China Sends Ominous Signal: Mfg PMIs Slide To 9 Month Lows As Credit Impulse Fizzles

China’s economy was the first to recover from the covid collapse thanks to trillions of credit pumped into the economy. It now appears to be the first to also reverse the expansion and shrink as the tidal wave of credit comes to an end.

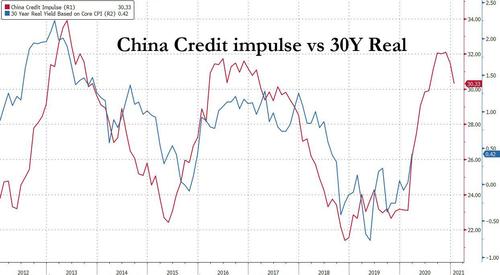

Back in December, we first pointed out that after a tremendous surge for much of the prior two years, China’s credit impulse had peaked (with real rates still tracking the impulse with the usual 12 month delay)…

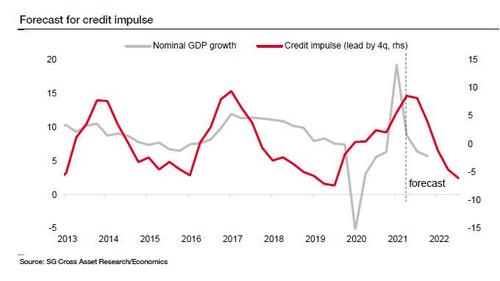

… with SocGen forecasting that a big slump was forthcoming to China’s credit impulse…

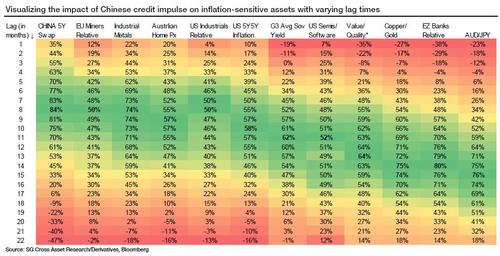

… one which, like a global tidal wave of disinflation, would have profound consequences for various inflation-sensitive assets around the world.

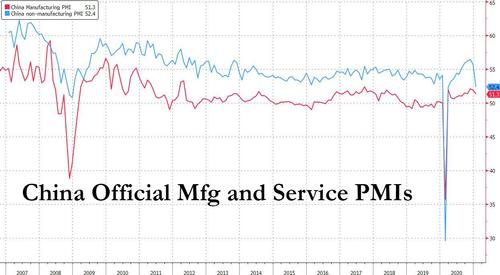

Over the weekend, this fading in China’s credit impulse was on full display in China’s own official mfg PMI which shrank to the lowest level since March, dropping to 52.4 and missing expectations with a sub-index of new export orders slipping into contraction…

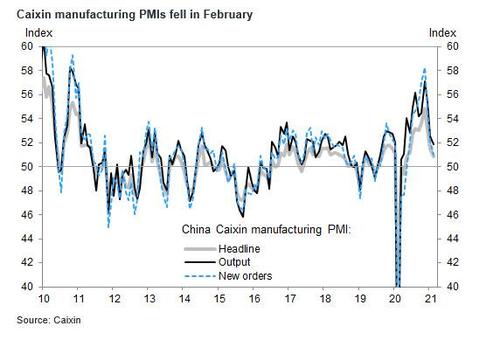

… with a similar decline recorded in Monday’s Caixin mfg PMI, which fell to 50.9 in February from 51.5 in January and below the 51.4 consensus. New orders and production sub-indexes implied growth momentum moderated in the manufacturing sector in February, in line with the official NBS Mfg PMI.

Some more details on the Caixin PMI from Goldman:

China’s Caixin manufacturing PMI fell to 50.9 in February from 51.5 in January, though still in expansionary territory. Most sub-indexes implied growth momentum moderated in the manufacturing sector. The production sub-index dropped to 51.9 in February from 52.5, and the new orders sub-index fell to 51.0 from 52.2. The new export order sub-index edged up only marginally to 47.5 from 47.4, still below 50 due to the resurgence of COVID-19 infections globally as highlighted by surveyed companies.

Surveyed companies remained cautious in hiring and the employment sub-index fell slightly to 48.1 from 49.6 in January. The raw materials inventory sub-index rose by 0.6pp to 48.8, but the finished goods inventory index edged down to 50.3 from 51.0. Stock shortages and travel restrictions continued to affect suppliers’ delivery in February. Price indicators suggest inflationary pressures moderated slightly but remained relatively high due to rising raw material prices and transportation costs according to the survey. The input price index fell slightly to 58.1 from 58.9 in January, and the output price index was 53.5, moderating from 54.9 in January. On future output, surveyed companies remained optimistic and expect “rising client demand globally once the pandemic comes to an end and planned product releases make debut”.

Goldman’s conclusion: “Both the NBS and Caixin manufacturing PMIs moderated more than expected in February, with sub-indexes showing slower growth in the manufacturing sector. That said, both surveys indicated optimistic sentiment from manufacturers on future output.”

If that wasn’t enough, a former finance minister warned fiscal risks remain “extremely severe with risks and challenges”, with low revenue for five years ahead and no prospect of any spending cuts ahead, suggesting policy may need to be tightened at some point

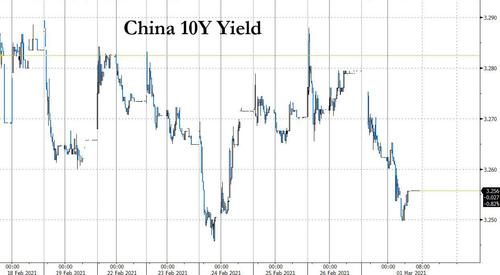

In kneejerk response, China’s 10-year government bond futures closed 0.3% higher, the most since Dec. 22, while In the cash bond market, the yield on 10-year sovereign notes dropped 2 bps to 3.26%, having barely budged in the past week and completely oblivious to the turmoil gripping the rest of the global bond market.

“Investors may think the economic recovery in China has become less strong than expected, which could stoke risk-off sentiment in the short run and help bonds,” said Hao Zhou, senior emerging markets economist at Commerzbank AG in Singapore.

Why is this important? Because just as the world is freaking out over rising yields and global reflation, the primary dynamo of global inflationary trends, China’s economy, is now fading and its credit impulse is set to shrink rapidly. Not only will this affect reflation assets but also push yields lower. However, thanks to the 6-12 month diffusion lag of China’s credit impulse, we first have about 9 more months of higher yields and commodity prices before the hangover finally arrives.

Tyler Durden

Mon, 03/01/2021 – 08:49

via ZeroHedge News https://ift.tt/2NT820u Tyler Durden