Stocks, Crypto, & Bond Yields Surge Amid Commodity Purge

An odd day.

While China PMIs were ugly, US PMIs signaled record-breaking inflation is on its way to the end-user (and supply chain disruptions means it won’t ease anytime soon)…

Source: Bloomberg

And that came after the House passed Biden’s $1.9 trillion stimulus.

Bond yields rose at the long-end (makes sense – inflation/growth etc), but compressed in the belly (will The Fed say something? The ECB did today)…

Source: Bloomberg

10Y yield rose back to the 1.45% line in the sand…

Source: Bloomberg

With dividend yields and treasury yields back in line…

Source: Bloomberg

Stocks soared (month-start flows and growth/stimmy hope)… Small Caps and Nasdaq had their best day since the election/vaccine day in early Nov…

NOTE the late day puke on Friday was quickly erased at the futures open but the moves didnt really accelerate until Europe opened.

All the major indices bounced off their 50DMAs…

GME was up 30%… just because…

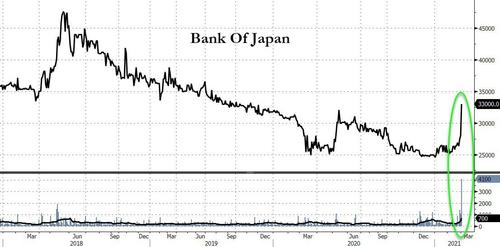

Meanwhile, before we leave equity land, there’s this malarkey. The Bank of Japan (yes the central bank trades publicly), which trades on the Tokyo Stock Exchange’s Jasdaq section, surged by the daily limit of 18%, the most since 2005 on massive volume. The shares, or subscriber certificates as they’re technically called, have no real benefit, with no voting rights and offering very limited dividends.

Source: Bloomberg

But “short-term retail investors don’t care about dividends, they’re looking just for capital gains,” said Tomoichiro Kubota, a senior market analyst at Matsui Securities Co. “They’ll see it as attractive so long as the share price keeps rising and there are buyers.”

But commodities tumbled (growth/inflation doubts?)…

Source: Bloomberg

Led by oil (OPEC+ anxiety, China PMI demand fears, and scary virus headlines)…

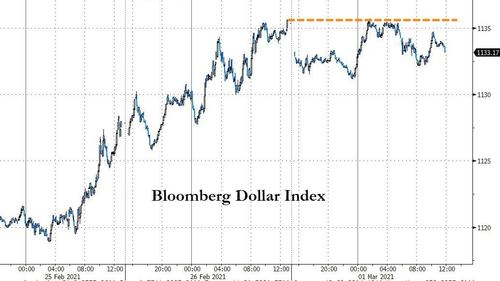

The dollar was flat to lower…

Source: Bloomberg

But Gold was dumped…

And while silver slipped lower late on, it managed to hold some gains…

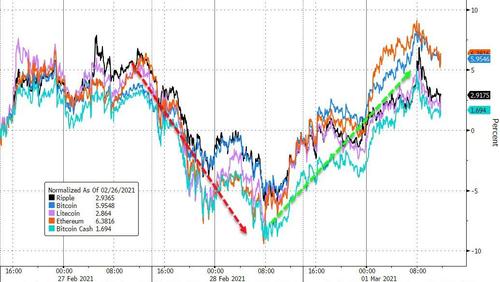

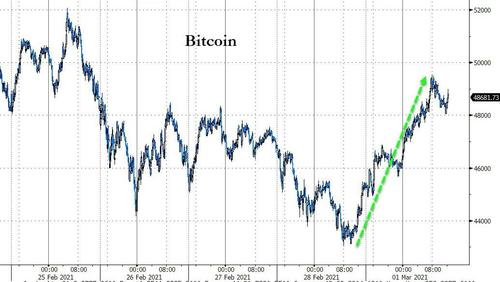

And Crypto was aggressively bid off weak weekend dip lows…

Source: Bloomberg

A positive sentiment Citi note sent Bitcoin back up near $50k…

Source: Bloomberg

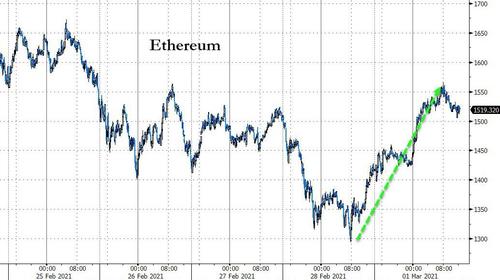

And Ethereum jumped after Mark Cuban’s comments…

Source: Bloomberg

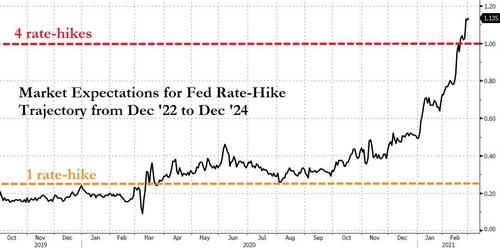

Finally, we note that the market is now pricing in some serious tightening by The Fed over the next few years…

Source: Bloomberg

And as rates rise, financial conditions are tightening in the US (now at their tightest in 3 months)

Source: Bloomberg

Get back to work Mr.Powell!

Tyler Durden

Mon, 03/01/2021 – 16:00

via ZeroHedge News https://ift.tt/3uGtnei Tyler Durden