Key Events This Busy Week: Powell, Stimulus And More Inflation Cues

As DB’s Jim Reid writes in his Early Morning Reid, “this week marks the first anniversary of the initial big selloff in global markets due to the Covid-19 pandemic on Monday February 24th 2020” adding that even as the magnitude of the problem developed in front of our eyes, “there can’t have been many on the planet who would have thought that the majority of the Western World would still be in some kind of lockdown 12 months later let alone predicted where markets would have traded over the last year.”

He continues: “Indeed the shadow of the pandemic will live on for many years in some form or another for life, economies and financial markets and last week was another where it’s impact and potential future aftermath was strongly felt.” The highlight was a 20bps rise in 10yr US real yields and with that tomorrow and Wednesday’s semi-annual testimony from Powell before the Senate Banking and House Financial Services Committees. It would seem out of character for Powell to deliver a hawkish spin, especially given this back up in real yields and a repricing of the Fed (albeit small) in recent times.

So get ready for even more soothing words for markets for Powell… but even so the inflation fears are unlikely to go away whatever he says. That debate will continue to rumble on for months and possibly much longer. Case in point: we basically saw nearly one incremental 25bps hike priced into the Dec 24 contract over the last week and that fed (pardon the pun) into higher real yields but has taken the edge off the rise in breakevens for now. Overnight yields were on the move again though as US 10y breakevens are back up +3.1bps to 2.187% and have helped push 10y USTs +4.5bps higher to 1.384% with the 2s10s curve steepening by a similar amount to 127.6bps; that said much of the move has since been reversed.

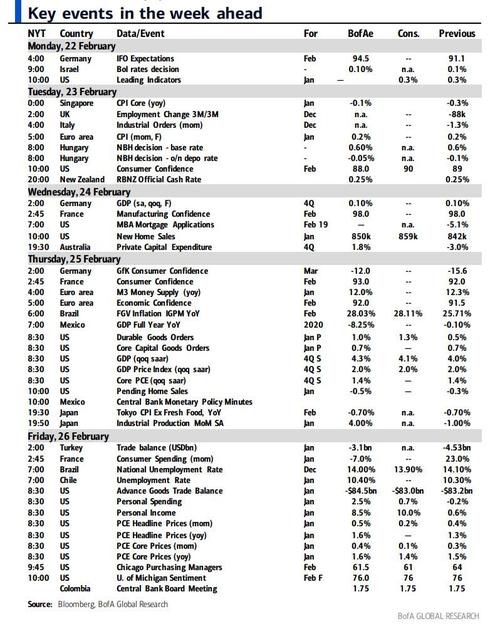

On the data front, this week attention will be on the US PCE core prices, GDP data, durable goods orders, consumer confidence and housing data. Monetary policy meeting in New Zealand. CPI and GDP across the Euro area. In Emerging Markets, there are monetary policy meetings in Korea, Colombia, Hungary and Israel.

Turning back to the other big topic – namely the US fiscal stimulus – the Congressional Budget Office said that the stimulus bill heading for a House vote over the next week slightly exceeds $1.9tn, which will force congressional Democrats to make adjustments before the bill can pass the Senate due to reconciliation rules. The House aims to vote on the stimulus package on Friday, with the Senate voting soon after if disagreements over the contents can be ironed out.

On the pandemic, today will see UK Prime Minister Johnson deliver his roadmap out of the lockdown. Given the UK is well ahead in terms of vaccinations, it may be a template (or a warning) for others on how to get out of what may be the last lockdown (at least until the next “mutant strain” takes hold).

Also on the virus front, Israel lifted a number of restrictions yesterday and that will be an even more real time template even if restrictions have been far lower there of late than in the West. On Saturday, the Israeli health ministry released data suggesting the risk of illness from the virus has dropped 95.8% for those who have had both doses of the Pfizer vaccine. It was also claimed that the vaccine was 98% effective in preventing fever or breathing problems. Another study from Israel, that was reported yesterday, suggested the Pfizer vaccine was 89.4% effective at preventing transmission, one of the first to show that vaccines reduce the spread of the virus as well as illness. So lots of positive news on the vaccine front emerging (and hence even more pent up reflation pressures).

Finally, as earnings season winds down in the US, 64 companies in the S&P 500 are still to report as well as a further 109 from the STOXX 600. Among the highlights will be Home Depot, Medtronic, HSBC and Intuit tomorrow. Then on Wednesday, we’ll hear from Nvidia, Lowe’s, Booking Holdings, TJX, Iberdrola, Lloyds Banking Group and Royal Bank of Canada. Thursday sees releases from Salesforce, AB InBev, American Tower, Standard Chartered, Axa, Moderna, Centrica and HP, before Deutsche Telekom release on Friday.

Here is a day-by-day calendar of events, courtesy of Deutsche Bank

Monday February 22

- Data: Germany February Ifo business climate indicator, US January Chicago Fed national activity index, leading index, February Dallas Fed manufacturing activity

- Central Banks: ECB’s Lagarde and Fed’s Bowman speak

- Politics: UK Prime Minister Johnson sets out roadmap out of lockdown

Tuesday February 23

- Data: UK December employment, unemployment, Euro Area final January CPI, US February Conference Board consumer confidence, Richmond Fed manufacturing index

- Central Banks: Fed Chair Powell and Bank of Canada Governor Macklem speak

- Earnings: Home Depot, Medtronic, HSBC, Intuit

Wednesday February 24

- Data: Germany final Q4 GDP, US January new home sales

- Central Banks: Fed Chair Powell, Vice Chair Clarida, Fed’s Brainard and BoE’s Haldane speak

- Earnings: Nvidia, Lowe’s, Booking Holdings, TJX, Iberdrola, Lloyds Banking Group, Royal Bank of Canada

Thursday February 25

- Data: Germany March GfK consumer confidence, France February consumer confidence, Euro Area January M3 money supply, final February consumer confidence, Italy February consumer confidence index, US preliminary January durable goods orders, nondefence capital goods orders ex air, January pending home sales, weekly initial jobless claims, second estimate Q4 GDP, February Kansas City Fed manufacturing activity, Japan preliminary January industrial production (23:50 UK time), January retail sales (23:50 UK time)

- Central Banks: Fed’s Vice Chair Quarles, Fed’s Bostic, Bullard and Williams speak, Bank of Korea monetary policy decision

- Earnings: Salesforce, AB InBev, American Tower, Standard Chartered, Axa, Moderna, Centrica, HP

- Politics: EU leaders meet for European Council via videoconference

Friday February 26

- Data: France preliminary February CPI, final Q4 GDP, US preliminary January wholesale inventories, January personal income, personal spending, February MNI Chicago PMI, final February University of Michigan sentiment

- Central Banks: ECB’s Schnabel and BoE’s Ramsden speak

- Earnings: Deutsche Telekom

- Politics: EU leaders continue European Council meeting via videoconference, G20 finance ministers and central bank governors meet via videoconference

* * *

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the durable goods report and Q4 GDP revision on Thursday and core PCE inflation on Friday. There are numerous speaking engagements from Fed officials this week, including Powell’s semi-annual monetary report to Congress on Tuesday and Wednesday.

Monday, February 22

- 09:00 AM Dallas Fed President Kaplan (FOMC non-voter) speaks: Dallas Fed President Robert Kaplan will participate in a virtual international energy forum.

- 10:30 AM Dallas Fed manufacturing index, February (consensus 5.0, last 7.0)

- 12:00 PM Dallas Fed President Kaplan (FOMC non-voter) speaks: Dallas Fed President Robert Kaplan will participate in a virtual Q&A hosted by the Garland Chamber of Commerce.

- 03:30 PM Dallas Fed President Kaplan (FOMC non-voter) speaks: Dallas Fed President Robert Kaplan will deliver opening remarks at a virtual event hosted by the Dallas Fed.

- 03:30 PM Fed Governor Bowman (FOMC voter) speaks: Fed Governor Michelle Bowman will discuss economic inclusion at a virtual event hosted by the Dallas Fed. Prepared text is expected.

Tuesday, February 23

- 09:00 AM FHFA house price index, December (consensus +0.9%, last +1.0%)

- 09:00 AM S&P/Case-Shiller 20-city home price index, December (GS +1.2%, consensus +1.25%, last +1.42%): We estimate the S&P/Case-Shiller 20-city home price index rose by 1.2% in December, following a 1.4% increase in November.

- 10:00 AM Conference Board consumer confidence, February (GS 90.5, consensus 90.0, last 89.3): We estimate that the Conference Board consumer confidence index increased by 1.2pt to 90.5 in February. Our forecast reflects mixed signals from other consumer confidence measures but an improving virus situation.

- 10:00 AM Richmond Fed manufacturing index, February (consensus +16, last +14)

- 10:00 AM Fed Chair Powell (FOMC voter) appears before the Senate Banking Committee: Fed Chair Jerome Powell will deliver the semi-annual monetary policy report before the Senate Banking Committee. Prepared text is expected.

Wednesday, February 24

- 10:00 AM New home sales, January (GS flat, consensus +1.5%, last +1.6%): We estimate that new home sales remained unchanged in January, reflecting sequentially higher permits but fewer mortgage applications and housing starts.

- 10:00 AM Fed Chair Powell (FOMC voter) appears before the House Financial Services Committee: Fed Chair Jerome Powell will deliver the semi-annual monetary policy report before the House Financial Services Committee. Prepared text is expected.

- 10:30 AM Fed Governor Brainard (FOMC voter) speaks: Fed Governor Lael Brainard will give a virtual speech on the Fed’s maximum employment mandate at an event hosted by Harvard University. Text and moderated Q&A are expected.

- 01:00 PM Fed Vice Chair Clarida (FOMC voter) speaks: Fed Vice Chair Clarida will discuss the economic outlook and monetary policy at a virtual event hosted by the U.S. Chamber of Commerce. Prepared text and moderated Q&A are expected.

- 04:00 PM Fed Vice Chair Clarida (FOMC voter) speaks: Fed Vice Chair Clarida will discuss the economic outlook and monetary policy at a virtual event hosted by the American Chamber of Commerce in Australia. Prepared text and moderated Q&A are expected.

Thursday, February 25

- 08:30 AM Durable goods orders, January preliminary (GS +1.2%, consensus +1.1%, last +1.3%); Durable goods orders ex-transportation, January preliminary (GS +1.2%, consensus +0.7%, last +1.3%); Core capital goods orders, January preliminary (GS +1.2%, consensus +0.8%, last +0.8%); Core capital goods shipments, January preliminary (GS +1.5%, consensus +0.6%, last +2.4%): We estimate durable goods orders rose 1.2% in the preliminary January report, reflecting modestly higher aircraft cancellations but strong core measures. We estimate a 1.2% increase in core capital orders and a 1.5% increase in core capital shipments goods, reflecting reflects the further rise in business equipment production, continued industrial-sector resilience during the third wave, and a boost from the relatively late Chinese New Year.

- 08:30 AM Initial jobless claims, week ended February 20 (GS 825k, consensus 840k, last 861k); Continuing jobless claims, week ended February 13 (consensus 4,420k, last 4,494k): We estimate initial jobless claims decreased to 825k in the week ended February 20.

- 08:30 AM GDP, Q4 second (GS +4.6%, consensus +4.2, last +4.0%): Personal consumption, Q4 second (GS +2.8%, consensus +2.5%, last +2.5%): We estimate a six tenths upward revision to Q4 GDP growth to +4.6% (qoq ar). In addition to firmer inventory and residential investment data since the advance release, our forecast reflects upward revisions to services consumption (healthcare and telecommunications) following the Census QSS survey.

- 08:30 AM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will deliver opening remarks at a banking outlook conference. Prepared text is expected.

- 10:00 AM Pending home sales, January (GS flat, consensus -0.5%, last -0.3%): We estimate that pending home sales remained unchanged in January.

- 10:30 AM St. Louis Fed President Bullard (FOMC non-voter) speaks: St. Louis Fed President James Bullard will discuss the economy and monetary policy at an event hosted by Georgia State University. Prepared text and audience Q&A are expected.

- 11:00 AM Kansas City Fed manufacturing index, February (consensus +15, last +17)

- 11:10 AM Fed Vice Chair for Supervision Quarles speaks: Federal Reserve Board Vice Chair for Supervision Randal Quarles will discuss stress tests at a virtual banking conference hosted by the Atlanta Fed. Prepared text and moderated text are expected.

- 03:00 PM New York Fed President John Williams (FOMC voter) speaks: New York Fed President John Williams will participate in a virtual discussion hosted by One Hundred Black Men of New York. Prepared text and moderated Q&A are expected.

Friday, February 26

- 08:30 AM Personal income, January (GS +9.2%, consensus +9.5%, last +0.6%); Personal spending, January (GS +2.6% consensus +2.4%, last -0.2%); PCE price index, January (GS +0.47%, consensus +0.3%, last +0.43%); Core PCE price index, January (GS +0.41%, consensus +0.1%, last +0.31%); PCE price index (yoy), January (GS +1.61%, consensus +1.4%, last +1.28%); Core PCE price index (yoy), January (GS +1.69%, consensus +1.4%, last +1.45%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE price index rose by 0.41% month-over-month in January, corresponding to a 1.69% increase from a year earlier. Additionally, we expect that the headline PCE price index increased by 0.47% in January, corresponding to a 1.61% increase from a year earlier. We expect a 9.2% increase in personal income and a 2.6% increase in personal spending in January, reflecting a boost from the Phase 4 relief bill.

- 08:30 AM Advance goods trade balance, January (GS -$82.7bn, consensus -$83.0bn, last -$84.2bn): We estimate that the goods trade deficit decreased by $1.5bn to $82.7bn in January compared to the final December report, reflecting lower imports.

- 08:30 AM Wholesale inventories, January preliminary (consensus +0.3%, last +0.3%): Retail inventories, January (last +1.0%)

- 09:45 AM Chicago PMI, February (GS 62.0, consensus 61.0, last 63.8): We estimate that the Chicago PMI pulled back by 1.8pt to 62.0 in February, reflecting moderation in other manufacturing surveys but a continued boost from the supplier deliveries component.

- 10:00 AM University of Michigan consumer sentiment, February final (GS 76.5, consensus 76.4, last 76.2): We expect University of Michigan consumer sentiment to edge 0.3pt higher from the preliminary estimate for February, in which the index declined by 2.8pt. The report’s measure of 5- to 10-year inflation expectations remained unchanged at 2.7% in the preliminary report.

Source: Deutsche Bank, Goldman Sachs, BofA

Tyler Durden

Mon, 02/22/2021 – 09:17

via ZeroHedge News https://ift.tt/3k9CqQa Tyler Durden