Food Inflation Is The Best Better Predictor Of Bond Yields

From Russell Clark, CIO and founder of Russell Clark Investment Management (formerly Horseman Global)

Food Inflation And Asset Markets

Food inflation globally has been remarkably low in recent decades. Food prices compare very favorably to other inflation indicators such as the gold price. The US provides good, long term food inflation data back to 1913. While the spike in gold prices in the 1970s foreshadowed rising food inflation, so far rising gold prices seen since 2000 have not presaged an increase in food prices.

However, while food prices inflation has remained benign in the US, this is not true in China, where African Swine Flu has forced pork prices to 4 times US prices. This is starting to create upward pressure on grain prices globally. US corn prices and pork prices tend to follow each other with a lag.

The intriguing thing about food inflation is that it seems to match up much more closely with US bond yields than any other commodity, particularly gold and oil, two commodities usually associated with inflation.

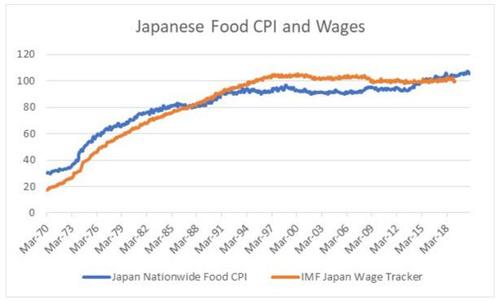

From an intellectual point of view, both food and labor are perishable. That is, if they are not used or consumed immediately, the ability to store them is constrained. This is not true of other commodities such as oil and gold, that can be stored indefinitely. Japan’s experience shows that food inflation and wage inflation seem to be closely related. Logically, from a political and economic point of view, wages should move with food prices. Japanese data bears this out.

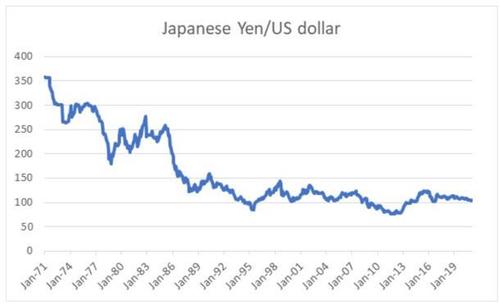

The Great Depression is the only other modern period of sustained food deflation, so central bankers have probably been justified in taking extreme measure to try and offset food deflation. Such extreme measure began in the 1990s as Japanese foreign reserves began to swell when the Bank of Japan tried to weaken Yen to create inflation. China had also had rapidly rising foreign reserves, but in recent years has not seen any increase. Food inflation seems to imply the Chinese are happy to allow the Yuan to appreciate.

The appreciation of the Yen versus the US Dollar in the 1970s and 1980s stopped when food inflation fell, and the Japanese began to build foreign reserves.

This leads to the conclusion that many of the features of modern markets and economies, such as income inequality, very low interest rates, and the ideas of secular stagnation are not related to demographics, or central bank policy, but to a 40-year bear market in food prices. If Chinese pork prices remain at four times the US price, investors should question their assumptions on bond yields, currencies, and inflation outlooks.

Tyler Durden

Mon, 02/22/2021 – 19:20

via ZeroHedge News https://ift.tt/3dDzVnV Tyler Durden