With NASDAQ Now Red For The Year, All Eyes Are On ARKK

As the NASDAQ took another drubbing on Wednesday, leading many to think that the turmoil of late isn’t just going to go away on its own, all eyes were on the market’s latest “visionary” investor, Cathie Wood at ARK Invest.

Wood has been in the news over the last 12 to 18 months due to the meteoric rise in ARK’s flagship ETFs, including the ARKK Innovation Fund. But of late, even more eyes have been on Wood because questions loom about how Wood’s fund would handle the tech bubble, that has been building in size and speed since March 2020’s Covid lows, if it burst.

And if this week has been any indication, we may find out soon enough.

Heading into Wednesday night, the NASDAQ had turned red on the year.

And as we noted on Wednesday, ARKK made its way into a bear market. From its highs on Feb 16th, ARKK has plunged 22%…

Breaking below its 50DMA and testing its 100DMA…

Meanwhile, there has been nary a word of panic from Wood, who seems to be sticking by her time-tested (read: 18 months) method of buying whatever tech garbage sells off on any given day. For example, we noted last week that ARKK had added names like VUZI to short seller targets like Workhorse and companies having internal control issues, like 3D Systems.

On Thursday morning, it was revealed that funds run by Wood added another 2.7 million shares of Palantir, along with SPAC names Butterfly Network and CM Life Sciences. Wood also added Tesla and Zoom on Wednesday, StreetInsider reported.

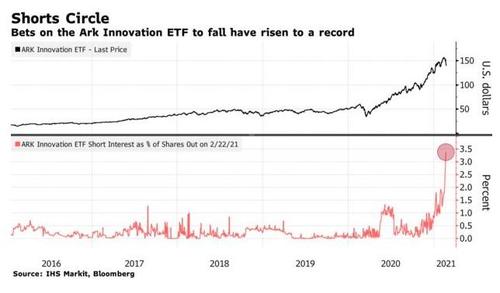

Doubts about Wood’s stock picking acumen also seem to be growing, as we have been noting. Short bets against ARKK continue to rise – a trend we first pointed out that had started weeks ago.

We noted several weeks ago that short interest in ARK funds had “exploded” after ARK’s banner 2020. Short interest as a percentage of shares outstanding for the firm’s flagship $21 billion ARK Innovation ETF spiked to an all time high of 1.9% from just 0.3% two months ago, according to data from IHS Markit Ltd. and Bloomberg. That number now stands at nearly 3.5%, as evidenced in the chart above.

Also this week, Wood disclosed on Wednesday that she had bought 255,621 shares of Zoom for the ARKK ETF. Zoom popped 10% to start the week on Monday, but then fell 9% on Tuesday before falling again, 2.4% on Wednesday.

Wood was also featured on a Benzinga podcast on Wednesday. On the podcast, she called Zoom “probably undervalued.” As a reminder, the $100 billion market cap Zoom Video Communications trades with a forward P/E of 117.6 and trades at 56 times sales.

When asked about Tesla, she echoed the sentiment of Gene Munster on CNBC earlier in the week and praised the company’s autonomous offering. You know, the one that doesn’t really exist. “Our conviction on its autonomous strategy has increased over last few months,” she said, apparently unaware that Tesla has logged just 12.2 autonomous testing miles in California.

And if Wood wants the rest of the year to go smoothly, she better hope Tesla holds up. Tesla makes up 9.3% of her Next Generation Internet ETF and 10% of her flagship ARKK ETF. It’s also 10.2% of her Autonomous Technology and Robotics ETF. In other words, if Tesla winds up plunging into the abyss, so might ARKK.

Wood also said Wednesday that she thought digital wallets were going to “gut banks” and she said that “banks are among [value traps].”

You can watch the entire podcast here:

Tyler Durden

Thu, 03/04/2021 – 08:45

via ZeroHedge News https://ift.tt/3qgu3DM Tyler Durden