Was That It For The Value Trade: JPM Warns Further Dollar Strength Will Hammer Commodities

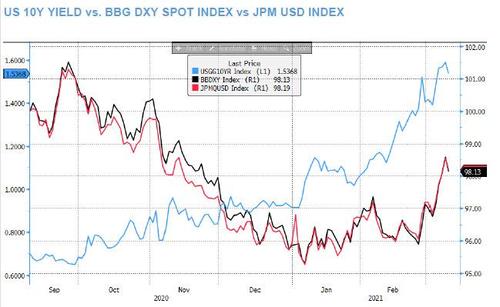

As JPMorgan writes (and shows) this morning, in picking up an observation we have made repeatedly in recent weeks, the USD and yields have shifted from a negative correlation to a positive correlation, with the bank suggesting that recent USD strength may be driving some of the recent weakness in commodities.

As JPM further notes, in terms of Equity sectors, Consumer Staples and Tech have the lowest, least negative 1Y correlation to the USD, while Metals/Miners and Homebuilders have the highest, most negative 1Y correlation to the dollar.

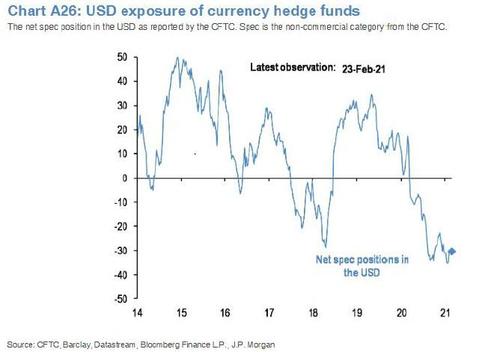

Another catalyst that could push the USD much higher is positioning, with JPM showing that net USD exposure among hedge funds is the most bearish on record.

Picking up on this theme, overnight Rabobank’s Michael Every cautions that yields can keep rising far higher, pointing out that according to Bloomberg economic forecasts “nominal US GDP growth will –briefly– hit a high of 7.6% ahead due to all the sugary Biden stimulus. On the back of *that*, the gap between US nominal GDP and the US 10-year will be at the widest since 1966.”

Next, as we wrote last night, consider that the spread between U.S. five- and 10-year inflation breakevens is now the most positive it’s ever been in Bloomberg data going back to the start of 2002. As Bloomberg’s Ven Ram wrote, “the differential, which may be thought of as the market’s evolution of inflation over the medium term versus the longer term, went briefly above zero following the financial crisis as well, but wasn’t so pronounced.”

As such, the Rabobank strategist cautions that “the risks must be near term that yields rise to meet nominal growth, even if the longer term (and perhaps not even that long) it is growth that will come down and again, taking yields with it.”

So, going back to JPM, the bank warns that “with yields continuing to move higher on either stronger growth and rising inflation expectations, the move in the USD could overshoot given the consensus short position in USD.”

The conclusion: “Overall, this may be negative for broader commodities and EM assets.”

Tyler Durden

Tue, 03/09/2021 – 10:49

via ZeroHedge News https://ift.tt/3bwhArr Tyler Durden