Did Gold Go Out Of Style?

Authored by Jesse Felder via The Felder Report,

Last summer I suggested that the fireworks show underway in the gold price at the time wouldn’t last forever and that a “a more tactical and discerning approach” might be warranted due to the increasing popularity of the precious metal. Since then, gold has fallen about $250 (13%) and sentiment has shifted significantly once again. Inflows into gold ETFs have turned to outflows and it is becoming common to question gold’s utility in an overall asset allocation model.

So it probably feels natural to ask if the gold trade is over and if it’s time to throw in the towel. The way I see it, there are two major factors to pay attention to in trying to answer this question.

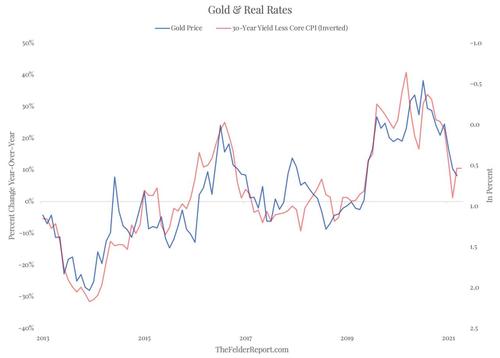

First, gold has a very tight relationship with real rates (interest rates adjusted for inflation).

When real rates rise, gold does poorly. But when they fall, gold really shines.

Recently, nominal interest rates have been rising faster than inflation creating a headwind for the gold price. However, there is good reason to believe that this trend could soon shift and become a strong tailwind for the gold price again. The rise in rates has already been dramatic and there is reason to believe it may be nearer to its end than its beginning. At the same time, inflation appears to be on the verge of picking up once again. If so, real rates will fall and gold will likely resume its uptrend.

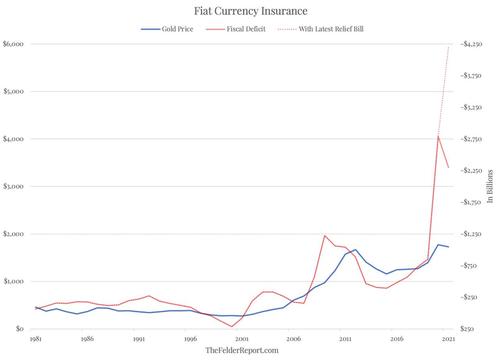

The second major factor to pay attention to is the direction and size of the U.S. government’s fiscal deficit. Currently, the CBO estimates that the 2021 deficit will be $2.3 trillion, slightly less than last year’s total. However, this does not include the $1.9 trillion stimulus package recently passed by congress. Nor does it include the possibility of a new $3 trillion infrastructure package which is currently being planned by the administration.

If deficits were in the process of peaking today, as they did coming out of the recession roughly a decade ago, then it may be the case that the gold trade was in its final innings. However, as the chart above shows, there is a case to be made that gold hasn’t even fully priced in last year’s deficit yet, let alone this year’s which will inevitably be even larger. Furthermore, there is also reason to believe that a paradigm shift in attitudes toward deficit spending represents secular support for the precious metal going forward.

Either way, neither gold’s utility as an inflation hedge nor as fiat currency insurance has actually been tarnished at all. It is only perceptions that have changed as a result of what appears, as yet, to be nothing more than a healthy correction in a bull market, perceptions that will shift yet again when gold finds its second wind.

Tyler Durden

Thu, 03/25/2021 – 14:44

via ZeroHedge News https://ift.tt/3tRKd8M Tyler Durden