Here Are The S&P Levels Where Volatility Is Set To Soar

For all the volatility observed in markets in the past two weeks, the S&P has been remarkably resilient even as the Nasdaq has slumped into a correction while the DJIA hit a new all time high, a divergence not observed since 1993.

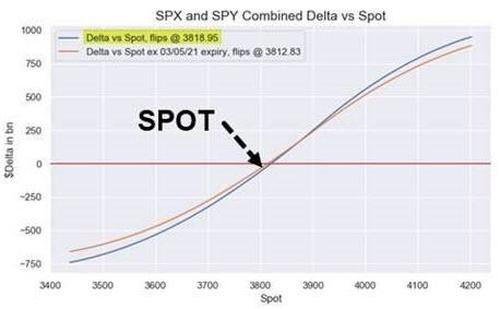

As we showed late last week, this can be explained largely with the creeping divergence in dealer delta and gamma which Nomura’s Charlie McElligott showed has flat to positive in spoos …

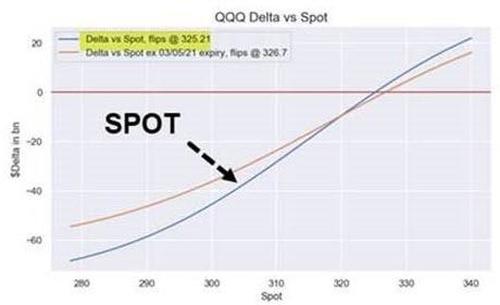

… while remaining deeply negative in QQQs.

Naturally, a lot has changed since last Thursday, with SpotGamma reporting this morning that the jittery market has stabilized modestly following an uptick in put interest overnight, “with >10k added to several strikes <=3700" which according to SG "adds stability to markets and is a favorable sign" as investors are now more hedged for downside risk and do not have to liquidate as prices slide.

But while that may help spoos, the QQQ still remains in deeply negative gamma territory “indicating (once again) much higher relative volatility” and it won’t flip positive until QQQ 371, or 5% higher from current prices (that said, SG reminds us that “a lot of QQQ negative gamma rolls off on Friday which indicates volatility may remain for the next few days, but could subside next week into the large 3/19 (next Friday) monthly OPEX”).

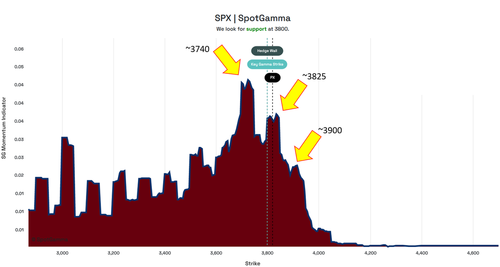

Finally we wanted to highlight a new Momentum indicator used by our friends at SpotGamma (which is available through the EquityHub portal). Specifically, SpotGamma notes that this chart is especially useful in assessing “local” volatility, noting that sharp changes in the Momentum Indicator (between the yellow arrows), indicates high volatility, while “Flat” areas generally align with SG levels and indicate where volatility may stall out. For more information please reach out to Spotgamma.

Tyler Durden

Tue, 03/09/2021 – 09:46

via ZeroHedge News https://ift.tt/3v5Qsap Tyler Durden