U.S. Exporters Of Semi Chipmaking Tools Struggle To Get Licenses To Sell To China Chip Giant SMIC

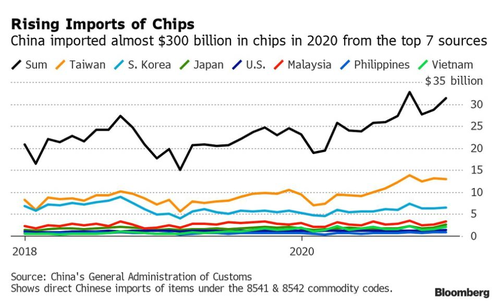

Despite the fact that the global semiconductor industry remains significantly constrained in terms of production output, the U.S. government has been dragging its feet in approving licenses for companies to sell chipmaking equipment to Chinese semi company SMIC.

SMIC is “the largest foundry in mainland China, is an important player in the global semiconductor supply chain, which is under pressure as pandemic lockdowns drive up demand for electronics such as laptops and phones”, according to Reuters.

Lam Research and Applied Materials are among companies trying to sell about $5 billion of parts and components to help make chips – but licensing has been a hold up. Semiconductor Manufacturing International Corp had been blacklisted by the U.S. in December over concerns it was helping China’s military, and its future under a Biden administration remains unclear, the Reuters report states.

Equipment that is used to make advanced 10 nm and smaller chips is “likely to be denied licenses”, and applications are taken on a case-by-case basis, according to the report.

“Lam Research is still in the application process and has not yet received a response,” a company spokesperson said. Applied Materials’ CFO said on a recent conference call that the company is not assuming licenses would come through.

Washington trade lawyer Giovanna Cinelli said the process is “a lot of back and forth, which has elongated the period of review.”

While the review period drags out, the situation for the global semi market doesn’t look like it’s going to get better anytime soon.

SMIC’s infrastructure lags behind cutting edge companies like Taiwan Semiconductor. Recall, just days ago we wrote about how a drought in Taiwan was taking the semi chip shortage from “crisis” to “critical” for the island.

Taiwan is suffering the island’s worst drought in decades, and this is terrible news for semiconductor manufacturers, who are being forced to make cuts on water usage while at the same time desperately trying to scramble and play catch-up with a drought of their own.

Taiwan is now planning to “further tighten water use in several cities that are home to a cluster of important manufacturers,” including plants in Taoyuan, Taichung, Hsinchu and Miaoli. They are going to be asked to cut consumption by up to 11%. Chiayi and Tainan, where Taiwan Semiconductor is based, will be asked to take a 7% cut.

All of these cuts come on top of another 7% cut already put into effect last month.

One chipmaker executive told Nikkei: “All the industries are concerned whether the situation will be alleviated soon. … No one wants to see the worst-case scenario of anyone being forced to dial back production capacity due to water issues.”

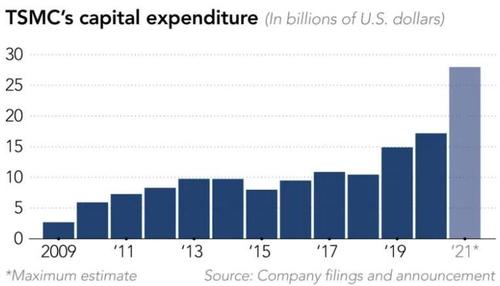

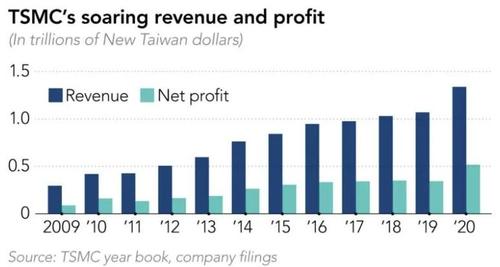

We just documented weeks ago how critical Taiwan would be in getting the semiconductor industry back up and running. We noted that Taiwan Semiconductor Manufacturing is rushing to try and build new facilities through the Chinese New Year in order to meet demand.

TSMC is one of the biggest suppliers of chips to company like Apple, Google and Qualcomm. As a result of a worldwide shortage in chips that was brought on due to the pandemic, they are now rushing to try and get a new factory in the southern Taiwanese city of Tainan built. Construction the new facility will take place throughout 2021, with completion expected in 2022.

Earlier in 2021 we noted that the semi situation had been turning dire and was now being referred to as the “most serious shortage in years”. Qualcomm’s CEO said last month that there were now shortages “across the board”.

And it wasn’t just Qualcomm executives speaking out: other industry leaders warned in recent weeks that they are susceptible to the shortages. Apple said recently that its new high end iPhones were on hold due to a shortage of components. NXP Semiconductors has also warned that the problems are no longer just confined to the auto industry. Sony also said last week it may not be able to to fully meet demand for its new gaming console in 2021 due to the shortage. Companies like Lenovo have also been feeling the crunch.

Neil Mawston, an analyst with Strategy Analytics, had said: “The virus pandemic, social distancing in factories, and soaring competition from tablets, laptops and electric cars are causing some of the toughest conditions for smartphone component supply in many years.”

At the center of the shortage is Taiwan Semiconductor Manufacturing Co., who now sits astride a larger political crisis between China and Taiwan while Biden officials in the U.S. work to find solutions, not only for the semiconductor issues, but for the larger conflict developing between the two nations.

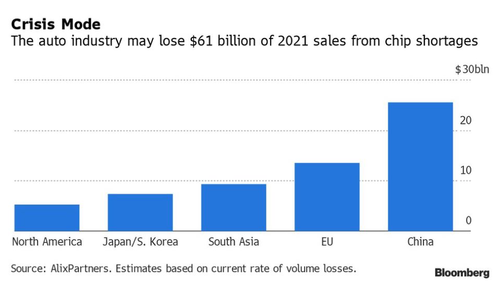

While the extent of the damage on consumer electronics remains to be seen, the shortages are expected to cost $61 billion worth of sales in the auto industry. Recall, we noted weeks ago that GM and Ford had joined Nissan in cutting production due to the shortage.

Several weeks ago the U.S. automaker announced that the shortage would “impact production in 2021”, according to StreetInsider. The company said in a statement that “semiconductor supply for the global auto industry remains very fluid”.

It continued: “Our supply chain organization is working closely with our supply base to find solutions for our suppliers’ semiconductor requirements and to mitigate impacts on GM. Despite our mitigation efforts, the semiconductor shortage will impact GM production in 2021.”

Tyler Durden

Thu, 03/04/2021 – 14:10

via ZeroHedge News https://ift.tt/3qiK4cr Tyler Durden