How Markets Would Respond To A Hawkish Fed

By Steve Englander, global head of FX strategy at Standard Chartered

How asset markets would respond to a hawkish Fed

Being dovish is harder than it looks for the FOMC. We expect two hikes in the 2023 dots. The consensus probably is close to expecting a single hike. If we are right, the initial response would probably be to add another half hike to the three already priced in by end-2023, taking the USD higher. But we think the Fed can present its dots as good news — a maximum employment soft landing is approaching quicker than expected. However, continuing the attitude of laissez-faire for long bond pricing would invite investors to take yields higher as economic data improved, even if the FOMC stuck with zero hikes in the dots.

How quick come the reasons for approving what we like

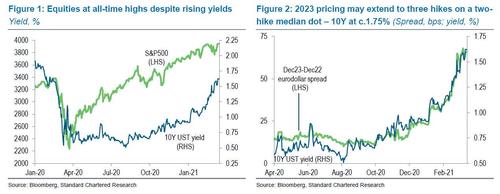

We think the FOMC will have a hard time expressing concern about asset markets with the S&P at an all-time high on 12 March, despite 10Y UST yields at post-February 2020 highs (Figure 1). Focus has been on the FOMC ‘dot plot’ in recent days, but if the FOMC and Fed Chair Powell do not push back against current yield levels, investors are likely to take yields higher as better data arrives.

We expect a two-hike median for 2023 in the Fed Summary of Economic Projections (dots) by a narrow margin versus one hike, but not a 2022 hike in the dots (FOMC dots likely to point to earlier lift-off ). A Bloomberg survey indicates that economists expect two Fed hikes in 2023, but do not expect any 2023 hike in the dots at the 17 March meeting. Money markets price in three hikes by end-2023, with the first hike now implied as more likely than not by end-2022. The rationale for the gap between market pricing and expected dots is avoidance of bond-market volatility.

Investors would likely initially consider our two-hike dot expectation, combined with continued FOMC tolerance of yield back-up, as very hawkish. The Dec23-Dec22 Eurodollar spread currently implies c.2½ 25bps hikes in 2023, but the market may feel emboldened to push this to three hikes. Given the recent relationship between the Dec23-Dec22 differential and the 10Y UST, such a 75bps spread would likely mean yields rising to c.1.75% (Figure 2). We expect two hikes to look reasonable in light of the economic and inflation projections in the dots, but we are mindful that with investors largely divided between zero and one hike in the 2023 dots, the optics of two hikes and no pushback on yields are very hawkish.

Currencies still vulnerable to a hawkish Fed

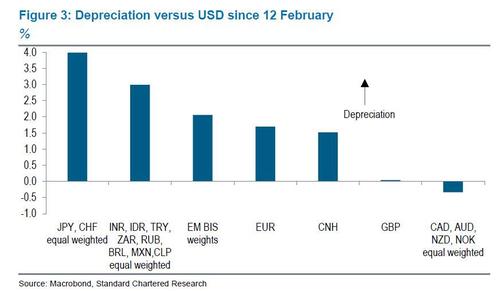

On the FX side, a hawkish stance would likely push the USD higher against almost all currencies, but investors would likely differentiate. Since the impact of upward US yield moves began to be felt in FX, G10 commodity currencies have appreciated slightly versus the USD, largely driven by the CAD.

The GBP has been essentially flat, while the EUR, CNH and transaction-weighted EM currencies have depreciated by 1.5-20%. We put together an equally weighted basket of major EM currencies with yields above 4%. This basket depreciated 3%, but with a lot of variation – the RUB and INR appreciated slightly, while the TRY and BRL fell very sharply. Most surprising to us was the underperformance of safe havens – the equally weighted CHF and JPY fell by 4%.

Our interpretation is that the run-up in yields has been accompanied by upward adjustments in growth expectations. With equity performance and overall financial conditions robust, the risk-off element is relatively modest. The safe havens face a double blast of yield widening, but no compensating safe-haven flow.

Initial USD strength is likely to wear off

If the hawkish shock takes 2 ½ hikes to 3 in market pricing, the rough magnitude should be about one third of the moves noted above. The first reaction may be to focus on the Fed policy shift rather than the growth optimism, so the sell-off could be broad-based initially, but we would expect that the positive context would be emphasised by post-meeting Fed speakers. Powell and other FOMC participants are likely to argue strongly that the projections represent a benign view that the economy will have a quicker soft landing at full employment than earlier anticipated.

Over the space of a few weeks, the extent of any USD positive thrust would be driven by US economic performance and that would lead to more relative-value differentiation as well. US data for March, mostly released in April, is likely to be very strong. Indications from mobility data, restaurant bookings and TSA checks suggest that reopening is making steady progress, Plus the March weather is better and new stimulus checks are beginning to arrive.

One hike in dots closest to neutral

We think that one 2023 hike in the dots is closest to neutral, although the initial reaction may be to treat it as slightly hawkish. The fact that money-market pricing on hikes is so substantial suggests that one hike would not be an enormous surprise. In the Bloomberg survey, 14 of 36 respondents expected a move off current rates, so the majority for flat was not overwhelming.

We are still concerned that even if the market comes to terms with a single 2023 hike in the dots, the unwillingness of the FOMC to express deep concern on the level of Treasuries would still be considered as opening up more upside than downside. So true north on the hawkish-dovish compass may be one hike in the dots and a slightly more animated expression of concern on aberrant or excessive bond-market moves.

How dovish can they get?

No 2023 hikes would be seen as dovish, but we are sceptical how much so and for how long. We expect the FOMC to remain non-interventionist on bond yields. So the FOMC message to investors might be read as, ‘the FOMC is telling you that it doesn’t see 2023 conditions justifying a policy hike – now you decide where 10Y yields should be given everything else that is going on’. This could be very dovish if the FOMC confidence on low inflation leads investors to adjust 2023 market pricing lower, or not so much if investors decide that the implied commitment is not credible. Moreover, the FOMC maintaining a laissez-faire stance on bond yields at current levels around 1.60% would probably be viewed as hawkish, even with no 2023 hikes in the dots.

To be really dovish, the Fed would have to find more convincing language to express concern on the run-up in bond yields. We think Powell would have to say something like: ‘we are watching both the pace and level of bond market yields to make sure that the pace of recovery is not compromised’. ‘Catching the eye’, a restatement of earlier modest implied threat, would be unlikely to suffice.

Central bank projections – forecasts, aspirations, promises or threats?

One element in our expectations of two hikes in the dots is that we see zero hikes as compromising the credibility of the projections, given the amount of good news already in the pipeline. A zero-hike projection would raise questions on the models that FOMC participants believe in: Is fiscal policy so ineffective as to produce such modest results? Is the Phillips curve indefinitely flat? What policy move would it take to make 2023 hikes plausible to the FOMC? Did FOMC participants use different models in March versus December; if so, what drove the changes? Why is the FOMC view on appropriate policy so different than the market’s expectation?

If there are no good answers to such questions, the forecast component of the projections is in question, and the next question is what the Fed (or any other central bank) is trying to communicate. Central banks can use projections to communicate the outcomes they prefer or to guide asset markets in pricing, but such guidance invites investors to assess how likely the preferred state of the world is and how the central bank’s policy could act to achieve this preferred state.

We see two 2023 hikes in the dots as the Fed’s likely outcome because Powell could credibly argue that there is symmetric risk around a two-hike projection rather than asymmetric risk. While less pointed, the question on a single hike would remain – how much stimulus would it take to convince the FOMC that two hikes more than two and a half years out are justified as a model projection? If you ran the new stimulus and reopening prospects through one of your econometric models, how much would the implied tightening be?

Even though the projections represent modal rather than probability-weighted views of FOMC participants, it is likely that most of the time the mode will not be far off the mean. Moving to two hikes in the dots would also mean that Powell could plausibly speculate that the dots would stabilize for a while, rather than having the market anticipate a sequence of upward adjustments.

Tyler Durden

Tue, 03/16/2021 – 08:15

via ZeroHedge News https://ift.tt/3cAWdoj Tyler Durden