Repo Wreck: 10Y Tumbles Below Fails Charge, Trades -3.1% In Repo

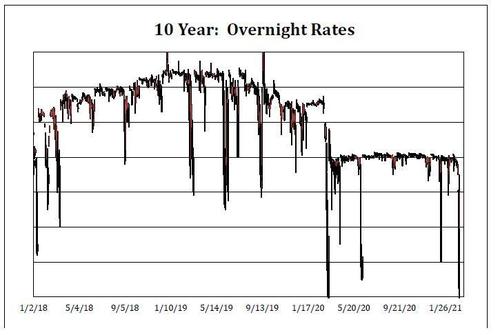

Last night we showed – for the second day in a row – that contrary to Powell’s protests, the situation in the repo market is going from bad to worse, as the 10Y traded as low as -4.25% in repo, deep below the fails charge of -3% meaning lenders of cash to Treasury shorts have to pay them instead of pocketing a lending fee.

This, as Curvature’s Scott Skym point out, was the lowest print since the absolute record print of -5.75% touched during the market insanity in March of 2020.

And while had hoped that the Treasury announcement that $38BN in 10Ys would be auctioned off in next week’s reopening would restore some normality to the repo market, that has failed to materialize as of Friday morning, when according to ICAP, the cost to borrow 10-year Treasuries in the repo market opened below the -3% penalty rate Friday, with the repo rate for 10-year Treasuries posted at -3.10%.

As we have repeatedly explained, and as Bloomberg comments this morning, when the interest rate on overnight cash loans backed by the newest 10-year note goes below -3%, it’s cheaper to pay the regulatory fine for failing to return the collateral on time than it is to renew the loan – a sign that short selling is intense.

This is hardly news considering the relentless move higher in yields which we now know has been facilitated by wave after wave of new shorts, to the point that the 10Y may now be the most actively shorted future of all major liquid instruments.

Regardless of the cause, unless the repo stabilizes in the coming days ahead of next week’s 10Y auction – which may be the most important market event of the quarter if last week’s catastrophic 7Y is any indication – then people will have a major problem on his hands, because after failing to admit that there is a major repo problem during yesterday’s WSJ Q&A the Fed chair will lose even more credibility as he now is forced to scramble to restore order, something which he may only be able to do with an emergency announcement ahead of the March 17 FOMC.

Finally, making matters even more serious, moments ago Politico reported that FDIC Chair Jelena McWilliams said it doesn’t see need for continued SLR relief beyond March 31, adding that in her view it “doesn’t that seem as though banking agencies need to extend an emergency move that made it cheaper for insured depository institutions to hold cash and U.S. government bonds on their balance sheets.” In other words, unless Powell immediately reassures markets that the SLR will get extended, it’s about to get far worse.

Tyler Durden

Fri, 03/05/2021 – 10:52

via ZeroHedge News https://ift.tt/3uYN8xF Tyler Durden