10Y Treasury Hits A Stunning -4.25% In Repo As Yields Blow Out

Last night we first pointed out something shocking: as a result of a massive wave of shorting in Treasurys in the past three days, the 10Y hit a record -4% in repo, an extremely rare event and one which occurs only when there is a dramatic shortage of collateral as a result of overshorting (think of it as very hard to borrow condition for stocks). What was even more amazing is that the repo rate was below the fails charge, which at least in theory is the absolute minimum that a 10Y rate can hit in repo. Effectively, it meant that an investor in the repo market lending money so others could short the 10Y ends up paying rather than getting paid. Needless to say, this is a clear breach of one of the most fundamental relationships in the repo market, where lenders of cash always get paid – however little – in order to make a more liquid and efficient market.

This stunning issue quickly escalated and this morning Bloomberg followed up on this critical topic:

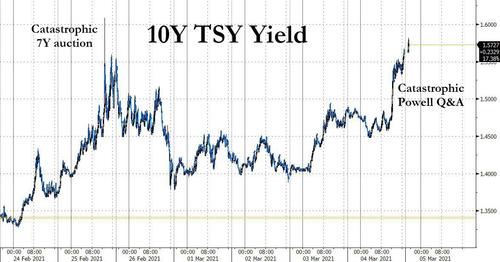

And with everyone suddenly obsessing with both the SLR and repo malfunction, that’s why we said that during today’s WSJ video conference event, Jerome Powell has to address i) the ongoing crunch in the repo market and ii) the fate of the SLR extension, as the two are closely tied – after all if the bond market is confident that there is capacity to soak up the trillions in reserves being released by the Fed as the Treasury drains the $1.5 trillion in cash held in the TGA account, many of the acute issues in the extremely illiquid Treasury market would go away.

Alas, for some bizarre reason Powell never got that question today… or perhaps he simply did not want to answer it and made it clear in advance. In any case, with everyone in the market expecting Powell to discuss the fate of the SLR, his failure to do so was one of the reasons why bond yields erupted shortly after 12pm, as uncertainty over the fate of the SLR – and by extension bank balance sheet capacity – has now grown exponentially (for those confused by all the SLR hoopla, please read this).

It’s also why during the disappointing Powell address we said that we should brace for an even more dramatic move in repo:

Let’s see if 10Y hits -8% in repo today

— zerohedge (@zerohedge) March 4, 2021

Ok, fine, we were just a bit hyperbolic, but in retrospect we may not have been too far off. Here’s why.

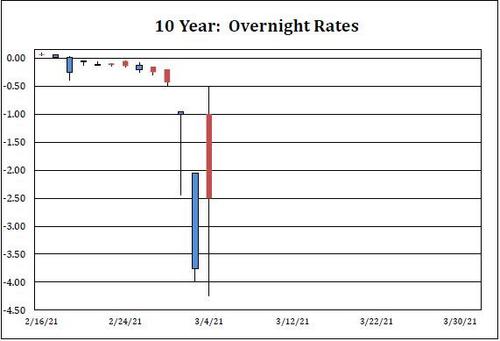

In his latest repo market commentary by Curvature’s Scott Skyrm published after the Powell conference, the repo guru asked – rhetorically – “how low can Repo rates go in the 10 Year Note? Or, in the past, how low have 10 Year Repo rates gone? Extremely low 10 Year Note rates only occur during single-issues.” That, Skyrm explained, is the period of time between when a new 10 Year Note was issued and its first reopening a month later. Which is true… however usually the single-issue repo crunch pushes the 10Y to -1%, at most -2% in repo. What we saw yesterday was unprecedented. Or rather, there was just one precedent… and it was during a market crash.

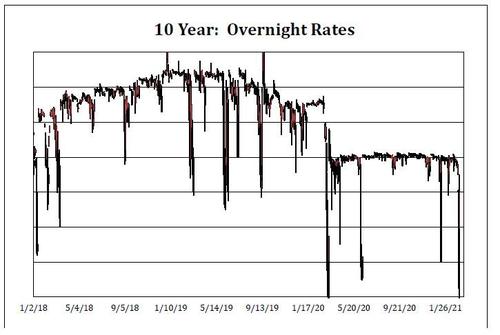

Skyrm said that from his own experience, what we call “extremely low” Repo rates is anything that’s below -3.00% – which is below the Fail Charge right now. Since the beginning of 2018, the 10 Year Note traded below -3.00% only two other times: a more “solid” -3.50% from 6/10/20 to 6/12/20, and the only time there was an even lower, record low repo print of -5.75% was during the peak of the covid crash, on 3/13/20.

What is striking is that March 3, 2021 was not a crisis. Neither was March 4. And yet, as Skyrm says after hitting -4.00% on Wednesday, the 10Y dipped even further to -4.25% today.

The good news is that after hitting a near record low in repo today, the 10Y stabilized modestly, rising to a still abnormal -1.00%, which may have been the result of today’s announcement that the Treasury’s 10Y reopening next week will be $38BN, which should relieve some of the single-issue pressure (it was below . But if there is more to the repo squeeze than just single-issue funding pressure, the 10Y will remain very special in repo for a long, long time.

Meanwhile, the shorting in the 10Y has now resumed, and after blowing out to 1.55% during Powell’s catastrophic speech, the benchmark treasury was last seen trading north of 1.57%, and fast approaching last week’s blowout level of 1.61%.

And while we wait for tomorrow’s repo market data to see just how massive the latest shorting burst has been, one thing that is certain is that with Powell neither doing nor saying anything today because as the Fed Chair said there was nothing “abnormal” about the market, the same market will now quickly push the 10Y to a level Powell does find “abnormal” and forces him to launch YCC far sooner than if Powell had simply said something about the SLR today and eased some of the soaring market panic.

Tyler Durden

Thu, 03/04/2021 – 19:40

via ZeroHedge News https://ift.tt/2O4kwT5 Tyler Durden