Why The SLR Is All That Matters For Markets Right Now

One of the biggest buzzwords in finance right now is the three letter acronym SLR, which stands not for a discontinued and particularly expensive Mercedes model, but for Supplemental Liquidity Ratio – a limit on how leveraged US banks can get – and whose fate could mean the difference between a stabilization in the bond market a violent, marketwide crash.

Here’s what’s going on.

Back on April 1, 2020, just as the market was crashing and one week after the Fed unleashed its bazooka to avoid a total systemic collapse, the Fed announces temporary change to its supplementary leverage ratio (SLR) rule “to ease strains in the Treasury market” and “increase banking organizations’ ability to provide credit to households and businesses.” Specifically, the Fed change would exclude U.S. Treasury securities and deposits at Federal Reserve Banks from the calculation of the rule for holding companies. The change would be in effect until March 31, 2021.

By adjusting the SLR, the Fed enabled enabled banks to hold more “no-risk” securities such as Treasuries without having to add the assets to calculations of how indebted they are. In doing so, the Fed effectively permitted banks to massively expand their leverage and hold as many Treasurys and deposits on their books as the market demanded without punishing them for being in breach of various SLR thresholds. This was critical because at roughly this time, the Fed also unleashed $3 trillion in QE as Helicopter Money was launched in the US, as a result of which banks would end up holding far more bonds and deposits than usual. In total, the SLR adjustment cut the capital demand on big banks by an estimated $55 billion and allowed more than $1 trillion in additional activity.

The problem however, is that in four weeks this temporary adjustment to the SLR is set to expire. This comes at an extremely sensitive moment for banks and the bond market.

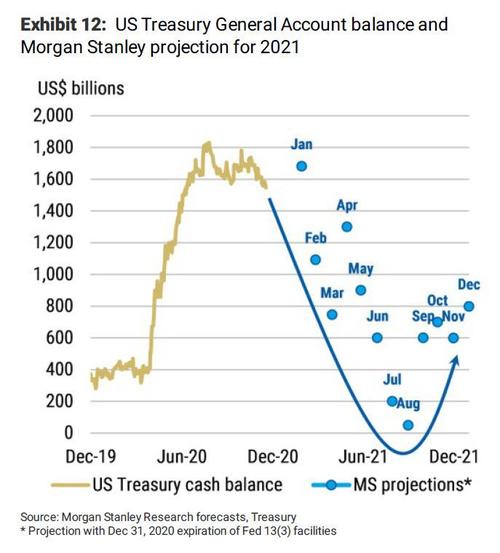

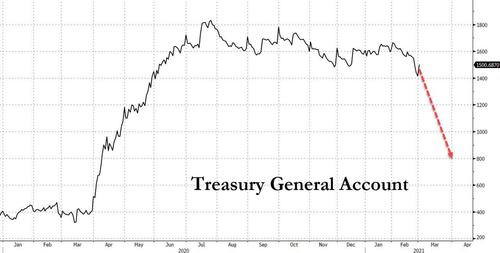

We first explained why one month ago in our post explaining why “Mind-Boggling Liquidity” was about to be unleashed on the markets: “Nobody Is Paying Attention To The $1.1 Trillion Flood About To Hit Markets.” As a reminder, as a result of reduced US funding needs, the Treasury forecast that its cash balance held at the Fed (also known as the TGA or Treasury General Account) would plunge by $800 billion, from $1.729 trillion at Dec 31, 2020 to just $800 billion.

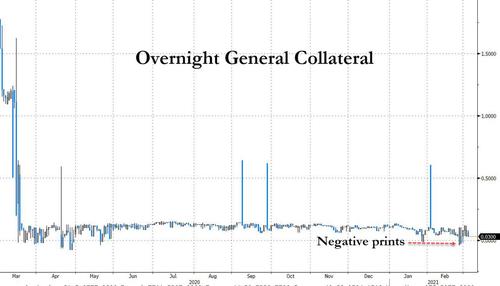

At the time, we also said that “the plunge in short-term debt (Bill) issuance – since there will no longer be an urgent need to keep cash balances in the $1+ trillion range – will compress short-term spreads (effective FF through 3M) to zero – or even negative – as there is suddenly a flood of liquidity which could prompt the Fed to engage the fixed-rate borrowing facility or even nudging the IOER higher.” Sure enough, last week the Overnight General Collateral Repo rate did dip negative for the first time since last year’s covid turmoil, a harbinger of the reserve deluge that is set to hit the market.

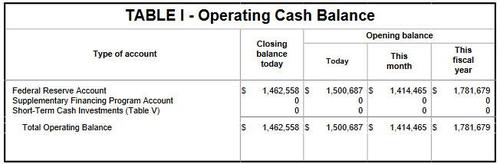

And while the Treasury has been slow in draining the cash held at the Fed, the pace is starting to pick up and on Tuesday the TGA declined by $38 billion to $1.463 trillion…

… meaning that there is still some $663 billion to go until march 31, when the Treasury previously indicated it intends to have a cash balance of $800 billion.

Ok fine, but what does the SLR have to do with any of this?

The answer was given by former NY Fed repo market guru (currently at Credit Suisse), Zoltan Pozsar who wrote last week, “Banks don’t have the balance sheet at the bank operating subsidiary level to add $1 trillion of deposits, reserves, and Treasuries: J.P. Morgan can’t grow more due to G-SIB constraints; Citibank flat-lined its balance sheet growth already; Bank of America has the capacity to add only $150 billion of deposits and HQLA; and Wells Fargo’s $500 billion capacity is constrained by its asset growth ban.”

The market-clogging expert elaborated further:

Unless we get SLR relief at the bank opco. level, or Wells Fargo’s ban is lifted, banks will have to turn away wealthy households’ and institutions’ deposits, which will then go to money funds. But money funds will face a constraint too: the marginal asset they will direct inflows into – the o/n RRP facility – is capped; each money fund can place only $30 billion into the facility, which is too little.

Banks’ balance sheet constraint becomes a collateral constraint for money funds, and collateral constraints may surface in both the spending and paydown scenarios. Collateral supply from coupon issuance will absorb this cash over time, but money markets react to what happens now, and with $1 trillion of new cash, there may be many pockets of collateral scarcity as these flows play out in real time.

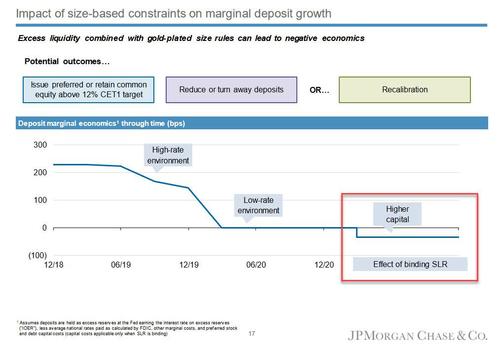

Then, pointing to a cautionary slide from JPM’s Q4 presentation deck which warned very clearly that negative deposit rates are coming in 2021 should “excess liquidity” and “higher capital” become a fixture – which is about to be the case…

… His conclusion dealt with the impact the SLR cap would have on rates:

If U.S. banks are full and money funds can’t take new money either, foreign banks will warehouse reserves at rates below those of J.P. Morgan but above those available in the bill market – and both are negative. The price of warehousing is a fee, i.e. a negative rate…

All this took place ahead of last week’s rate rout (some say Pozsar’s explanation of what is going on may have in fact precipitated it). So, in a follow up note on Thursday just as the 10Y blew out to 1.61%, Pozsar explained why the SLR is also critical to alleviate the Treasury market crunch – simply said without SLR relief, banks will not only be capped to accepting new money, but will be forced to sell even more Treasurys:

Fed Chair Powell and Governor Quarles passed up two opportunities this week to offer much needed clarity on the SLR treatment of reserves and treasuries.

- If SLR relief is made permanent, banks can go ahead and buy more treasuries, and they can also resume buying back their own stock. That’s clear and simple.

- If SLR relief ends and the buyback ban stays in place until the pandemic is over, banks have no choice but to buy treasuries. That’s pretty clear and simple too.

- What’s not clear and simple is the current state of affairs: the Fed already lifted the buyback ban but has still not provided any clarity on SLR relief, and if SLR relief does not happen, buybacks mean that banks will trim their balance sheet on both sides, shedding deposits, reserves, and also treasuries.

Accumulating low-yielding reserves and treasuries is dilutive to banks’ RoE, so buybacks are a top priority for banks’ management teams, and buybacks that come with trimming balance sheet are best done with light duration “loads.”

We are agnostic about whether the SLR relief will be made permanent or not, or if the buyback ban gets reinstated. Both will provide more balance sheet, but the former without a cost to shareholders and the latter at their expense. Regardless of the starkly different outcomes to bank shareholders, the system would end up with more balance sheet to fund the coming rounds of stimulus and both would offer clarity and direction to the rates market. Uncertainty does not.

His punchline was clear enough: “We’ve fielded many calls from clients during the day asking whether the sell-off in rates will force the Fed’s hand regarding SLR. That would be a terrible precedent but we need clarity regardless. And if the Fed’s choice is SLR relief, it needs to clarify whether reserves only or both reserves and treasuries will be exempt – concerns that only reserves will be exempt could also weigh on treasuries.”

And here is where Zoltan shines: while pointing out that “for every macro narrative that explains why U.S. treasury yields are rising, there is also a plumbing narrative that can explain things with equal persuasion.” And, as we noted earlier today, the treasury curve is now steep enough for most FX-hedged foreign investors to step in and harvest the slope….

FX-hedged TSYs are now more attractive than Bunds and JGBs pic.twitter.com/7joyFZeJq4

— zerohedge (@zerohedge) March 3, 2021

… But as Zoltan puts it vividly, “no one likes to step in front of a freight train.”

His conclusion is simple enough that even Fed president will get it:

For long-term treasury yields to stabilize, either the dollar has to weaken so foreign central banks buy or the Fed has to talk rates down, do operation twist (selling $1 trillion of front-end paper and buying $1 trillion of long-term paper), or provide closure on SLR relief. If there’s stability, carry traders will do the rest…

Well, with risk assets sliding and financial conditions suddenly tightening – in large part as a circular result of the lack of SLR clarity which has led to even more forced Treasury selling – the dollar has been rising (as a reminder, the dollar is first and foremost a barometer of systemic funding stress, and it always goes up when the market sniffs out a plumbing issue). Which leaves the Fed with three options:

- Talk rates down, which it has tried and failed to do for the past two weeks, so this is unlikely to work

- Announce that Operation Twist is coming, taking the opportunity during his video conference tomorrow to say something like “the Federal Reserve might consider extending the average maturity of bond purchases and will discuss this at the next FOMC meeting” or

- Announce that the SLR exemption will be extended, either for another 6-12 month, or permanently.

Which, if any, of these will Powell pick?

Earlier today we presented a case first made recently by BofA rates strategist (who like Zoltan also worked at the NY Fed) Mark Cabana, and who warned that “the Fed is simultaneously losing control of both the U.S. front end and back end rates curves for different reasons” and that the Fed “should” revive the Operation Twist to effectively address key issues dealing with market functioning. According to Cabana, a new operation Twist “kills three birds with one stone: It pulls up front end rates, it stabilizes back end rates, and it does so in a reserve neutral way that lessens bank SLR pressure to hold more capital.“

However, there are challenges: launching Operation Twist, would prompt question just how fragile is the financial system if the Fed panics after a modest 50bps move higher in yields. After all, the 10Y yield is still well below where it was one year ago before the Covid crisis erupted. Second, a Twist 3.0 – which is effectively Yield Curve Control – would remove the last bullet the Fed has left for when yields really spike, not to mention would mean full-blown nationalization by the Fed of the entire yield curve (although neither the ECB nor BOJ have any concerns about being permanently cornered).

As for SLR there are mounting political challenges. Last week, Senators Elizabeth Warren and Sherrod Brown urged U.S. regulators to reject lenders’ appeals to extend the SLR exemption. In a joint letter to the Federal Reserve, Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency, the Democratic Duo argued that the banking industry is taking advantage of the coronavirus crisis to “weaken one of the most important post-crisis regulatory reforms.” Warren of Massachusetts and Ohio’s Brown, who took over the Senate Banking Committee this year, said granting the extension would be a “grave error.”

Perhaps, but a bond market crash and deeply negative short-term yields would be a far more grave error, especially to the Democrats who are demanding that the Fed monetize trillions in debt in 2021 to fund Biden’s trillions in fiscal stimulus bills, something the Fed would not be able to do if the SLR exemption was not indefinitely extended.

Curiously, as Warren and Brown urged the Fed to let the SLR provision expire as scheduled on March 31, Republican lawmakers repeated encouragement during Fed Chairman Jerome Powell’s congressional testimony last weeks that the Fed do the banks’ bidding.

“Banks have taken very large reserves against losses and so have proven themselves pretty resilient,” Powell said to Brown during the Feb. 23 Senate hearing, citing intervention to limit bank dividend growth and share buybacks. “And the result, what you see now, is a banking system that has higher capital than it did going into the pandemic, and particularly for the largest banks.”

Meanwhile, Bloomberg reports that as the biggest banks lobby urgently for a deadline extension while the pandemic’s economic headwinds continue, Brown and Warren argue that if they need more of a safety cushion, the banks can find it by retaining some of the capital they’ve been returning to shareholders.

Ultimately, Powell declined to say whether the Fed favored the current expiration date, saying the Fed is still considering it.

“It’s something we’re in the middle of thinking about right now … we’ll be making a decision and announcing it pretty soon”

Alas, with Treasurys selling off every day and now dragging stocks lower with them, Powell’s time for consideration is now up.

And since we appear to have two opposing views – one from Zoltan who favors an immediate SLR extension and one from Cabana who urges a new Operation Twist, we give the final word to another repo guru, Curvature Securities’ Scott Skyrm, who in his latest repo market commentary wrote:

We are waiting to hear from the Fed about two pending issues right now: the SLR and an IOER/RRP rate increase. US Treasurys are currently exempt from the SLR at the large SIFI banks and that exemption ends on March 31. This month!

Our guess is the exemption will be extended between 3 and 6 months and announced at the March 17 FOMC meeting statement.

We believe there’s a good chance of an IOER and/or RRP rate hike on March 17. We believe the Fed SHOULD raise the rates and the decision not to raise the rates is only due to political considerations. Ultra low GC rates are a consequence of too much QE for too long. Too many Treasurys were removed from the market and placed on the Fed’s balance sheet. This is reminiscent of May through July of 2013. Back then, the Fed’s QE buying created a shortage of Treasurys in the market. That August, the Fed began the RRP program as a mechanism to put collateral back into the market. It seems like it’s time to start using the RRP program again!

Bottom line: Powell will extend the SLR exemption by 6 months at the March 17 FOMC meeting... and while the Fed may hold off on launching Operation Twist 3.0, it will hike IOER rates and also reactivate the Reverse Repo program to “put collateral back into the market.” Of course, since the Fed is likely to proceed with tapering QE later in 2021 (absent another major financial crisis which triggers more QE instead), Powell will still have to launch Operation Twist ahead of the first taper hint or else suffer a historic Taper Tantrum which could lead to a loss of control over the long-end.

In any case, at this very moment, the SLR remains the most important variable for both the stock and bond market, and since Powell now has no choice but to unveil his thoughts on the matter on March 17 (when he will extend its exemption by another 3-6 month), he may very well hint at what will happen tomorrow during the Wall Street Journal virtual event set to begin tomorrow at noon. Needless to say, any favorable mention of the SLR exemption will spark marketwide short covering and send both stocks and Treasurys soaring.

Tyler Durden

Wed, 03/03/2021 – 19:20

via ZeroHedge News https://ift.tt/3qfzToI Tyler Durden