How Much Money Will Biden’s New Stimulus Inject Into The Market

Looking at market action over the past few weeks, it is clear that markets are finally fretting about yields and inflation. As DB’s Jim Reid puts it, “there is no doubt the forces working in financial markets in 2021 will be fairly extreme – reopenings, massive pent-up demand, the strongest US growth since the early 1980s, huge central bank liquidity and a likely enormous Biden fiscal package.”

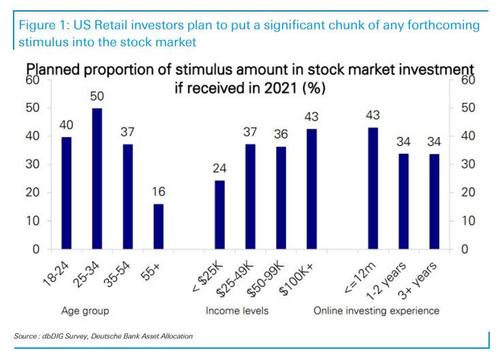

And yet, as everyone knows by now, a substantial portion of the coming Biden stimulus will quickly be redirected into stocks. But how much?

That’s the question Jim Reid asked in his recent daily note, writing that whilst rising yields are a threat to all risk assets, “it’s worth highlighting that a large amount of the upcoming US stimulus checks will probably find their way into equities.” He then refer to a survey conducted last week by DB’s chief equity strategist Binky Chadha polling online brokerage account users which suggested they would invest around 37% of future stimulus checks in the stock market. This is a material force because as Reid notes, “behind the recent surge in retail investing is a younger, often new-to-investing and aggressive cohort not afraid to employ leverage.”

This makes sense, although someone should probably tell those respondents with an income level over $100,000 (who plan on investing 43% of their stimulus into the market) that they aren’t getting a stimulus…

So here is Reid’s math: “Given stimulus checks are currently penciled in at c.$405bn in Biden’s plan, that gives us a maximum of around $150bn that could go into US equities based on our survey. Obviously only a proportion of recipients have trading accounts, though. If we estimate this at around 20% (based on some historical assumptions), that would still provide around c.$30bn of firepower – and that’s before we talk about any possible boosts to 401k plans outside of trading accounts.”

For some context, the DB credit strategist notes that over the last five years mutual funds and ETFs have seen monthly outflows of -$9.1bn from US equities. The marginal buyer has been companies themselves conducting buybacks. However, over the last four months following Biden’s victory, this number has increased to over $15bn per month (a near record).

His conclusion: “stimulus checks could accelerate the large inflows into US equities seen in recent months after many years of weak flow data. Will this be enough to offset any impact of higher yields? Expect this push/pull to continue for some time.”

Tyler Durden

Thu, 03/04/2021 – 19:20

via ZeroHedge News https://ift.tt/3qmemLg Tyler Durden