Nation’s Largest ESG Fund Has No Direct Renewable Holdings

Environmental, Social and Governance (ESG) – often referred to as ‘Socially Responsible Investing’ (SRI) or ‘Sustainable Investing’ (SI) – account for roughly 33% of total US assets under management, largely due to institutional investors which can then advertise their virtuous holdings.

Except, America’s largest ESG fund – the Parnassus Core Equity Fund – has no direct investments in renewable energy companies, according to Bloomberg, which notes that “Instead, the $25 billion Parnassus Core Equity Fund holds stocks like Linde Plc, an industrial gas company, Deere & Co., the largest manufacturer of agricultural machinery, and Xylem Inc., which makes water and wastewater pumps for municipal customers. It also owns big stakes in technology behemoths Microsoft Corp. and Amazon.com Inc.”

Managers of many environmental, social and governance funds were slammed in 2020 for running what amounted to index-trackers that relied on tech stocks to beat their market benchmarks—albeit with shiny green labels.

While Ben Allen, co-manager of the Parnassus fund, doesn’t dispute this critique of the ESG industry, he said his fund is different. Its assets are concentrated in 40 large-cap stocks that are measured against ESG metrics. He said publicly traded renewable energy companies aren’t big enough or mature enough to meet Parnassus’s investment criteria. –Bloomberg

That said, Parnassus has divested from fossil-fuels, selling its last such holding in September 2018, while they also claim to avoid direct investments in any energy-focused company unless there is a comprehensive plan in place to address their ‘carbon-insensitive’ business.

And as we know all too well – that typically means purchasing carbon ‘offsets’ to atone for their climate sins.

Microsoft, another large Parnassus holding, has pledged to remove all of its historical carbon emissions by 2050, Allen said. “In effect, Microsoft is winding back the clock to the 1970s,” Allen said. “It’s as if the company never existed.”

Until recently, Amazon was considered a pariah of the ESG industry, Allen said, having waited until 2019 to publish its first sustainability report. Amazon subsequently pledged that it will zero out its carbon footprint by 2040, or eliminate the greenhouse-gas emissions caused by its activities. –Bloomberg

“It’s true that we don’t own any pure-play solar manufacturers, but the portfolio is full of companies that are committed to the transition away from carbon,” said Parnassus’ Allen, who also serves as CEO of San Francisco-based Parnassus Investments which has around $41 billion in assets under management (AUM).

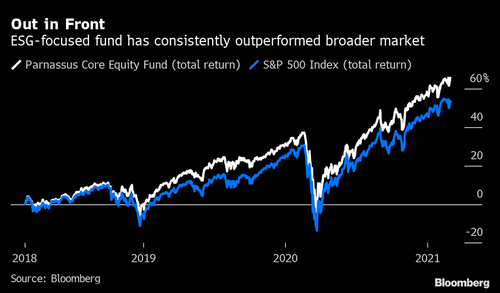

Still, the Parnassus fund has outperformed the S&P 500 over the last three years, and does hold stakes in companies involved in green-ish technologies.

The Parnassus fund has risen at an annual rate of 17.2% during the past three years as of Feb. 26, outperforming the 13.2% advance of the S&P 500 Index, including reinvested dividends.

Linde is a company in which the Parnassus fund held a $704 million stake as recently as Jan. 31. Its products are designed for “industrial applications to be as clean as possible,” Allen said. Linde is a leader in the hydrogen market and looking to triple its clean-hydrogen production, and has earmarked more than one-third of its annual research and development budget over the next decade to decarbonization, Allen said. –Bloomberg

Parnassus’ $956 million stake in Deere – “best known for its distinctive green-colored tractors (which tend to run on fossil fuels)” – was ‘greenlit’ because the company is investing in so-caled precision agriculture which uses information technology to optimize crop production, and utilizes less water and fewer pesticides “so it’s better for the environment and Deere’s bottom line,” according to Allen.

So – nevermind that Deere’s entire fleet of machinery are gross polluters. The company qualifies for ESG treatment because they’re investing in a technology to maximize crop yields.

“We hesitate to overplay the ESG hand,” said Allen – who some might argue is seriously stretching to fit the profile of a ‘green’ fund. “We have a responsible large-cap investment approach. We use the ‘E’ to help us discover what we want to avoid, and also to help us find stocks that we want to own.”

Tyler Durden

Thu, 03/04/2021 – 13:30

via ZeroHedge News https://ift.tt/30dO7w8 Tyler Durden