Market Rollercoaster Continues As Global Markets Rebound From Tuesday Rout

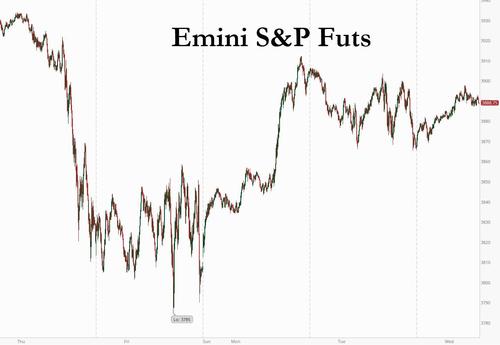

Once again market sentiment has reversed violently – or rather the opposite – overnight, with yesterday’s late day spoo slump inspired by the short squeeze in Rocket Mortgage – which forced hedge funds to liquidate their best positions – being faded and on Wednesday Emini futures jumped 0.6%, global shares gained with European indexes echoed positive moves in Asia, as a recent retreat in Treasury yields fuelled demand for riskier assets… even though the 10Y has rebounded 5bps to 1.45% overnight as focus again turned back to the stimulus-fueled recovery from the pandemic. The MSCI world equity index gained 0.4% while oil halted its longest losing streak since December.

At 0730 a.m. EST, Dow E-minis were up 202 points, or 0.64% and S&P 500 E-minis were up 21.5 points, or 0.56%. Small caps were sharply higher with Russell 2000 futures up 1.1% while Nasdaq 100 E-minis were up 86.5 points, or 0.65% as a swift global roll out of vaccines and a new round of stimulus bolstered bets on a quick economic rebound, with investors also focusing on private employment and service sector reports. Bank of America, Goldman Sachs and Morgan Stanley were up between 1.2% and 1.7% in trading before the bell.

Chevron and Exxon Mobil rose about 1.5% each as oil prices were boosted by expectations that OPEC+ producers might decide against increasing output when they meet this week. However, Exxon said that it planned to cut its workforce in Singapore, home to its largest oil refining and petrochemical complex, by about 7% due to “unprecedented market conditions” resulting from the COVID-19 pandemic.

Amid the latest virus developments, Texas sweepingly rolled back coronavirus restrictions on Tuesday, lifting a mask mandate and saying most businesses may open at full capacity next week as many U.S. states record a sharp decline in new infections and hospitalization. President Joe Biden also said the United States will have enough COVID-19 vaccine for every American adult by the end of May.

“We are caught in the middle of this crossfire between a more positive macro situation, and some excesses that have been developing here and there,” said Olivier Marciot, senior portfolio manager at Unigestion. “The market is reassessing the situation as whether or not it (stock market gains) have been too high and too fast.”

Expect more positive news on the stimulus front: the Senate is expected to take up Biden’s $1.9 trillion coronavirus relief package on Wednesday, with Democrats aiming to get it signed into law before March 14, when some current jobless benefits expire.

Europe’s Stoxx 600 added 0.4%, fading early gains of as much as 0.8%, with Frankfurt shares climbing 0.9% to a record high and London’s FTSE adding 1.3% before the UK’s new budget is introduced, with measures to boost the economy. European carmakers led the gains, adding as much as 2.6% to reach their highest since June 2018. Here are some of the biggest European movers today:

- Georg Fischer shares jump as much as 6.6% after full-year results beat the average analyst estimate. Baader Helvea says the 2020 results and outlook for 2021 “confirm our positive view on the business model.”

- Kuehne + Nagel shares climb as much as 3.9% to a record after the Swiss logistics company reported higher-than-expected earnings and dividend payouts.

- The Stoxx Europe 600 Automobile & Parts Index (SXAP) rises as much as 2.9% with Volkswagen outperforming after UBS raised its PT to a Street-high, and Stellantis advancing after its first set of earnings.

- The Stoxx Europe 600 Basic Resources Index gains as much as 1.7%, hitting the highest level since April 2011, led by steelmakers as steel rebar futures climb to near a decade-high in China.

- Hiscox shares slide as much as 14%, the most since April 2020, as reported gross written premiums for the full year missed the average analyst estimate. The firm also cancels its dividend.

Earlier in the session, Asia stocks rose with MSCI’s index of Asia-Pacific shares ex Japan up 1.7%, led by the Hang Seng Index as shares of Macau casino operators and heavyweight Tencent Holdings climbed, as did markets in Australia, where data showed the economy maintained its rapid recovery in the final three months of 2020.

China’s Shanghai Composite surged 2% after state media commentary saw stable policy and the Caixin services PMI matched estimates. Hong Kong’s gauge jumped 2.7%, the most since Jan. 19. Tencent contributed the most to its advance, as well as to that of the MSCI Asia Pacific Index. Sea Ltd., which is backed by Tencent, said it expects e-commerce revenue to double in 2021. Galaxy Entertainment jumped 7.7%, the most on the Hang Seng index, after Macau decided to allow people to enter casino floors without having to show a negative Covid-19 test result. Sands China also rose more than 5%. Equity measures in China, Thailand, India and Taiwan also advanced more than 1.5%. Sector-wise, financials and materials led gains in Asia. Banks and insurers rallied in China on expectations of higher interest rates and a continued market rotation into relatively-cheaper sectors.

The V-shaped recovery coming into sharp relief in Australia is highlighting expectations for a global rebound that boosts earnings and supports the run up in stocks. At the same time, investors are keeping an eye on inflationary pressures that could shake confidence by undercutting pledges from central banks to keep monetary policy loose. “Key ingredients are still there to support the reflation trade,” said Sebastien Galy, senior strategist at Nordea Investment Funds. “We remain supported by extremely lax liquidity conditions for quite a while as central banks will look through transitory inflation.”

Japanese shares also rose, reversing earlier losses, as investors jumped in to buy automakers, trading houses and other stocks seen as cheap. The Topix index and Nikkei 225 Stock Average each erased a decline of 0.2% to close 0.5% higher. Pharmaceutical makers and banks were also among sectors that contributed most to the benchmark’s gain, while steelmakers rose a wave of optimism on regional commodities plays. A group of electronics stocks fell after technology shares led losses in the S&P 500 Tuesday. “With vaccine distribution and support from U.S. stimulus, the economy is expected to recover globally this year, which will be a favorable environment for buying Japanese cyclical and value stocks,” said Toshiya Matsunami, chief analyst at Nissay Asset Management Corp. in Tokyo. Japanese stocks declined in early trading after the Nikkei reported Tokyo is considering asking for about a two-week extension of its Covid-19 state of emergency order beyond March 7. FNN echoed that two-week call, adding that the central government could make its decision as early as Thursday and announce it the next day. “The market is not too worried over the emergency status situation,” said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management. “It may take a bit more time but over the long term, the Nikkei 225 is likely to head toward recovery of the 30,000 mark.”

On the other hand, aiding risk sentiment, the U.S. 10-year Treasury yield was last up 1.44%, well below last week’s peak of above 1.61% that triggered a selloff in the equities market on valuation worries. The 10Y TSY yield was up 5bp near 1.44%, leading developed market bonds to the downside; bunds trade 2.5bp better vs Treasuries, gilts outperform by 1.5bp. The 10Y has traded in a narrow 5bps range since the end of February as buyers emerge around the 1.45% area.

Treasuries dipped as U.S. trading began after sliding during London morning, with focus on pandemic recovery lifting U.S. equity futures. The curve has continued to steepen; long-end yields are cheaper by ~5bp with front-end little changed. European bonds outperformed.

10-year Bund yields rose after officials familiar with internal discussions said ECB policy makers see no need for drastic action to combat rising bond yields.

Some analysts have continued to warn that stock prices may be frothy – a fear echoed by a top Chinese regulatory official on Tuesday – and as result make it hard for equity markets to hang on to gains. Fears that last week’s sell-off in U.S. Treasuries, which rattled stock markets, could resume may also put a lid on stock prices, they said. “While markets have stabilized …, the tone remains tenuous as investors continue to fear a further sell-off in rates,” analysts at TD Securities said in a note.

The swings in fixed income that roiled markets last week have moderated, but the outlook for longer-term borrowing costs and real yields remains a major point of debate.

“If interest rates start moving higher and quicker than expected, then there’s a chance there might be more significant pullback in the market,” Katerina Simonetti, Morgan Stanley Private Wealth Management senior vice president, told Bloomberg TV.

The overnight rebound in market sentiment did little for the dollar, and the Bloomberg Dollar Spot Index fluctuated and the greenback was mixed against its Group-of-10 peers. The euro briefly jumped to $1.2113, the highest level this week. The pound strengthened against the dollar and the euro before Chancellor Rishi Sunak unveils his budget, where he’s set to announce further fiscal support to the U.K. economy. U.K. service industries reported the quickest acceleration in inflation in a year, with rises in the cost of fuel and shipping. The Australian dollar was steady near large FX option strikes at 0.7825 due March 4, muting bullish reaction to 4Q GDP data that topped most estimates. Norway’s krone led G-10 gains as oil prices rebounded after a three-day fall, with the OPEC+ alliance said to be poised to agree an output increase at its meeting this week in a sign of the market’s underlying resilience as the impact of the pandemic ebbs.

Developing-nation currencies resumed their advance as comments by U.S. officials eased the fallout from last week’s surge in Treasury yields, fueling risk appetite. MSCI Inc.’s gauge tracking emerging-market currencies increased 0.2%, the most in more than a week, with Asian currencies including the Indian rupee, Indonesian rupiah and Taiwanese dollar rising the most. Stocks advanced, boosted by finance and communication-services shares, while the premium investors demand to hold developing-nation bonds over Treasuries fell. “Following last week’s selloff and the temporary stabilization in rates, we have seen bottom pickers coming in,” said Trieu Pham, a strategist at ING Groep NV in London. Still, Pham said he remains cautious and expects rates to move higher again. “There should be still a feeling of unease, especially for emerging-market debt investors.”

In commodities, Brent crude futures extended gains, reversing oil’s longest losing streak since December and rising as much as 1.9% to $63.88/bbl by 9:50am London time. WTI also climbed, adding as much as 1.8% to $60.82/bbl. Bitcoin soared back over $52,000 after tech icon Tim Draper predicted bitcoin would hit $5,000,000.

Looking at the day ahead, the data highlight will be the release of the February services and composite PMIs from around the world, as well as the ISM services index in the US. In addition, there’ll be the Euro Area PPI reading for January, the final Italian GDP reading for Q4, and the ADP’s February report of private payrolls in the US. Fed speakers include Harker, Bostic and Evans, while there’ll also be the release of the Fed’s Beige Book. From other central banks, we’ll hear from ECB Vice President de Guindos, the ECB’s Hernandez de Cos, Panetta and Schnabel, and the BoE’s Tenreyro. Finally in the UK, Chancellor Sunak will be setting out the 2021 Budget.

Market Snapshot

- S&P 500 futures up 0.7% to 3,894.00

- MXAP up 1.3% to 212.22

- MXAPJ up 1.8% to 715.98

- Nikkei up 0.5% to 29,559.10

- Topix up 0.5% to 1,904.54

- Hang Seng Index up 2.7% to 29,880.42

- Shanghai Composite up 1.9% to 3,576.91

- Sensex up 2.2% to 51,404.09

- Australia S&P/ASX 200 up 0.8% to 6,817.98

- Kospi up 1.3% to 3,082.99

- Brent futures up 1.1% to $63.38/bbl

- Gold spot down 0.6% to $1,728.05

- U.S. Dollar Index little changed at 90.71

- Euro up 0.1% to $1.2105

- Brent futures up 1.1% to $63.42/bbl

Top Overnight News from Bloomberg

- Bond traders have been saying for years that liquidity is there in the world’s biggest bond market, except when you really need it. Last week’s startling gyrations in U.S. Treasury yields may offer fresh backing for that mantra, and prompt another bout of soul-searching in a $21 trillion market that forms the bedrock of global finance. While stocks are prone to sudden swings, such episodes are supposed to be few and far between in a government- debt market that sets the benchmark risk-free rate for much of the world

- Britain is expected to sell nearly half as much debt next fiscal year, including the nation’s first green gilt, as the government balances budget discipline with dealing the worst recession in three centuries. The Debt Management Office will sell 249.5 billion pounds ($346 billion) of gilts in 2021-22, according to the median estimate in a Bloomberg survey of 16 primary dealers

- Consumers in the world’s largest economies amassed $2.9 trillion in extra savings during Covid-related lockdowns, a vast cash hoard that creates the potential for a powerful recovery from the pandemic recession

- The EU is still months away from issuing Covid-19 immunity certificates, raising the risk of another lost tourism season for the bloc’s aviation and hospitality industries

- Italy is making its first foray into the green bond market, the latest major debt issuer to tap into one of the fastest-growing sectors of finance. The nation is selling debt maturing in 2045 via banks, an unusual tenor that is expected to draw interest from domestic investors as well as specialist environmental funds. European nations are piling into the market as they seek to finance a greener recovery from the pandemic

- Chancellor Angela Merkel backed a relaxation of coronavirus restrictions despite a stubbornly high infection rate, acknowledging that many Germans are weary of curbs on daily life after months of lockdown

A quick look at global markets courtesy of Newsquawk

An improved mood was observed in Asia as equity markets shrugged off the weak handover from Wall Street where the major indices declined led by ongoing selling in tech amid reopening optimism and regulatory concerns after US Senator Warren commented that we need to break up big tech and that she was more concerned about big tech now than a year ago. ASX 200 (+0.8%) was underpinned by strength across the mining sectors after yesterday’s rebound in metal prices and with participants cheering stronger than expected Q4 GDP data which showed the economy expanded Q/Q by 3.1% vs. Exp. 2.5%. Nikkei 225 (+0.5%) traded with cautious gains as early support from a predominantly weaker currency gradually faded amid expectations of an extension to the state or emergency for Tokyo where officials are considering requesting for the government to maintain the emergency declaration in the capital for an additional two weeks. Hang Seng (+2.7%) and Shanghai Comp. (+2.0%) conformed to the positive tone across the region after Chinese press reported that analysts suggested the PBoC could reduce RRR for certain banks this month, although the advances in the mainland were gradual after the latest Chinese PMI data releases including Caixin Services PMI which printed its lowest reading since April last year. Finally, 10yr JGBs were contained amid the mostly positive risk tone across the region and with demand for bonds also subdued by the lack of BoJ purchases in the market, while the RBA were active today for AUD 1bln of semi government bonds which was inline with last Wednesday’s operation.

Top Overnight News

- Asia Stocks Jump as Tencent, Casino Shares Spur Hong Kong Bounce

- Australian Attorney-General Porter Denies 1988 Rape Claim

- China Revs Up Grand Chip Ambitions to Counter U.S. Blacklistings

- China Hacking India Port as Part of Shadow War, U.S. Firm Says

European indices opened the session firmer across the board (Eurostoxx 50 +0.6%) following on from APAC’s positive handover – with the FTSE 100 (+0.9%) the leading bourse in the run-up to the much-anticipated UK budget. Stateside, US equity futures abide by the same pattern with RTY (+1.1%) the outperformer and relatively broad-based gains across the NQ (+0.6%) , ES (+0.5%) and YM (+0.7%). Back to Europe, sectors are all in the green but in the most part seeing relatively modest gains. A slight pro-cyclical approach is perceived with the leading sector being Autos (+3.0%), whilst Energy (+1.3%), Travel & Leisure (+1.4%), Basic Resources (+1.0%) and Banks (+1.8%) among the top performers. Ahead of the UK Budget at 12:30 GMT (link to newsquawk preview), homebuilders and pub stocks are among the stocks to watch as it has been suggested UK Chancellor Sunak will announce further specific support for the housing sector and damaged hospitality sector. Some stocks on watch include: homebuilders Taylor Wimpey (+3.4%) and Persimmon (+4.3%); residential banks Lloyds (+2.0%) and NatWest (+1.4%); pub chain JD Wetherspoon (+4.3%); retailers Marks & Spencer (+2.2%) and JD Sports (+2.8%); infrastructure names Balfour Beatty (+1.7%) and CRH (+1.8%); “sin” stocks BATS (+0.6%), Imperial Brands (+0.8%), Diageo (+0.6%) and trading platform Hargreaves Lansdown (+1.7%). Alongside this, to the detriment of the UK equity market, Goldman Sachs have forecast that if corporation tax increases 6% to 25% it could spark a fall in UK stocks and cut up to 4% off the FTSE 100 index’s market capitalization. Nonetheless, the bank has noted that the COVID vaccine rollout and unlocking of the economy will matter more for UK stocks. Elsewhere, Hiscox (-9.5%) have seen the most downside this morning following their earnings where they reported a FY pretax loss of USD 268.5mln & a missed on gross written premiums USD 4.0bln vs exp. USD 4.13bln. Saint-Gobain (+4.0%) trades higher after the Co. invested in a plasterboard line which is expected to help the company expand its range of products.

Top European News

- Employers May Face Fines Under Draft EU Gender Pay Gap Rules

- Hiscox Plunges as Insurer Pulls Dividend, Posts Record Loss

- London’s Deserted Offices Could Gain 25% Over Next Five Years

- Hungary’s Orban to Pull Party From EPP Caucus, Nemzet Reports

In FX, the Buck is trying to stop the rot and draw lines in the sand right across the board following yesterday’s fall from grace, with some assistance from a resumption in UST bear-steepening that has pulled the recovery rug from bonds in general. However, trade is volatile and having flattered to deceive above the 50 DMA on Tuesday, the DXY only just evaded a clear downside breach of the 21 marker (90.627) within a 90.871-626 band and the Dollar remains mixed vs major counterparts and weaker for choice against EMs ahead of a busy agenda including weekly MBA mortgage applications, ADP, the final Markit services and composite PMIs, non-manufacturing ISM and more Fed speak before the latest Beige Book.

- GBP/NZD/AUD/CAD – All firmer vs the Greenback, as Sterling hovers around 1.4000 in the run up to the UK Budget and the Pound also picks up momentum relative to the Euro following indecision in the cross around 0.8650 even though final services and composite PMIs were somewhat underwhelming vs manufacturing, flash readings and their Eurozone prints. Meanwhile, the Kiwi is holding near 0.7300 where 1.4 bn option expiries lie in wake of eyewatering rises in GDT auction prices, the Aussie has taken firmer grip of the 0.7800 handle on the back of firmer than expected Q4 GDP and the Loonie has extended gains to test 1.2600 following decent Canadian Q4 growth and gleaning support from firm crude prices ahead of building permits.

- EUR – Not the biggest net G10 mover or even on a cumulative basis, but in focus amidst the aforementioned mostly firmer than forecast Eurozone PMIs, bar German for a change, and an ECB report via sources suggesting that the GC sees no need to take drastic action to cap debt yields, in contrast to some officials that have advocated enlarging the PEPP. Eur/Usd is back below 1.2100 from circa 1.2113 at one stage when a 38.2% Fib retracement level was hurdled (1.2088) to expose a 50% Fib (1.2117) of the same pull-back from 1.2243 to 1.1992.

- CHF/JPY – The Franc is looking rather deflated after weaker than anticipated Swiss CPI, with Usd/Chf pivoting 0.9150 and Eur/Chf revisiting recent peaks into 1.1100, but the Yen is underperforming and still looking vulnerable to losing its battle to stay afloat of 107.00 given dovish BoJ vibes from Kataoka overnight.

In commodities, WTI and Brent front-month futures have seen a tear higher in recent trade and are hovering around best levels during early European trade. Oil prices saw gains following President Biden revealing he hopes for every adult in the US to be vaccinated by May which in turn boosted demand hopes and the economic outlook. However, gains were capped due to the big builds in private inventories, crude stocks increased by 7.4mln bbls, ahead of the EIA data later today which may provide further short-term volatility on prices. Despite saying this, it could be overlooked due to the fundamental OPEC+ meeting later today. Ahead of the confab, it was reported OPEC+ members are in agreement that the market can take more supply which would be expected to amount to a reduction in oil prices. On the flipside, it was reported this morning OPEC+ options include a rollover of current cuts and several members support the idea of no supply easing in April which resulted in immediate upside for both WTI and Brent. Note, a Rolling Headline covering the event is available on the Headline Feed. Meanwhile, it’s also worth keeping tabs on the geopolitical landscape as Iraqi sources noted of missile strikes targeting a base that houses US troops, albeit no casualties were reported. Furthermore, a Saudi-led coalition said it has destroyed a drone launched by Yemen Houthis towards the southern region of Saudi Arabia – the latest in a series of increasing attacks against the oil-rich nation. WTI has eclipsed USD 61.00/bbl (vs low USD 59.27/bbl) and Brent USD 64.00/bbl (vs high USD 62.40/bbl) at best, but just below these handles currently. Elsewhere, precious metals are both softer on the session during early European hours with spot gold trading at USD 1,725/oz and spot silver trading at 26.60/oz – with the precious metals failing to garner much impetus from the receding Dollar. Elsewhere, base metals predominantly softer on the session with LME copper -1.0%. Leading on from this and of note for aluminium, the US Commerce Department issued an anti-dumping duty from 18 countries, including up to 242.8% on imports from Germany and 4.83% on imports from Bahrain. Additionally, these duties will come on top of 10% US tariffs imposed on the majority of aluminium imports.

US Event Calendar

- 8:15am: Feb. ADP Employment Change, est. 200,000, prior 174,000

- 9:45am: Feb. Markit US Services PMI, est. 58.9, prior 58.9

- 10am: Feb. ISM Services Index, est. 58.7, prior 58.7

- 10am: Fed’s Harker Discusses Equitable Workforce Discovery

- 12pm: Fed’s Bostic Discusses an Inclusive Economy

- 2pm: U.S. Federal Reserve Releases Beige Book

DB’s Jim Reid concludes the overnight wrap

As lockdown continues to drag, the twins have started to resort to asking “why this and why that?” to virtually every single part of life. Examples include “Daddy, why you got no hair?”, “Why you go to work?” and my favourite at bed time last night, “Daddy, why you got eyebrows?”. On the final one it took me until after they went to sleep to actually remember it was to stop sweat and water going into your eyes. I said they were ornamental which was an incredibly stupid answer especially when you think how wild mine have grown in lockdown. Luckily Zoom is quite low definition.

There were more than a few raised eyebrows at the last few days price action in global markets but things are calming back down for now. Following the best performance for US equities since June on Monday, yesterday saw another (mild) retrenchment as the focus once again turned back to the sustainability of current valuations in a higher-yield environment. It’s true to say that the recent moves shouldn’t be exaggerated though, as the S&P 500 is still only -1.64% beneath its all-time closing high seen less than a month ago, but the big question is whether those valuations can be justified as the economy and markets are weaned off the massive levels of stimulus they’ve been receiving over the last year. Although talking of stimulus yesterday’s CoTD looked at a proprietary DB survey of US brokerage account holders. This “Retail” group said they would invest an average of 37% of future stimulus checks into the stock market. We did some back of the envelope calculations in the note as to how much firepower this could bring. See it here for more and for the full survey findings. Email jim-reid.thematicresearch@db.com if you want to be on the Chart of The Day distribution.

Back to markets and by the close of play the S&P 500 shed -0.81% thanks to a sharp move lower in tech stocks, with the NASDAQ (-1.69%) and the NYSE FANG+ (-1.90%) both underperforming as the worries about valuations in a higher yield environment persist. Semiconductors (-3.10%) and large tech stocks like Apple (-2.09%) and Tesla (-4.45%) were particularly under pressure. Small-cap stocks also struggled with the Russell 2000 falling -1.93%. In Europe, equity markets managed to hold onto their gains as the STOXX 600 rose +0.19%.

Given the recent volatility in sovereign bond markets, there was much attention on Fed Governor Brainard’s remarks around lunchtime in the US. She noted that “those moves last week, and the speed of the moves, caught my eye.” Governor Brainard added that disorderly conditions or a persistent tightening of financial conditions that could potentially hinder progress toward the Fed’s dual mandate would cause her concern. She also again highlighted that “Even after the conditions for liftoff have been met, changes in that policy rate are likely to be only gradual.” 10yr US treasuries yields continued to mean revert yesterday as they fell -2.6bps lower to 1.391%, as the drop in real rates (-6.3bps) overcame the +3.7bps increase in 10yr breakevens. 5yr yields also continued to normalise, falling -3.7bps, as the more extreme pricing of future Fed hikes from late last week continued to be reversed.

Over in Europe there was a general decline in yields as well, with those on 10yr bunds (-1.8bps) and OATs (-2.1bps) both moving lower, as gilts (-7.2bps) outperformed strongly ahead of today’s budget announcement. And following last week’s comments from key ECB policymakers that they were closely monitoring the level of yields, we got additional remarks from Fabio Panetta of the ECB’s Executive Board, who said that “The steepening in the nominal GDP-weighted yield curve we have been seeing is unwelcome and must be resisted”. As it happens, the move in 10yr German bund yields over the last 3 sessions (-12.0bps) has now more than reversed the increase over the 3 sessions before that (+10.7bps), in contrast to Treasury yields which still stand +2.6bps above their levels of Monday last week.

Staying on Europe, Bloomberg reported yesterday that the European Commission were likely to suspend the EU rules in 2022 as the bloc recovers from the pandemic. The official decision isn’t actually due for another two months, but the officials cited in the report said that the recommendation would be the rules aren’t reintroduced until 2023. A question I had is whether they’ll ever come back in the same form? Maybe much depends on how successful (or not) the US is in reviving its economy with the upcoming stimulus package.

On the topic of US stimulus, President Biden and Senate Majority Leader Schumer are in the midst of their first test to keep their party all onside ahead of the vote on the new stimulus bill. Moderate Senators Manchin and Shaheen both have raised concerns on some of the spending items in the bill, namely the weekly pandemic unemployment bonus set to expire March 14 and the income cap for stimulus checks. They want to keep the unemployment bonus at the current $300/week – which a majority of Democrats have been trying to raise to $400/week – while also wanting to cap the income level for families getting stimulus checks at $200,000. Senator Manchin did not call any of the measures deal-breakers and wants to reach a resolution today ahead of a vote later this week. Overall party leaders remain confident the bill will pass the Senate and also its return trip to the House this week or over the weekend.

Overnight in Asia, markets have switched back to risk on mode with the Nikkei (+0.39%), Hang Seng (+1.86%), Shanghai Comp (+1.43%), Kospi (+0.81%) and Asx (+0.82%) all up. Supporting this has been stronger February services and composite PMIs for many Asian countries. Japan’s final services PMI came at 46.3 (vs. 45.8 flash) with the composite at 48.2 (vs.47.6 flash) while India’s services PMI came in at 55.3 (vs. 52.8 last month) with the composite at 57.3 (vs. 55.8). China’s Caixin services PMI printed in line with consensus at 51.5 with the composite at 51.7 (vs. 52.2 last month). In terms of other data releases, Australia’s 4Q GDP came in at +3.1% qoq (vs. +2.5% qoq expected) while the previous quarter was revised up by 0.1pp to 3.4%. Lastly, futures on the S&P 500 are also trading up +0.43% this morning and the European ones are pointing to a positive open.

Here in the UK, attention will today turn to the government’s 2021 Budget, which Chancellor Sunak will be presenting in the House of Commons at around 12:30 London time, before later holding a press conference at 17:00. Much of the potential announcements have already been trailed in the press, such as the possibility of higher corporation taxes and an extension of the furlough scheme (now to September as confirmed last night), but as ever with UK budgets there may be some unrevealed rabbits that could yet be pulled out of the hat. The backdrop is a relatively bright one by the standards of recent months, with the UK having had one of the most successful vaccine rollouts of any major country. This helped the 7-day case average fall to 7,680 yesterday, which is its lowest since October 3. For those wanting more detail on the budget, our UK economists put out their preview last week (link here).

Elsewhere on the pandemic, Bloomberg reported that Chancellor Merkel was in favour of extending the German lockdown until March 28, which includes the closure of non-essential shops and restaurants, albeit with a relaxation on private gatherings from March 8. At the other end of the spectrum, Texas – the second most-populous state in the US with nearly 29 million residents – has lifted its state wide mask mandate and the Governor announced that all businesses will be allowed to open at 100% of capacity as of next Monday. This runs counter to the current CDC guidelines. Elsewhere San Francisco reopened indoor dining, theatres and gyms on a limited basis as the state lowered the county’s restrictions. On the vaccine front, President Biden announced that Merck & Co. will be working in partnership with Johnson & Johnson to produce more of the latter’s vaccine, which received authorisation this past weekend. The Biden administration expects nearly 20 million doses in total by the end of this month, having already been allocated 3.9 million. President Biden has also said that the U.S. may have enough vaccines for every adult American by the end of May.

Looking at yesterday’s data, the flash Euro Area CPI reading for February came in at 0.9% as expected, whilst core inflation also came in as expected at 1.1%. Separately in Germany there were some underperformances in the data, as retail sales fell by -4.5% in January (vs. +0.3% expected) amidst the country’s lockdown, and unemployment rose by +9k (vs. -10k expected) in February, which marks the first monthly increase in since back in January.

To the day ahead now, and the data highlight will be the release of the February services and composite PMIs from around the world, as well as the ISM services index in the US. In addition, there’ll be the Euro Area PPI reading for January, the final Italian GDP reading for Q4, and the ADP’s February report of private payrolls in the US. Fed speakers include Harker, Bostic and Evans, while there’ll also be the release of the Fed’s Beige Book. From other central banks, we’ll hear from ECB Vice President de Guindos, the ECB’s Hernandez de Cos, Panetta and Schnabel, and the BoE’s Tenreyro. Finally in the UK, Chancellor Sunak will be setting out the 2021 Budget.

Tyler Durden

Wed, 03/03/2021 – 08:01

via ZeroHedge News https://ift.tt/3c1fFKm Tyler Durden