Bond Market Calls Fed’s Bluff With Biggest Short Ever…

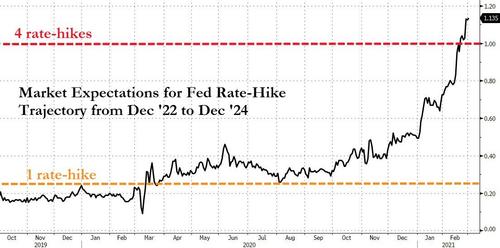

The last few weeks have seen the short-end of the yield curve panic, pricing in more than 4 rate-hikes from Dec 2022 to Dec 2024…

Source: Bloomberg

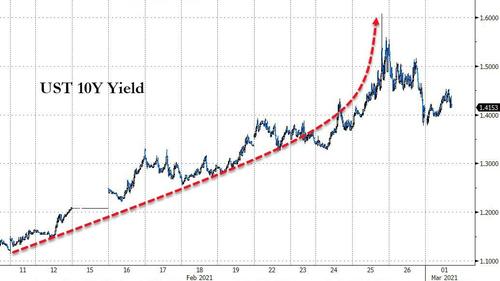

And Bond yields have screamed higher in recent days as fears of rampant inflation and a Fed on the sidelines prompts selling…

Source: Bloomberg

And as bond yields rose so growthy big-tech was monkey-hammered lower…

So, are market participants calling The Fed’s bluff and demanding they step in with even more dovish easing to rescue rates (and thus big tech)? How else will the government afford the $1.9 trillion ‘stimmy’ absent low rates and a will Fed buyer.

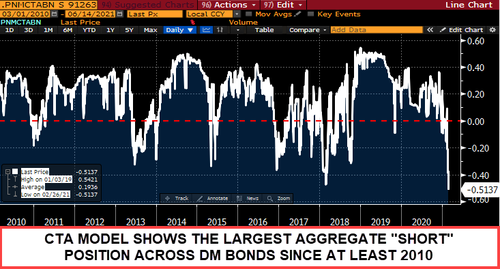

As Nomura’s Charlie McElligott notes, a reversal “squeeze” in USTs could come FAST – especially in-light of the magnitude of the aggregate “Short” position in Global Fixed-Income across CTA Trend universe, with the Nomura QIS CTA model showing the largest “Short” position in both TY and Global DM Bonds in our model history, dating-back to 2010…

This “big short” from CTAs in Global DM Bonds dynamic then has created the kindling for a blast of “mechanical” buy-to-cover flow into a potential Rates rally on Fed jawboning on Financial Conditions (which have tightened recently)…

…or say, SLR clarity…

The potential for a policy announcement from the Fed regarding Banks supplementary leverage ratio (SLR) rule—the window is shrinking for the Fed to address very seriously market “plumbing” concerns about the complete opacity surrounding the forward-path of the SLR exemption for Banks—meaning the Fed need to clarify to the market whether the SLR relief is going to be extended, while at the same time state whether Treasuries, Reserves or both (!) will be exempted again; this shocking lack of “market feel” from the Fed (as seen last week in Chairman Powell’s complete avoidance of the issue in testimony to Congress) is contributing to the Treasury selloff, as Banks lack visibility whether they can continue to expand their balance sheets with purchases of USTs…or conversely, need to shed balance-sheet, deposits and USTs

…and if Bonds rip higher and Rate vol collapses, legacy long-term “Momentum” longs in bond-proxy Nasdaq and Mega-Cap Tech would likely see explosive moves higher again too.

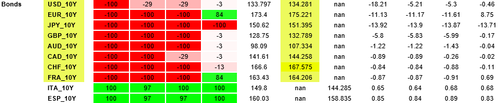

For now however, Rates / USTs path of least resistance continues WEAKER until we hear from the Fed as we await this week’s potential Rates “inflection catalysts”; but here are today’s estimated “buy-to-cover” levels for CTAs in said current Global DM Bond “shorts” of note:

What could get bonds up there? Feb jawboning…

Perhaps that is why there is a SIGNIFICANT amount of Fed-speak this week, coming ahead the blackout kicking-off this Saturday (Brainard today, tomorrow), Evans (Wednesday), Powell (Thursday at noon EST) along with Williams, Bostic, Kaskari, Mester, Daly and Harker sprinkled throughout as well. As Nomura’s Rob Dent notes, this obviously comes at a critical time for the Rates space, with timing which would allow them to push-back against the Rates move with enhanced “forward guidance,” under the guise of “tightening in financial conditions” – perhaps even “Operation Twist” trial balloons?

Tyler Durden

Mon, 03/01/2021 – 15:10

via ZeroHedge News https://ift.tt/381lma5 Tyler Durden