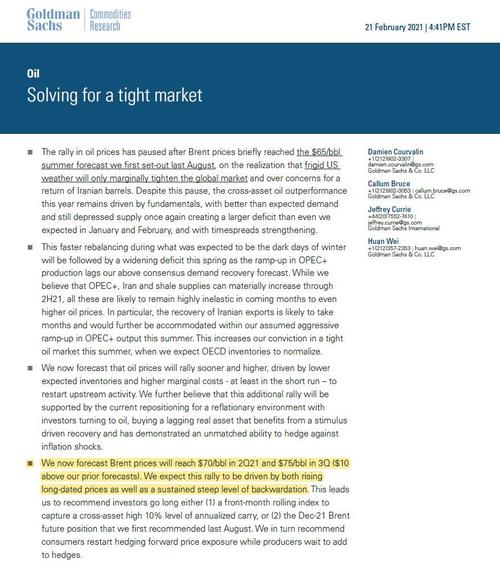

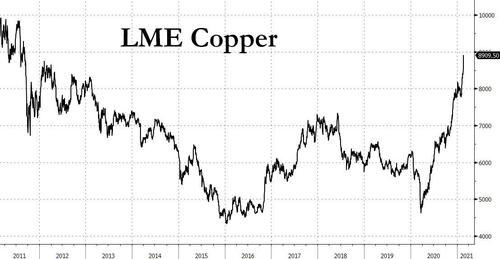

Indeed, commodity prices were almost uniformly green on Monday with Brent rising above $63 a barrel as Goldman Sachs predicted prices could hit $75 in Q3. Shares of Jiangxi Copper Co., China’s top producer, gained 15% in Hong Kong, as copper soared above $9,000 a ton and approaching its all time highs, as investors priced in bets for inflation and economic growth.

As a result of the continued surge in yields, global shares sank on Monday as expectations for faster inflation battered bonds, hammered cryptos and boosted commodities, while rising real yields made equity valuations look more stretched in comparison. Technology shares led losses in equities with futures on the Nasdaq 100 sliding 1.4%; S&P Emini futures tumbled over 1% before recovering some losses; they were last down 0.8% to 3,872.

Boeing shares dropped 3.4% in U.S. premarket trading after airlines in Japan and South Korea, as well as United Airlines in the U.S., halted flights using Boeing 777 aircraft following an explosive engine failure on Saturday that showered debris over a Denver suburb. The U.S. Federal Aviation Administration ordered emergency inspections of the engine’s fan blades; inspections apply to 777s equipped with PW4077 engines made by Raytheon’s Pratt & Whitney division.

“We are still in a risk-on environment,” Adrian Zuercher, head of global asset allocation at UBS Wealth Management, said on Bloomberg TV. “Everybody is playing out the outlook for better economic growth, the outlook for more fiscal stimulus. It’s normal that nominal yields are trending higher.”

In Europe, the Stoxx 600 fell 1.0%, its lowest in 10 days, after opening lower following three weeks of gains with most sectors in the red. Tech, auto, media post biggest declines, down at least 1.2% while miners bucked the trend to rise 0.7% as metal prices climb. Germany’s DAX, France’s CAC 40 and Spain’s IBEX 35 index fell 1% each, Britain’s FTSE 100 lost 0.85% and Italy’s FTSE MIB index fell 0.9%. Here are some of the biggest European movers today:

- ASTM shares rise as much as 28% in Milan to EU25.68 and are the day’s best performer on the FTSE Italia All-Share Index after the company received a voluntary tender offer from Nuova Argo Finanziaria’s company NAF 2 for EU25.60/share.

- European travel and leisure stocks gain ahead of U.K. Prime Minister Boris Johnson unveiling the government’s “road map” out of its third coronavirus lockdown in the afternoon, which is expected to outline a gradual reopening to ensure restrictions don’t have to be reimposed.

- G4S shares fall as much as 10%, the most intraday since May 2020, as the U.K. Takeover Panel, which oversees acquisitions, ended the auction for the company without the highest bidder Allied Universal needing to increase its 245p/share offer.

- Varta shares drop as much as 9.2%, extending their 4-day decline, as Berenberg downgrades to hold from buy and cuts PT to EU130 from EU145, saying the shares already adequately reflect any upside still seen.

Earlier in the session, Asian shares reversed an early gain and were set to finish the day lower as a continued decline in Chinese and Indian stocks weighed. China’s stock benchmark, the CSI 300 fell 3.1%, dragged down by consumer staples, which had their biggest drop since July. Losses in Indian shares also weighed, with the S&P BSE Sensex dropping for a fifth day. A measure of Asia’s health care companies underperformed. A group of materials stocks bucked the day’s trend, with the MSCI Asia Pacific Materials Index climbing 1.3% to its highest level since Aug. 2011 as copper and nickel prices surged.

Japanese stocks bucked the red trend and rose for the first time in four sessions, with all but six of the 33 sector groups in the benchmark Topix gaining. Electronics makers and banks provided the most support to the Topix, while Tokyo Electron Ltd. and SoftBank Group boosted the Nikkei 225. “Japanese bank stocks are cyclical and prone to reaction to U.S. rates, which is one of the key focus this week,” said Mamoru Shimode, chief strategist at Resona Asset Management, pointing to Federal Reserve Chair Jerome Powell’s scheduled testimony at the Senate Banking Committee on Tuesday. Treasuries extended declines in Asia trade after their worst week of the year, with the 10-year yield climbing as much as six basis points to 1.39%. “10-year JGBs are also rising, but should the U.S. long-term rates also increase further, it could lead to stocks taking a tumble,” Shimode said. “The pace at which these rates are rising is a bit fast.”

In Australia, travel-related stocks rose as the nation’s Covid-19 vaccination program kicked off, and after a draft study showed that the Pfizer-BioNTech shot was 89.4% effective at preventing laboratory-confirmed infections. Australia’s central bank resumed purchases of three-year securities to defend its yield target. Ten-year yields in both Australia and New Zealand surged more than 10 basis points.

The reflationary risk-off scare also hammered cryptos, with Bitcoin tumbling 5% as prices pulled back from an all-time high.

Ironically, the broad selloff comes as Fed Chair Jerome Powell delivers his semi-annual testimony before Congress this week and is guaranteed to reiterate a commitment to keeping policy super easy for as long as needed to drive inflation higher.

“The coming week is relatively thin on the international data agenda, but after the recent rise in long bond yields, Fed Chairman Powell’s hearings in both chambers of Congress (Tuesday / Wednesday) will be attracting great interest,” said Elisabet Kopelman, U.S. economist at SEB. “The fact that the most recent rise in long bond yields has been driven by higher real interest rates and not just inflation expectations increases the probability of a dovish message.”

European Central Bank President Christine Lagarde is also expected to sound dovish in a speech later Monday.

After plunging in early Asian trade, Treasury futures were off session lows into early U.S. session, although yields remain cheaper by as much as 4bp with losses led by intermediates ahead of belly supply this week. Cash 10-year yields reached as high as 1.3925% before easing back to around 1.375%; Treasuries lead most global yields higher, underperforming bunds by 3bp and gilts by 1.2bp. Treasuries declined during Asia session after their worst week of the year, with cheapening momentum sustained amid lack of buying appetite. Initial rise in yields pushed 5s30s curve to 157.45bp, steepest since 2014, while 2s10s spread reached widest since early 2017. Analysts at BofA noted 30-year bonds had returned -9.4% in the year to date, the worst start since 2013.

“Real assets are outperforming financial assets big in ‘21 as cyclical, political, secular trends say higher inflation,” the analysts said in a note. “Surging commodities, energy laggards in vogue, materials in secular breakouts.”

Sure enough, one of the star outperformers has been copper, a key component of renewable technology, which shot up 7.7% last week to a nine-year peak. The broader LMEX base metal index climbed 5.5% on the week.

Oil prices have gone along for the ride, aided by tightening supplies and freezing weather, giving Brent gains of 22% for the year so far. On Monday, Brent crude futures were up 0.7% at $63.33 a barrel. U.S. crude added 0.7% to $59.65.

All of that has been a boon for commodity-linked currencies, with the Canadian, Australian and New Zealand dollars all higher for the year so far. The Aussie and kiwi were the best performers after the dollar as base metals stormed higher on Monday, with copper rallying above $9,000 a ton on bets that increased demand driven by the recovery from the pandemic will spur a historic deficit; sovereign debt in Australia and New Zealand slid on concerns about faster inflation. The pound edged up after dipping below the key $1.40 mark; sterling remains supported by the U.K.’s vaccine roll-out, with traders assessing U.K. Prime Minister Boris Johnson’s plans to gradually ease a national lock-down. The Swiss franc led a drop against the greenback

The dollar was mixed against its Group-of-10 peers, as it pared gains in the European session; the euro recovered after dropping to a session low of $1.2091 in early European trading. The dollar index has been relatively range-bound, with downward pressure from the country’s expanding twin deficits balanced by higher bond yields. The index was last at 90.342, not far from where it started the year at 90.260.

Rising Treasury yields has helped the dollar gain against the yen to 105.60, given the Bank of Japan is actively restraining yields at home. The euro was steady at $1.2104, corralled between support at $1.2021 and resistance around $1.2169.

One commodity not doing so well is gold, partly due to rising bond yields and partly as investors question if crypto currencies might be a better hedge against inflation. Gold stood at $1,793 an ounce, having started the year at $1,896. Bitcoin was off 3.3% on Monday at $55,535, but started the year at $32,216.

Looking at today’s relatively quiet session, expected data include the Leading Index. Dish, Discovery and Palo Alto Networks are among companies reporting earnings.

Market Snapshot

- S&P 500 futures down 0.9% to 3,868.25

- MXAP down 0.8% to 216.57

- MXAPJ down 1.2% to 727.00

- Nikkei up 0.5% to 30,156.03

- Topix up 0.5% to 1,938.35

- Hang Seng Index down 1.1% to 30,319.83

- Shanghai Composite down 1.5% to 3,642.45

- Sensex down 2.1% to 49,832.93

- Australia S&P/ASX 200 down 0.2% to 6,780.89

- Kospi down 0.9% to 3,079.75

- Brent futures up 0.8% to $63.42/bbl

- Gold spot up 0.8% to $1,798.35

- U.S. Dollar Index little changed at 90.35

- SXXP Index down 1% to 410.94

- German 10Y yield little changed at -0.30%

- Euro little changed at $1.2113

Top Overnight News from Bloomberg

- Market pricing shows traders are bringing forward forecasts for when the Federal Reserve will raise interest rates amid growing reflation optimism. At the same time, there are limits to how fast the central bank can act

- Reflation trades reached a fever pitch in Australia’s bond markets Monday in a burst of activity that will be hard for global policy makers to ignore. Ten-year yields climbed the most since the height of the market dislocation in March 2020, while benchmark three-year yields inched further above the Reserve Bank of Australia’s 0.1% target

- China urged the Biden administration to take steps to “build up goodwill,” including removing tariffs and sanctions, as Beijing continued to put the onus on Washington to repair their fractured relationship

- The Pfizer Inc. and BioNTech SE Covid-19 vaccine appeared to stop the vast majority of recipients in Israel becoming infected, providing the first real-world indication that the immunization will curb transmission of the coronavirus

- U.K. Prime Minister Boris Johnson will announce that all schools in England will reopen from March 8, as he sets out how the national coronavirus lockdown will be lifted gradually over the coming months

- Brent oil resumed gains as the market assessed the fallout from the big freeze across Texas, with Goldman Sachs Group Inc. predicting prices will advance into the $70s in coming months

- Saudi Arabia and Russia are once again heading into an OPEC+ meeting on opposite sides of a crucial debate about the oil market. The positions mirror those taken at recent meetings, but this time the Saudis have a new bargaining chip — 1 million barrels a day of voluntary cuts

A quick look at global markets courtesy nf Newsquawk

Asian equity markets began the week indecisively heading closer to month-end as participants digested a continued increase in yields and with weekend newsflow not providing much to spur sentiment in either direction. ASX 200 (-0.2%) traded lacklustre with strength in mining stocks offset by a subdued picture across the broader market and as attention remained dominated by a slew of earnings results. Nikkei 225 (+0.5%) outperformed after bouncing off the 30k level with Tokyo exporters cheering the recent currency weakness and KOSPI (-0.9%) initially benefitted from strong trade data which showed exports and imports during the first 20-days of February surged by 16.7% and 24.1% Y/Y, respectively, before gradually giving up its gains. Hang Seng (-1.1%) and Shanghai Comp. (-1.45%) were choppy with a bout of early pressure seen in the mainland after the PBoC opted to drain liquidity once again and maintained its Loan Prime Rates as expected. There were also reports last week which underscored the ongoing friction between US and China and potential for this to spillover to the rare earths trade, although mainland markets briefly pared their losses as participants reflected on comments from Chinese Foreign Minister Wang Yi who stated that China always advocates win-win cooperation and seeks dialogue not confrontation with the US. Furthermore, Wang added that both sides must respect each other and hopes the US will adjust policies, remove unreasonable tariffs on Chinese goods and abandon suppression of Chinese tech progress, while he also called on the US to stop smearing China’s Communist Party and stop conniving with separatist forces. Finally, 10yr JGBs were lower and briefly broke beneath the 151.00 level as they tracked the declines in T-notes and with yields resuming their recent ascent, while the BoJ were in the market today although this was only for a total of JPY 250bln of bonds spread across 10yr+ maturities, floating rate and inflation-indexed bonds.

Top Asian News

- Chinese Official Signals Overhaul of Hong Kong’s Election System

- Iraq Decides Against China Crude-Supply Deal, Says Oil Minister

- Iran’s Compromise With Nuclear Monitors Limits Escalation

- SoftBank Group Bonds Jump After $2.25 Billion Buyback Offer

European equities kicked the week off on the back foot (Euro Stoxx 50 -0.6%) as the losses seen during APAC trade reverberated into the region and accelerated upon the cash open. The downbeat sentiment comes against the backdrop of the surge in yields, whilst the growing confidence in the global recovery – namely in the US – is prompting increased chatter of when the Fed may begin to think about tapering its QE programme. That being said, bourses clambered off worst levels following the constructive German Ifo Survey which topped forecasts across all metrics. Nonetheless indices failed to sustain this momentum and remain in negative territory at the time of writing, while US equity futures trade subdued with the tech-led NQ (-1.2%) underperforming vs its peers. Sectors are all in firm negative territory with no clear risk bias. Tech underperforms in tandem with the NQ futures – whilst it’s worth highlighting that the UK competition watchdog warned Big Tech names of incoming antitrust probes, whereby the Chief Executive of the CMA said they plan to start a number of probes into internet giants in the coming months, including Amazon (-1.2% pre-mkt) and Google (-1.3% pre-mkt), according to the FT. Energy is the outperformer as prices in the complex remain elevated amid recovery hopes coupled with OPEC+ support. Similarly, losses in the Materials sector remain limited amid the surge in base metal prices, with LME copper topping USD 9,000/t. Financials also fare better than some of its peers amid the high yield environment. Delving into the breakdown, Travel & Leisure tops the charts amid further positive vaccine updates – with the Pfizer/BioNTech COVID-19 jabs said to be 98.9% effective at preventing COVID-19 deaths and was 89.4% effective at preventing laboratory-confirmed infections according to reports citing a draft publication of the study conducted by the companies and Israel’s Health Ministry. Separately, potential bullish impetus for the sector could also emanate from UK PM Johnson’s plans to ease COVID-19 restrictions, which will be unveiled later today and will see families reunited and all schools to reopen within weeks. Furthermore, IAG (+1.2%) could also be supporting the sector as the Co’s British Airways reached two financing agreements that will increase total liquidity by GBP 2.45bln, although dividend will be paid by British Airways before end-2023. In terms of other movers and shakers, Airbus (-0.5%) is faring slightly better than the CAC (-0.8%) after a Boeing (-3.4% pre-mkt) 777-200 jet scattered debris over a residential area near Denver after one of its engines failed on take-off. The plane had an engine manufactured by Pratt & Whitney who are owned by Raytheon Technologies (-3% pre-mkt). Safran (-1.1%) and Rolls-Royce (-1.3%) trade lower in sympathy. Elsewhere, Volkswagen (-0.3%) and Porsche (-0.7%) succumb to the broader sentiment amid comments by Porsche’s CEO suggesting that the unit is targeting cost cuts of around EUR 10bln by 2025 vs prior view of EUR 6bln and that talks are ongoing about which route is best to take with its Bugatti brand, with a decision expected in H1. Finally, Continental (-0.3%) opened lower after it said it will not propose a 2020 dividend as it has pencilled in a net loss for the year.

Top European News

- Alpha Bank, Davidson Kempner Seal $13 Billion Bad Loan Deal

- Germany Damps Hopes for Easing Curbs as Contagion Rates Rise

- G4S Slumps as Auction Ends Without Allied Needing to Boost Offer

- British Airways Delays $630 Million in Payments to Pension Fund

In FX, although US Treasury yields have slipped from overnight highs near 1.40% in 10 year notes and 2.20% for the long bond, the Dollar has started the new (EU) week in better shape than it ended last Friday, and it appears to be regaining safe-haven appeal as stock markets get more anxious about the sharp/ongoing rise in long term rates. Indeed, the index rebounded firmly from worst levels between 90.211-578 parameters having held just above prior session and week lows (90.172 and 90.117 respectively), and could garner more momentum from a technical perspective if it can breach the pre-weekend high and/or 21 DMA that are in close proximity (at 90.655 and 90.662). Conversely, the Franc is floundering across the board irrespective of latest weekly Swiss bank sight deposit balances indicating no intervention. Instead, Usd/Chf and Eur/Chf have rebounded through 0.9000 and 1.0900 amidst a marked reduction in IMM speculative longs, while the cross is also elevated due to relative Euro resilience on specific factors.

- JPY – The Yen is also underperforming and feeling the brunt of the global debt rout that has seen UST-JGB spreads diverge again, with Usd/Jpy back above 105.50 and upcoming month end flows relatively neutral per one large US bank that highlights the strong Nikkei performance that could prompt upside in Eur/Jpy and Gby/Jpy into Friday.

- GBP/AUD/NZD/EUR/CAD – All unwinding gains vs the Greenback, but the Pound recovering from a pull-back through 1.4000 ahead of UK PM Johnson’s blueprint for lifting lockdown and a speech from BoE’s Vlieghe, the Aussie holding firmly above 0.7850 following another ramp in the 10 year yield and Kiwi keeping sight of 0.7300 in wake of S&P’s NZ ratings upgrade (to AA+) and PM Ardern lowering Auckland’s alert level to 1, awaiting retail sales data. Elsewhere, the Euro has benefited to an extent from an upbeat German Ifo survey as all key metrics beat expectations and the institute noted that travel companies have turned a tad more optimistic for the first time in more than 12 months. However, the Loonie is lagging due to the downturn in broad risk sentiment rather than anything else, albeit still gleaning some support from firm crude prices within a 1.2580-1.2654 range.

- SCANDI/EM/ETC – The aforementioned risk-off mood is adversely affecting the Nok more than the Sek in advance of comments from Riksbank’s Floden, with the former nearer the top of a 10.3300-10.2170 band and latter pivoting 10.0300 inside 10.0530-10.0135, while the Try is straddling 7.0000 vs the Usd after an improvement in Turkish manufacturing sentiment and BofA lifted its 2021 GDP estimate to 4.6% from 4.1%. Nevertheless, the Cnh and Cny have held up better than EM peers after the PBoC maintained 1 and 5 year LPRs, as expected, and set a firmer midpoint for the onshore Yuan overnight, while the apparent insatiable hunger for crypto currencies rages on as Bitcoin reached a new ATH just shy of Usd 58.5k before waning.

In commodities, WTI and Brent front-month futures are firmer but off best levels, in-fitting with the deterioration seen in broader sentiment. The complex remains elevated by underlying fundamentals still being present such as OPEC+ support and vaccination progress. Moreover, Goldman Sachs brought forward its forecast and sees Brent crude reaching USD 70/bbl in Q2 and USD 75/bbl in Q3. The analysts updated expectations for global oil demand and look for 100mln bpd by late-July vs August, while its base case for the March OPEC+ meeting is for a 500k bpd increase in quotas in April and for Saudi Arabia to reverse its 1mln bpd voluntary cut starting April. Such an upgrade perhaps provided some underlying support to prices in APAC and early European trade. WTI resides just under USD 60/bbl (vs high USD 60.12/bbl) and Brent mid-USD 63/bbl (vs high USD 64.00/bbl). Other risk events on the table today include UK PM Johnson addressing Parliament and laying out the UK’s lockdown roadmap ahead. Elsewhere, precious metals are seeing notable upside during early European hours with spot gold USD 1,795/oz, showing gains of ~1%, testing the USD 1,800/oz range the Dollar influence prevails, and spot silver supports this narrative at 27.50/oz gains of 0.7%. Turning to base metals, LME copper follows the broader market sentiment and has moved off best levels, but remains with gains of around 0.9%. LME copper topped USD 9,000/t for the first time since September 2011 in part due to the weaker Dollar. Copper is regarded as a recovery gauge, with the reflationary backdrop keeping the commodity propped up. Furthermore, demand for the red metal is expected to ramp up as tech and EVs see a boom, with the base metal a key contributor to wiring. Finally, Japan’s crude steel output fell 3.9% Y/Y, dropping for the eleventh consecutive month as the COVID-19 pandemic continues to dent demand.

US Event Calendar

- 8:30am: Jan. Chicago Fed Nat Activity Index, est. 0.50, prior 0.52

- 10am: Jan. Leading Index, est. 0.3%, prior 0.3%

- 10:30am: Feb. Dallas Fed Manf. Activity, est. 5.0, prior 7.0

Central Bank Speakers

- 9am: Fed’s Kaplan Speaks at International Energy Forum

- 12pm: Fed’s Kaplan Takes Part in Moderated Q&A

- 3:30pm: Fed’s Kaplan Speaks at Fed Conference

- 3:30pm: Fed’s Bowman Discusses Economic Inclusion

DB’s Jim Reid concludes the overnight wrap

This week marks the first anniversary of the initial big selloff in global markets due to the Covid-19 pandemic on Monday February 24th 2020. Even as the magnitude of the problem developed in front of our eyes, there can’t have been many on the planet who would have thought that the majority of the Western World would still be in some kind of lockdown 12 months later let alone predicted where markets would have traded over the last year.

Indeed the shadow of the pandemic will live on for many years in some form or another for life, economies and financial markets and last week was another where it’s impact and potential future aftermath was strongly felt. The highlight was a 20bps rise in 10yr US real yields and with that tomorrow and Wednesday’s semi-annual testimony from Powell before the Senate Banking and House Financial Services Committees become important events. It would seem out of character for Powell to deliver a hawkish spin, especially given this back up in real yields and a repricing of the Fed (albeit small) in recent times. So soothing words for markets seems likely but the inflation fears are unlikely to go away whatever he says. That debate will continue to rumble on for months and possibly much longer.

Ironically though, in a week where fears over inflation risk mounted, 10 year US breakevens actually fell c.7bps. We basically saw nearly one incremental 25bps hike priced into the Dec 24 contract over the last week and that fed (pardon the pun) into higher real yields but has taken the edge off the rise in breakevens for now. Overnight yields are on the move again though as US 10y breakevens are back up +3.1bps to 2.187% and have helped push 10y USTs +4.5bps higher to 1.384% with the 2s10s curve steepening by a similar amount to 127.6bps.

I had an enormous amount of questions last week about what the pain threshold for yields is with regards to risky assets. Sadly it’s a multi faceted answer as it depends on multiple things. The speed of the move, whether it’s prompted by economic growth or inflation, whether real yields proportionally move or not and what markets think the reaction function of the authorities will be. One thing I would say is that before Xmas I read a lot of arguments as to why in a ZIRP world you could justify very high tech/growth equity valuations. So it stands to reason that if yields reverse that argument falters. So maybe markets with the most sensitivity here will be the more vulnerable if that argument was ever correct in the first place.

Our equity strategist Binky Chadha is more sanguine. He put a good piece out over the weekend suggesting that equity inflows continue to be huge even as rates have been rising for several months. He believes this is very much in keeping with the historical pattern, with previous rising rate episodes associated with strong inflows into equities and slowing inflows into bond funds. Even after the taper tantrum in 2013, he noted that equity funds enjoyed inflows of over $300bn over the following 12 months, previously the best stretch of equity inflows over the past decade before the current period. Binky believes that Equity flows are also supported by strong macro data surprises and growth, and in his view a peak in growth, and not rates, holds the key for when equity inflows will turn. See his note here .

Overnight in Asia, markets are trading mixed as a rise in metal prices is continuing to stoke inflation concerns. The Nikkei (+0.74%) and Hang Seng (+0.11%) are up while the CSI (-1.47%), Shanghai Comp (-0.06%), Kospi (-0.59%) and India’s Nifty (-0.69%) are all down. Futures on the S&P 500 are also down -0.17% and European ones are also pointing to a weaker open. In terms of metal prices, Copper has climbed to the highest level since 2011 and is currently trading at $9,133.50 (c. +3%) while Nickel is trading up +2.2% at $20,010/ ton, the highest since 2014. Elsewhere, crude oil prices are also up by c. +1.20% this morning but Bitcoin is down by -2.45% as we type after they reached a high of $57,355 over the weekend after breaking through a trillion dollars of total market value on Friday.

Turning to the US fiscal stimulus, the Congressional Budget Office has said that the stimulus bill heading for a House vote over the next week slightly exceeds $1.9tn, which will force congressional Democrats to make adjustments before the bill can pass the Senate due to reconciliation rules. The House aims to vote on the stimulus package on Friday, with the Senate voting soon after if disagreements over the contents can be ironed out.

On the pandemic, today will see UK Prime Minister Johnson deliver his roadmap out of the lockdown. Given the UK is well ahead of the Western World in terms of vaccinations we may be a template (or a warning) for others on how to get out of what we all hope will be the last lockdown of our lifetimes! My wife will be looking closely for when schools reopen and for me the phrase “golf course reopening” will be the focus.

Israel lifted a number of restrictions yesterday and that will be an even more real time template even if restrictions have been far lower there of late than in the West. On Saturday, the Israeli health ministry released data suggesting the risk of illness from the virus has dropped 95.8% for those who have had both doses of the Pfizer vaccine. It was also claimed that the vaccine was 98% effective in preventing fever or breathing problems. Another study from Israel, that was reported yesterday, suggested the Pfizer vaccine was 89.4% effective at preventing transmission, one of the first to show that vaccines reduce the spread of the virus as well as illness. So lots of positive news on the vaccine front emerging.

Finally before we review last week, as earnings season winds down in the US, 64 companies in the S&P 500 are still to report as well as a further 109 from the STOXX 600. Among the highlights will be Home Depot, Medtronic, HSBC and Intuit tomorrow. Then on Wednesday, we’ll hear from Nvidia, Lowe’s, Booking Holdings, TJX, Iberdrola, Lloyds Banking Group and Royal Bank of Canada. Thursday sees releases from Salesforce, AB InBev, American Tower, Standard Chartered, Axa, Moderna, Centrica and HP, before Deutsche Telekom release on Friday.

Recapping last week now, and investor sentiment cooled as global bond yields continued their climb. Risk assets slowly ground to a halt though rather than sharply correcting as US 10yr yields finished the week +12.8bps higher to 1.336%, nearly 83bps higher than their record lows from August and they now sit just shy of where they were just before the pandemic first caused market panic a year ago.

The big driver of the move last week was real rates, which rose +20.0bps to -0.816%, their highest levels since the Monday after the weekend when we learned that President Biden was announced the winner of the election. The move at the long end of the curve saw the 2y10y yield curve steepen another +13.0bps to 122.5bps, the steepest the curve has been since March 2017. 10Yr Bund yields rose sharply as well, increasing +12.3bps to -0.31%, while 10yr Gilt yields rose +18.1bps to 0.70%. Both are now nearly at the highest levels since the start of the pandemic.

The S&P 500 lost -0.71% over the holiday-shortened week (-0.19% Friday), having fallen every day of 4-day week – its longest negative run since mid-December. The biggest one-day move of those losses was only -0.44% though while the intraday trading range of each day was less than 1.0%, which highlights that markets were not yet panicked. The NASDAQ was down a larger -1.57% over the course of the week, and US equities generally lagged their European counterparts as the rise in rates disproportionately hurt tech stocks, which are more highly concentrated in the S&P. Bank stock on both sides of the Atlantic rallied once more with US Banks rising +5.50% while their European counterparts gained +3.79%. The larger exposure to cyclical stocks helped the STOXX 600 to finish the week up +0.21% (+0.53% Friday) with the French CAC (+1.23%) and Spanish IBEX (+1.20%) notably outperforming.

In terms of data from Friday, the main highlight were the flash PMIs from around the world. The Euro-area composite PMI rose 0.3pts to 48.1 in February (vs. 48.0 expected) with manufacturing remaining strong (57.7 actual, vs 54.3 est), supported by robust global demand. Services struggled under the elongated Covid-19 restrictions but the underlying surveys showed increased confidence that the downturn will be temporary. The services PMI reading fell in both Germany (-0.9pts to 45.9) and France (-3.7pts to 43.6), though it surprised in the UK – jumping to 49.7 from 39.5 last month. This was somewhat surprising as UK retail sales (ex-autos) massively underperformed, declining -8.8% m-o-m, the second biggest fall on record. Elsewhere, the flash Markit US Composite PMI surprised to the upside at 58.8 (vs 57.9 expected) – the highest reading since March 2015 and a tenth higher than last month – with the services component in particular coming in above expectations as some pandemic restrictions were eased in many of the largest US states.

Tyler Durden

Mon, 02/22/2021 – 08:02

via ZeroHedge News https://ift.tt/2ZKlp5r Tyler Durden