Ignoring Years Of Silver Price Manipulation, Orwellian CFTC Now Goes After Reddit Apes

Submitted by Ronan Manly, BullionStar.com

On Monday 1 March, an article in Bloomberg by CFTC connected lawyers from law firm Clifford Chance revealed that the Commodity Futures Trading Commission (CFTC) is reportedly investigating retail silver trader activity in the silver price and that the US Department of Justice looks set to investigate as well.

Before looking at this shocker of an Orwellian development, it’s helpful to provide some context on the CFTC’s track behavior in this area and to show how hypocritical such a development would be.

Rewinding exactly one month previously to Monday 1 February, as the spot price of silver rallied to an 8-year high of just under US$ 30 per troy ounce amid heightened retail interest and the emergence of the #SilverSqueeze, it was predictable that the establishment on Wall Street and in Washington DC, an establishment with a collective vested interest in a low and suppressed silver price, would feel the heat and attempt to counteract the rally.

On the regulator front, this was demonstrated by none other than the US Government’s Commodity Futures Trading Commission (CFTC), whose acting Chairman Rostin “Russ” Behnam, released an unprecedented statement, actually on 01 February, saying that:

“The CFTC is closely monitoring recent activity in the silver markets. The Commission is communicating with fellow regulators, the exchanges, and stakeholders to address any potential threats to the integrity of the derivatives markets for silver, and remains vigilant in surveilling these markets for fraud and manipulation.”

Although a short statement from the CFTC, it signaled panic, panic on Wall Street and in Washington, that a #SilverSqueeze triggered demand surge in physical silver could pressure the supply side and thus trigger the collapse of the gigantic ongoing paper silver trading charade.

The statement also signaled that the #SilverSqueeze was critical enough to Wall Street that the CFTC felt the need to coordinate with other regulators, exchanges and stakeholders (i.e. bullion banks). But more so, the statement was both hilarious and hypocritical.

Fraud and Manipulation

For anyone familiar with the CFTC and the silver market will immediately have raised their eyebrows that the CFTC “remains vigilant in surveilling these markets for fraud and manipulation.”

As a reminder, this is the same CFTC that on 25 September 2013 after a 5-year investigation into whether the COMEX silver futures market was manipulated by JP Morgan and other banks, closed down the investigation, saying that its Division of Enforcement and Division of Market Oversight had found no evidence of wrongdoing, despite spending 7,000 staff hours on said investigation since 2008. The CFTC head of enforcement at that time was David Meister, who then left the CFTC only a week after closing down the silver investigation, in a job well done.

Chairman of the CFTC at that time was Gary Gensler, the same Gensler who is now about to be appointed by old man Biden as head of the SEC. Meister, a lawyer by profession, returned to Wall Street and his former law firm Skadden, and is now head of Skadden’s government enforcement and white collar crime group in New York.

And the 2008 – 2013 investigation was only one of a total of 3 CFTC investigations into the COMEX silver market since 2004, none of which found anything:

“And three times, starting in 2004, the Commodity Futures Trading Commission also looked into allegations of market manipulation of the silver market by JPMorgan.”

“The CFTC closed the third of those three inquiries in 2013 without taking action. JPMorgan has cited those CFTC investigations while defending against civil lawsuits, accusing plaintiffs of rehashing “implausible theories” of silver futures manipulation that were rejected by regulators.”

Yet by 2018, when the US Department of Justice and FBI under the direction of Avi Perry negotiated a guilty plea deal with former JP Morgan precious metals trader John Edmonds for fraudulent manipulation of precious metals markets between 2009 to 2015, which subsequently led to the DoJ fining JP Morgan US$ 920 million in 2020 for a multi-year precious metals manipulation scheme, the CFTC could no longer look the other way, and was forced to acknowledge the “fraud and manipulation“. And the CFTC even collected the JP Morgan fine. As a reminder, the CFTC under Gensler had failed to find the following:

“JPMorgan Chase & Co. (JPMorgan) has entered into a resolution with the Department of Justice to resolve criminal charges related to two distinct schemes to defraud: the first involving tens of thousands of episodes of unlawful trading in the markets for precious metals futures contracts, and the second involving thousands of episodes of unlawful trading in the markets for U.S. Treasury futures contracts.”

“For over eight years, traders on JP Morgan’s precious metals and U.S. Treasuries desks engaged in separate schemes to defraud other market participants that involved thousands of instances of unlawful trading meant to enhance profits and avoid losses”

Likewise, this is the same CFTC that has now, as it can no longer pretend not to know, been roped into involvement with the Department of Justice’s ongoing indictment against Michael Nowak, former global head of JP Morgan’s precious metals trading desk and former LBMA board member, for allegedly running a RICO conspiracy and for “allegedly engaged in a massive, multiyear scheme to manipulate the market for precious metals futures contracts and defraud market participants.” in what has been called a criminal ring by DoJ prosecutors.

You can see, for example that in 2010, the CFTC looked the other way when interviewing Nowak:

“In 2010, [Nowak] sat for two days of interviews with CFTC investigators, explaining the bank’s trading strategies.

“To your knowledge, have traders at JPMorgan in the metals group put up bids and offers to the market which they didn’t intend to execute and then pulled them before they got hit or lifted?” one CFTC investigator asked.

“No,” Nowak responded.

The CFTC closed the third of [it’s] three inquiries in 2013 without taking action.”

Unbelievably, David Meister (who shut down the CFTC investigation into silver market manipulation in 2013 and left the CFTC) has now turned up representing Michael Nowak in the Department of Justice case, and as of a few weeks ago the DoJ was trying to have Meister disqualified from the case, saying that he is conflicted as he headed the CFTC’s investigation into JP Morgan, the one that was shut down in 2013. You can’t make this stuff up.

The Usual Suspects

Following the 1 February 2021 statement from the CFTC’s Rostin Behnam in which he referenced the CFTC as “communicating with fellow regulators, the exchanges, and stakeholders”, it soon became clear who those other regulators were, for on Thursday 4 February, US Treasury Secretary Janet Yellen called a meeting with the heads of the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), Federal Reserve Bank of New York (FRBNY), and US Federal Reserve, to, according to NBC “discuss financial service issues after a mob of online traders drove surges in prices for GameStop, silver, and other stocks and commodities. Se here and here.

Hilariously, given the multi-year silver price manipulation by the Wall Street bullion banks, the US Treasury had the gall to put out a statement in advance of the 4 February meeting saying that:

“Secretary Yellen believes the integrity of markets is important and has asked for a discussion of recent volatility in financial markets and whether recent activities are consistent with investor protection and fair and efficient markets.“

You couldn’t make this stuff up. You will recall the first week of February was also the same week in which the NYSE listed iShares Silver Trust (SLV) amended its prospectus warned that “demand for silver may temporarily exceed available supply” thus preventing the SLV from acquiring sufficient physical silver, while the NYSE listed Aberdeen Standard Physical Silver Shares ETF (SIVR) amended it’s prospectus warned Wall Street that “an online campaign intended to harm hedge funds and large banks is encouraging retail investors to purchase silver and shares of Silver ETPs to intentionally increase prices.”

Acting Chairman

Fast forward to Tuesday 23 February, and the CFTC’s acting chairman Rostin Behnam was back, warning of the evils of a group of retail physical silver investors that have called out Wall Street’s criminal and fraudulent manipulation of the silver market, this time in a virtual meeting of the CFTC’s Market Risk Advisory Committee:

“Good morning and welcome to the first virtual meeting of the CFTC’s Market Risk Advisory Committee of 2021. Before we begin, I would like to take a moment to comment on recent market dynamics. With respect to precious metals, I want to reiterate that we are closely monitoring recent activity in markets and on social media.”

“We are [also] monitoring irregularities in the Texas energy markets following last week’s freeze…Regarding the most recent events in the precious metals and energy markets, I am personally, along with dedicated staff throughout the agency, communicating with fellow regulators, exchanges, and stakeholders to address any potential threats to the integrity of the derivatives markets, evaluating in real-time structural and transparency concerns. We at the CFTC continue to employ heightened alertness in surveilling these markets for fraud and manipulation.

See “Opening Statement of Acting Chairman Rostin Behnam before the Market Risk Advisory Committee”, 23 February 2021

So Benham and his CFTC staff are engaged in real-time evaluation of structural and transparency concerns about the silver market? Would this evaluation include the structural nature of the continual naked shorting of huge volumes of silver contracts by bullion banks when the price is about to break out higher? Or the transparency concerns around the indecipherability of the COMEX Commitment of Traders Report and COMEX Bank Participation Report which hide the identity of the bullion banks that are the big shorts?

Clifford Chancers?

Which brings us to the article written by the New York branch of City of London mega multinational law firm Clifford Chance on Monday 1 March which appeared on the Bloomberg Law website under the misleading title of “Spike in Silver Prices Has Similarities to GameStop Trading; Regulators on Alert”.

Written by 4 lawyers from Clifford Chance, the authors were David Yeres, senior counsel of Clifford Chance in New York, Robert Houck, a partner at Clifford Chance New York, and Benjamin Peacock and Gege Wang, associates at Clifford Chance. Yeres, according to his bio, “specializes in derivative transaction law matters and related investigations and disputes”. Houck, who has expertise in complex trading and markets issues, “represents clients in government investigations and complex commercial litigation”.

Houck also “leads a 17-partner group that includes seven former federal prosecutors, as well as former senior regulators and prosecutors from other regulatory agencies including the SEC and the Commodity Futures Trading Commission (CFTC).”

You can speculate why and how this article just happened to appear on Bloomberg only 6 days after Behnam’s appearance in front of the CFTC Market Risk Advisory Committee, and Clifford Chance may be “chancing their arm” in trying to be in on an investigation, but with a connected team (some partners are former regulators), it would be realistic to assume that they have been in contact with the CFTC’s Rostin Behnam, who by the way is also a lawyer by profession and has previously practiced in New York City.

The Clifford Chancers begin their article stating that:

“speculation surrounds the recent spike in silver prices, with comparisons to the pattern seen with GameStop shares and questions about market manipulation through Reddit posts.”

Notwithstanding the fact that Clifford Chance has never published an article about downward spikes in the silver price, or the frequent waterfall cascades in the COMEX silver price with huge volume on no news, especially during New York trading hours, the question must be asked as to who is comparing the price pattern of silver to that of GameStop? For the comparison is completely ludicrous.

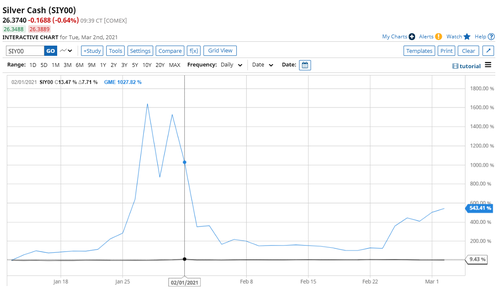

Why? Because from 12 January to 27 January, the GameStop stock (GME) price rose by an incredible 1642% (see blue line in chart below), while over the same time the COMEX silver price. compared to GME, hardly budged ( see black line in chart below). See the 1 February silver price rise highlighted at the position of the red arrow.

The second chart below shows that on 1 February 2021, the silver price roseby about 9.43% during that day – see the black dot on the black line. In comparison to GME, you can hardly see the price rise. It’s just a blip on the black line.

The Clifford Chance article goes on:

“The Commodity Futures Trading Commission (CFTC) is reportedly investigating potential manipulation of silver prices after those prices rose dramatically in recent weeks, and the Department of Justice will likely investigate as well.”

Rose dramatically in recent weeks? That is ridiculous. Over Sunday night 31 January to early Monday morning 1 February, during Asian trading hours, spot and COMEX silver prices rose from about US$ 27.00 to about $29.59, a rise of approximately 9.5%. As New York opened a few hours later, the price was smashed back down in the paper silver markets and continued to fall through Tuesday afternoon 2 February to reach $26.4, a drop of 10.57%, and to a level below the Sunday night open.

CONEX? – New York Intraday

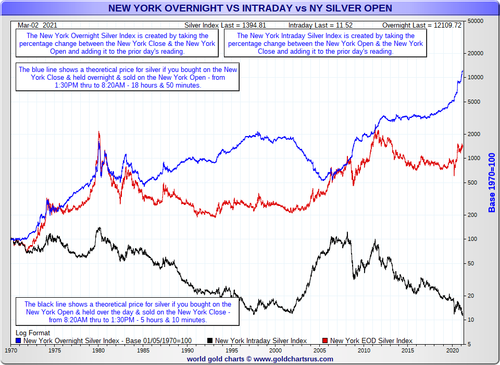

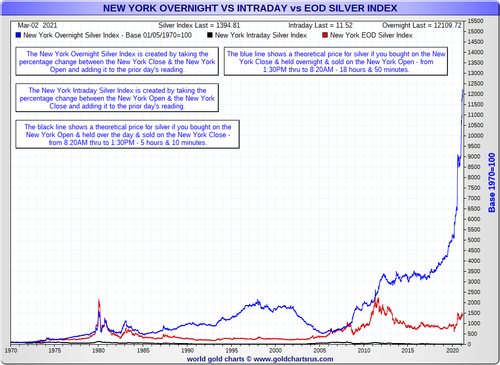

Where is the call from Clifford Chance to investigate why the silver price was suddenly smashed down as New York opened on 1 February? In fact, where is the Clifford Chance call to investigate the fact that a trading strategy of buying at the New York close silver price and selling at the New York open silver price (New York Overnight Index) would have returned 12,000% since 1970 (or 120 times), whereas a strategy of buying at the New York open and selling at the New York close (New York Intraday Index) would have lost nearly 90% of your investment since 1970.

This is illustrated in the below two charts from Nick Laird’s www.GoldChartsRUs.com, firstly in non-log format, and then in log format since the differences are so large. See blue line (Overnight Index) compared to black line (Intraday Index).

So why does Clifford Chance not represent retail traders and investors and take a case against the CFTC for failing to prevent outright suppression of the silver price in New York especially since around 2005?

Another key question is what makes Clifford Chance believe that the Department of Justice is also likely to investigate the Reddit silver crowd? Inside contacts? Probable. But surely the DoJ has more important things to do?

The Clifford Chance article continues:

“Silver prices may have followed a pattern first observed in the prices of GameStop and other stocks, in which retail buyers encouraged each other on Reddit and other websites.

As with GameStop, the retail interest in silver may derive at least in part from a desire to “punish” institutional traders who, the retail traders believe, are suppressing prices to benefit their short positions.”

As explained above, silver prices did not follow a pattern of GME and other stocks (presumably Clifford Chance is referring to stocks such as AMC). Therefore, this angle is completely redundant as the price patterns are not similar.

And the line “in which retail buyers encouraged each other on Reddit and other websites”? – Yes, it’s called pointing out that the silver price is manipulated and suppressed by Wall Street and the LBMA banks, and that buying physical silver will allow the market to break free of this paper manipulation.

And the line “As with GameStop, the retail interest in silver may derive at least in part from a desire to “punish” institutional traders who, the retail traders believe, are suppressing prices to benefit their short positions.” You don’t say?

For ‘institutional traders’, Clifford Chance is presumably too embarrassed to say bullion banks. Yes, the bullion banks need to be punished for their manipulation sins. It’s called war against the bankers. Clifford Chance continues:

“Any CFTC or DOJ investigation will likely include close scrutiny of communications by retail traders for potential ‘coordinated-trading’ price manipulation.”

This is too funny. Does this mean the “sell SLV, Buy PSLV” memes on Reddit? or the call to “Take delivery on the COMEX!” Or the “don’t buy fractional reserve paper silver, buy real physical silver bars and silver coins produced by precious metals refineries and mints”?

The Clifford Chance article does not even define which exchanges or market places it is referring to under a CFTC / DoJ investigation, or how or why the CFTC or DoJ would have any remit over people buying physical silver. Clifford Chance continues:

“Ultimately, however, the authorities may be more inclined to focus upon institutional traders who traded silver in a manner intended to influence prices, and in particular on traders who sold in order to defend lower prices against the increased retail buying interest.

Nice of Clifford Chance to confirm that institutional players sell paper to try to keep the price down and to torpedo retail silver buying interest.

Now they’re talking! But why ‘Ultimately’? When does ultimately refer that? Tomorrow, as they say, never comes. Unless the CFTC is dragged kicking and screaming, it will never investigate institutional traders who try to “defend lower prices” (i.e. who try to suppress the price).

Why? The short answer is that the CFTC is an arm of the US Government, and the US Government does not want the paper silver trading scheme to end, as this would then be the end of the paper gold trading scheme, and the beginning of the end of the US dollar.

Next comes the Orwellian part of the article. Here Clifford Chance takes proven and prosecuted price manipulation behavior by investment bank trading desks, and then tries to project this activity on to the antics of Reddit members such as the 37,000 Silver Apes of Reddit subreddit r/WallStreetSilver. Not to mention that its a Clifford Chance pitch for business to the CFTC:

“In determining whether retail traders engaged in manipulation or attempted manipulation, the CFTC and DOJ will likely look to previous settlements based on “coordinated trading.” In the foreign exchange and ISDAfix settlements from 2014 to 2018, the authorities alleged that traders at various banks shared information about their positions in chat rooms and agreed to trade in a manner that would mutually benefit their positions.

Authorities will be interested in determining whether similar coordination occurred among retail silver traders. In order to prove manipulation, the authorities would need to show more than retail traders taking to social media as cheerleaders.

A classic tactic of “Don’t look over there, Look here”, don’t look at the bullion bank shorts in the paper silver market, look at the Reddit Silver forums.

Billboards and Stacks

There then follows even more Orwellian doublespeak which Clifford Chance directs at the Reddit Apes using a check list which precisely describes the actual everyday trading activity of bullion banks in the London LBMA and COMEX silver market:

“Rather, authorities would need to demonstrate that:

- the coordinating traders had the collective ability to influence market prices

- the traders intended to create an artificial price (or, perhaps, that they traded with a reckless disregard for price integrity)

- an artificial price was created

- the coordinating traders caused the artificial price”

What about erecting billboard signs to buy physical silver as the Reddit Silver crowd is now doing? Is that on the Clifford Chance checklist for prosecution? We hope so. As that would then give the Reddit billboard initiative far more exposure than it otherwise would get.

But wait, the Clifford Chance authors continue, the CFTC and DoJ wouldn’t have to find any of the above to prosecute retail traders, they could merely:

“prove attempted manipulation merely by demonstrating that coordinating traders had both the collective ability and specific intent to create an artificial price, without needing to prove the existence of an artificial price.”

Well, if that’s the case, if the hurdle is merely proving collective ability and specific intent, then it’s an open and closed case against the bullion banks, as the Wall Street bullion banks certainly have “the collective ability and specific intent to create an artificial price”. So if that’s the benchmark, then the banks can all be prosecuted, and everyone else lives happily ever after.

Clifford Chance then deflects attention away from the multi-year suppression of the silver price by bullion banks by actually bringing in discussion of ‘institutional shorts’, but only in the context of a reaction to the Reddit physical silver buyers.

“The authorities may be particularly interested in determining whether institutional traders with long or short positions engaged in any misconduct.”

“Investigation of institutional shorts would likely focus on trading to “defend” lower prices’”

Clifford Chance continues it’s deflection tactics by posing the possibility that both retail traders and institutional shorts have ‘sincere beliefs’, the retail side a sincere belief that silver prices have been suppressed by the bullion bank shorts, and the bullion bank shorts a sincere belief of “selling aggressively to defend lower prices that they supposedly believe reflect silver’s actual value“. You could not make this stuff up.

This again is an Orwellian attempt by Clifford Chance to try to paint over the multi-year silver price suppression scheme of the bullion banks.

Clifford Chance concludes that:

“bringing factually complex manipulation and attempted manipulation cases against dozens, or even hundreds, of retail traders may be a particularly daunting task for the authorities.”

We would agree, Likewise, what about 37,000 members of r/WallStreetSilver who post photos of their silver stacks and plan to put up “Buy Silver” billboards all over the USA?

A bit of Humor

The Clifford Chance article ends with some humor, claiming that “the CFTC and DOJ strive for independence from political considerations”, and “may face pressure to focus their efforts on institutional short sellers, who have been the target of wide and vocal popular criticism for their role in the markets.” Speaking of humor:

Given that the CFTC is an arm of Wall Street, the CFTC will never, as you will probably agree, focus their efforts on the institutional short sellers. Beyond the laughs, the only way to break the consortium’s control over the COMEX and spot silver price is to buy physical and take it off the market so that the demand for physical silver will overwhelm physical supply, thus creating a situation in which the paper price will be shown up for what it is, an artificial price sorcerized into existence by the international bullion bank cartel under the watchful eye of governments and their financial sector regulators.

This article was originally published on the BullionStar.com website under “Orwellian CFTC, which ignored years of silver price manipulation, now going after Reddit Apes”

Tyler Durden

Thu, 03/04/2021 – 14:52

via ZeroHedge News https://ift.tt/3kIO44P Tyler Durden