Supercharged Economy Leaves Global Supply Chain “Stretched Thin”

Shipping container shortages across Asia, vessel traffic jams at ports, higher shipping costs, and soaring input prices – are all part of the very stretched global supply chain in a post-pandemic world that remains in turmoil. Trillions of dollars unleashed by central banks and governments resulted in the overstimulation of the worldwide economy. Continuation of artificial demand stoked by stimulus could exacerbate supply-chain disruptions.

“I’ve never seen anything like this,” Lars Mikael Jensen, head of Global Ocean Network at A.P. Moller-Maersk, the world’s largest shipping company, told NYTimes last week.

… and, of course, Jensen had never seen anything like this before, due in part to the amount of stimulus unleashed, tens of trillions of dollars around the world, was entirely unprecedented.

More disorder nears as President Joe Biden’s $1.9-trillion relief bill is expected to turbocharger consumer demand for products made overseas, which will only result in additional stress on the global supply chain.

Chief Executive Steve Greenspon at Honey-Can-Do International LLC told WSJ that the rate at which Americans are purchasing clothes racks, shelves, and other housewares is remarkable. The “exceptionally high” demand produces bottlenecks at its manufacturers in China, resulting in a 50% increase in shipping cost and longer shipping time. Industry-wide, shipping costs are hitting record highs.

“Ships can sit offshore for weeks at a time in the US,” waiting to dock at busy ports, said Greenspon. “There doesn’t seem to be any relief.” Container ships anchored in San Pedro Bay and at berth in Ports of Los Angeles and Long Beach have risen to multi-year highs.

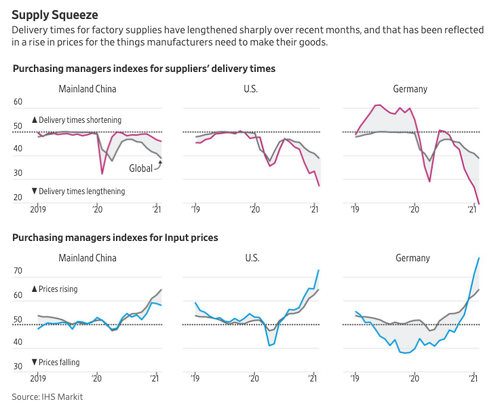

Data firm IHS Markit confirms a massive supply squeeze has been underway. Surveys of manufacturers around the world are reporting delivery times lengthening while input prices are soaring.

IHS Markit said shortages of components pushed input prices higher at the sharpest rate in nearly a decade.

“It is difficult to get electronics, in some cases, delivery times are a little longer, but we can handle it,” said Gordon Riske, chief executive of Kion Group AG , a Frankfurt-based manufacturer of forklifts. “Since the stimulus package is a done deal, the US will have about 7% growth. And we’re likely to have some capacity issues that we will address.”

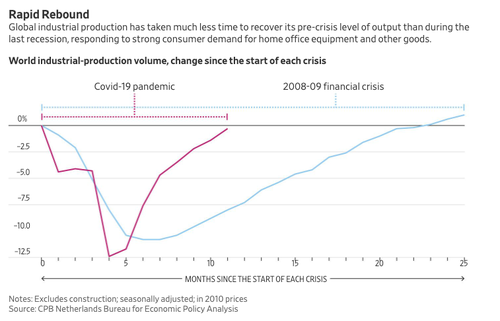

The speedy rebound in global industrial production, fueled by central banks and governments spraying their respective economies with billions, if not trillions of dollars, has resulted in a “V-shaped” recovery. However, additional rounds of stimulus would be needed to maintain the so-called “recovery.”

Artificial demand has pushed up the “price of every material, every part, plastic parts, glue, everything from China has increased,” said Lim Bao Lih, export manager at Classic International.

As Lih’s input prices increase along with shipping costs, Classic International might have to pass on costs to consumers.

Last week, readers found out their ‘cup of joe‘ in the future could cost more money because coffee processors have been slapped with higher freight costs.

Shortages have also been another tissue.

From semiconductors to steel, shortages have materialized. Several manufacturers in the US and Europe have faced shutdowns of production facilities due to chip shortages. The problem is so concerning that major chip associations in the US and China are forming a working group to alleviate shortages.

Besides shortages of components, the lack of shipping containers in Asia because of one-sided trade triggered Costco Wholesale Corp and Honda Motor Co Ltd in the United Kingdom to delay shipments.

Many of the supply chain woes have been ongoing for the past year. Another round of stimulus from the US, supercharging consumers, even more, may result in unintended inflation that will push up consumer prices.

Tyler Durden

Tue, 03/16/2021 – 07:17

via ZeroHedge News https://ift.tt/3tqv126 Tyler Durden