JPM: Clients Are Getting Concerned About Concentration Risk

From JPM’s Market Intelligence report published by Andrew Tyler

The global sell-off continues but rotation is the better description. We continue to see large-cap Tech being sold to fund the Reopening/Reflation trade. Client conversations reveal that much of this selling is in the more liquid names so there are now concerns about concentration risk should the equity markets have a textbook correction.

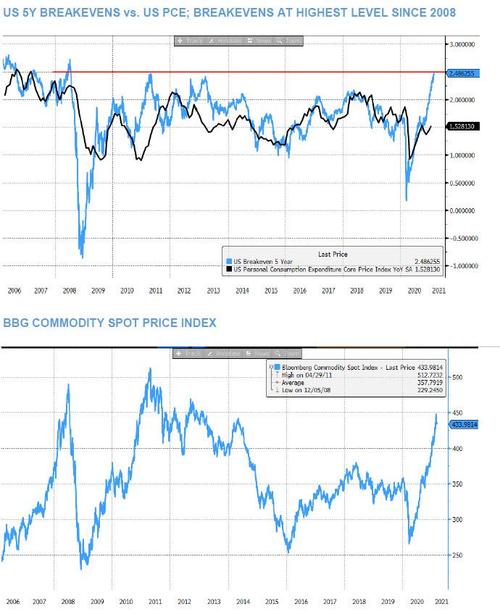

Inflation is another popular topic and this morning 5Y breakevens touched 2.49, a level last seen in July 2008. These inflation concerns are driven by the extraordinary fiscal and monetary stimulus and then exacerbated by the moves in the commodity markets, as illustrated in the next two charts. While breakevens and PCE, the Fed’s preferred measure of inflation, tend to track together we can see clearly that breakevens, one indicator of the market’s expectations for inflation, tend to overshoot PCE levels. The conclusion is that fears of the Fed pulling forward its rate hike liftoff are overblown.

POSITIONING INTELLIGENCE:

While equity markets have been choppy over the past few weeks, overall gross and net exposures have declined as the markets have pulled back a bit (i.e. mostly due to mark-to-market effect), but the underlying tone remains relatively constructive. If anything, it seems that the pullback in the market (and particularly in areas that have outperformed for a long time) has allowed HFs to increase shorts once again.

TAKEAWAYS

- 1.Are Single-Name Shorts Making a Comeback? Somewhat… N. American single-name shorts added by Equity L/S funds in the second half of Feb at a magnitude that was twice as large as what was added in the first half of the month. That said, ETF usage on short side remains high. In NA, Retailing has seen shorting pick up in 2H Feb along with Software, while Energy is the only industry that’s seen significant covering

- 2.N. America Rotations within Cyclicals and Out of Tech. Energy most net bought industry over 2H Feb and Banks bought slightly as well. Energy positioning still ~1std dev below 3-year average. TMT net positioning rolling over from recent highs as flows reversed during Feb from early buying to later selling. While overall Software and Tech Hardware net exposures are only falling from recent highs, net exposures to Mega Cap Tech have fallen dramatically since mid-2020 and are at 3-year lows

- 3.EMEA Sector Rotations: Continued Buying of Energy/Fins/Lux Goods, SomeSelling of Travel. Energy most net bought in EMEA in 2H Feb. Industrials and Materials getting sold. In addition, HFs selling longs into recent rally in EU Airlines and Travel & Leisure, which might suggest lower optimism around re-opening trends. Luxury Goods has seen a lot of buying recently and positioning is 3 std devsabove average. Positioning is also high in Semis and Consumer Services (inc.Gaming). E-Commerce (JPEUECOM) net positioning remains ~1 std dev above average and flows have been relatively paired off despite recent decline

- 4.APAC – Selling Across the Region; Low Positioning in Covid Recovery Stocks. Net flows slightly negative in Japan most recently as gross flows and exposure remain weak. Local China shares saw very strong net selling in late Febas the CSI 300 dropped 8%. HK stocks and ADRs both saw selling recently as theADR selling has been persistent throughout 2021 so far. Momentum and Value sold recently across AxJ & Japan.

Tyler Durden

Thu, 03/04/2021 – 11:13

via ZeroHedge News https://ift.tt/38apjJF Tyler Durden